Breadcrumbs

Japan leaving Indramayu coal is Indonesia’s chance to ramp up renewables

An opportunity to commit to no new coal, accelerate renewable energy and leverage the shifted appetite of investors.

Available in: Indonesia

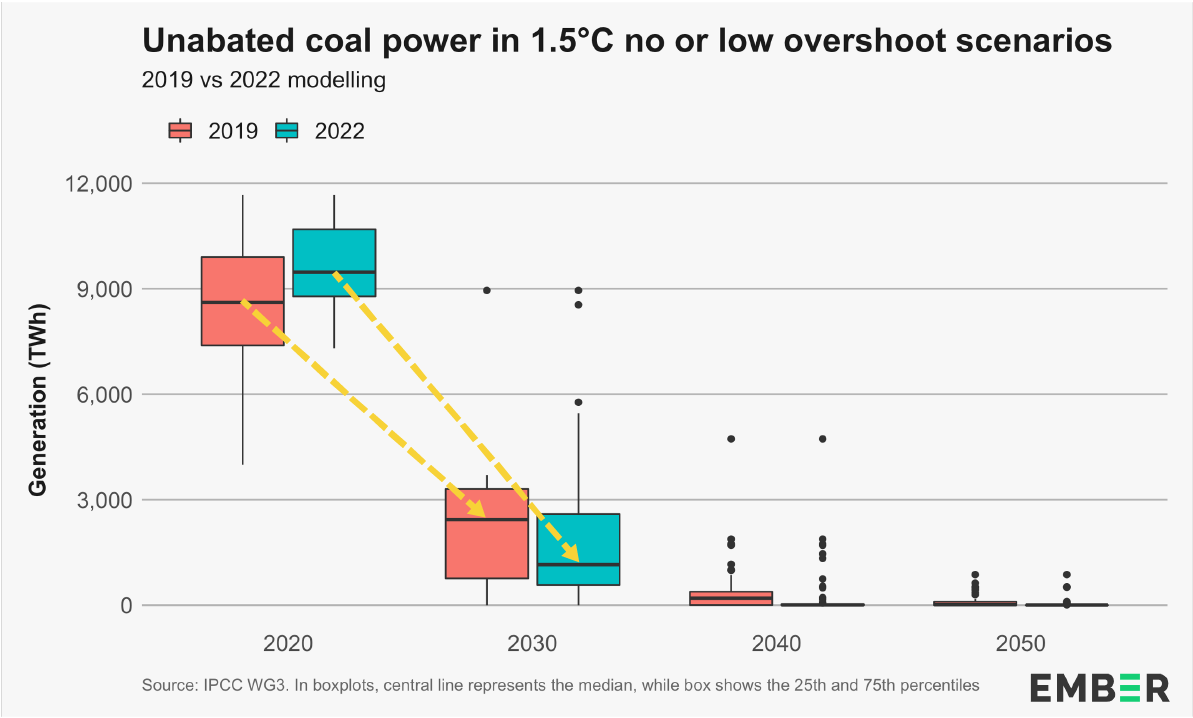

The latest IPCC report has confirmed that global coal use has to collapse for the world to have any hope of reaching 1.5 degrees. The report also underlined that coal is the only type of fossil fuel that needs to be phased out by 2050.

Japan’s decision on the Indramayu coal plant should provide the opportunity for PLN to restructure their electricity supply plan in the next RUPTL. Considering the oversupply on the PLN side and the global commitment to stop overseas coal financing on the investor side, halting several coal-fired power plants that have not started is the most reasonable option. Indonesia, after all, already has a plan to implement “no new coal” starting 2021.

If this action is taken, PLN could evade the inevitable future challenges of retiring young coal fleets like the Indramayu coal plant, and avoid jeopardising Indonesia’s plan to fully phase-out coal by 2050.

Last but not least, PLN could turn this unfortunate loss of financial source into an opportunity to leverage the shifted appetite of investors, Japan included, to obtain financial assistance to accelerate renewable energy deployment in Indonesia.

Japan’s cancellation of financial support for Indramayu coal plant provides Indonesia with an opportunity to commit to no new coal and accelerate renewable energy.

Featured in the media