Breadcrumbs

Efficiency can aid Chinese coal phase-out

Efficiency improvements across electricity-intensive sectors could help set China on a path to meeting recently announcement climate targets.

About

China has committed to ‘strictly limit’ the growth of coal consumption by 2025, and to phase it down after that on the way towards carbon neutrality by 2060. As the world’s largest producer and consumer of coal power, how can that goal be turned into the reality?

In this piece we consider how electricity efficiency could be part of the answer, looking at the opportunities for improvements across sectors.

Adapted from the full version in China’s Energy Magazine.

Executive summary

Why efficiency improvement is a key enabler for coal phase-out in China

China is the world’s largest consumer and producer of coal power. Announced climate targets means that China intends to peak coal generation before 2025, and cease all unabated coal generation before 2060.

Fast growing electricity demand could add additional difficulty to achieving these goals. One way to meet this challenge could be policy focused on improving electricity efficiency.

We find potential for gains in efficiency across these sectors:

- Industrial sector, which is generally more energy intensive than those of other countries

- Services sector, where electricity intensity is twice the world average

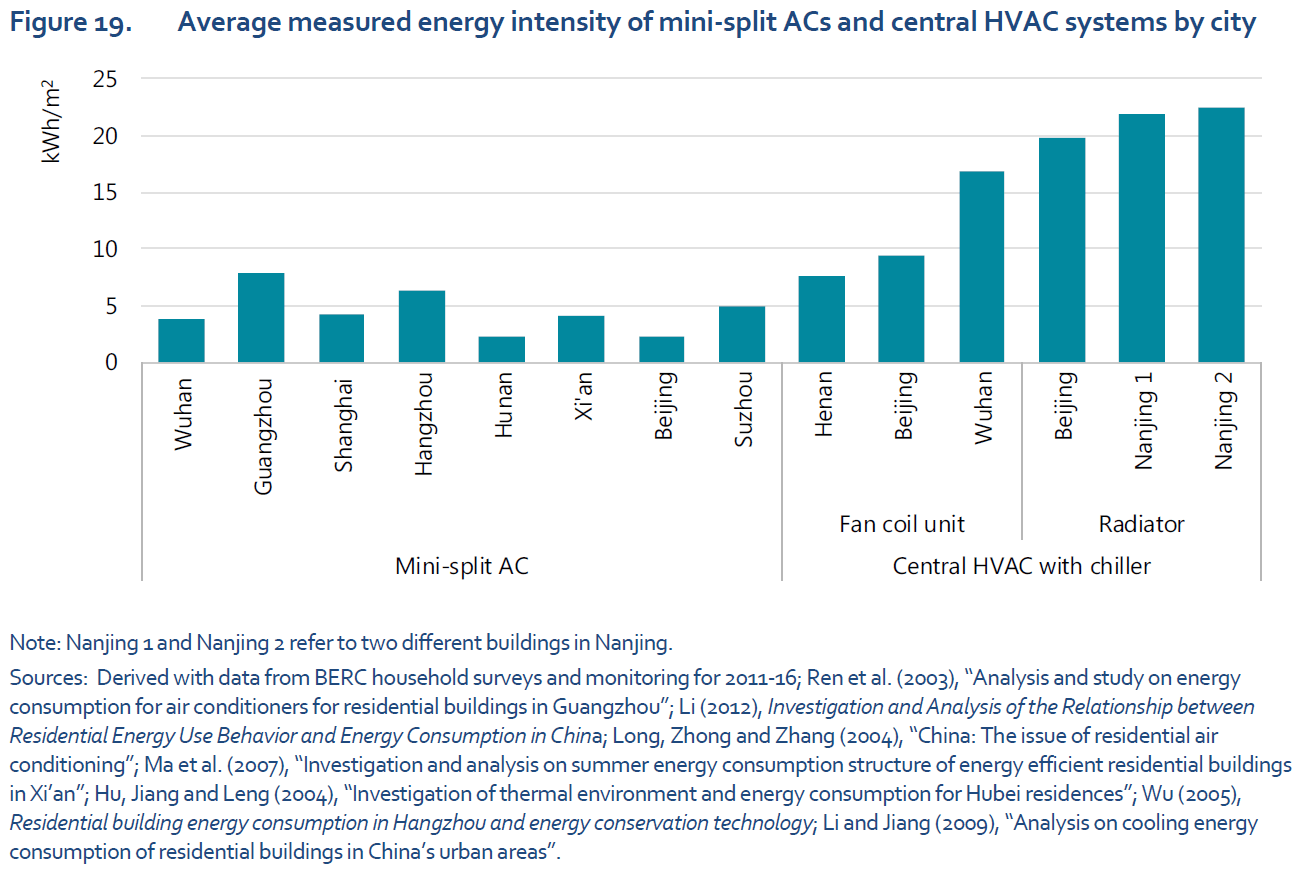

- Household sector, where domestic air conditioners pose an opportunity for improvement

Conclusion

Efficiency improvement as a step on the way to coal phase-out

China’s huge potential for electricity efficiency improvements, if realised, could help redress its excessive growth of electricity demand as the economy continues to grow. This, together with an inexorable march of renewable energy, is very likely to expedite the process of squeezing coal out of the generation-mix. Policymakers should therefore put more emphasis on tapping into the country’s potential for electricity efficiency improvement as they draft the 14th energy five-year plan – the first comprehensive policy guidance for steering China’s journey to carbon neutrality.