About

Today we launch our fifth annual review of the European power sector – and for the third year in a row with Agora Energiewende. The 5 key findings from the report are summarised below, but please download the report for the full picture, pieced together from a variety of European and national data sets.

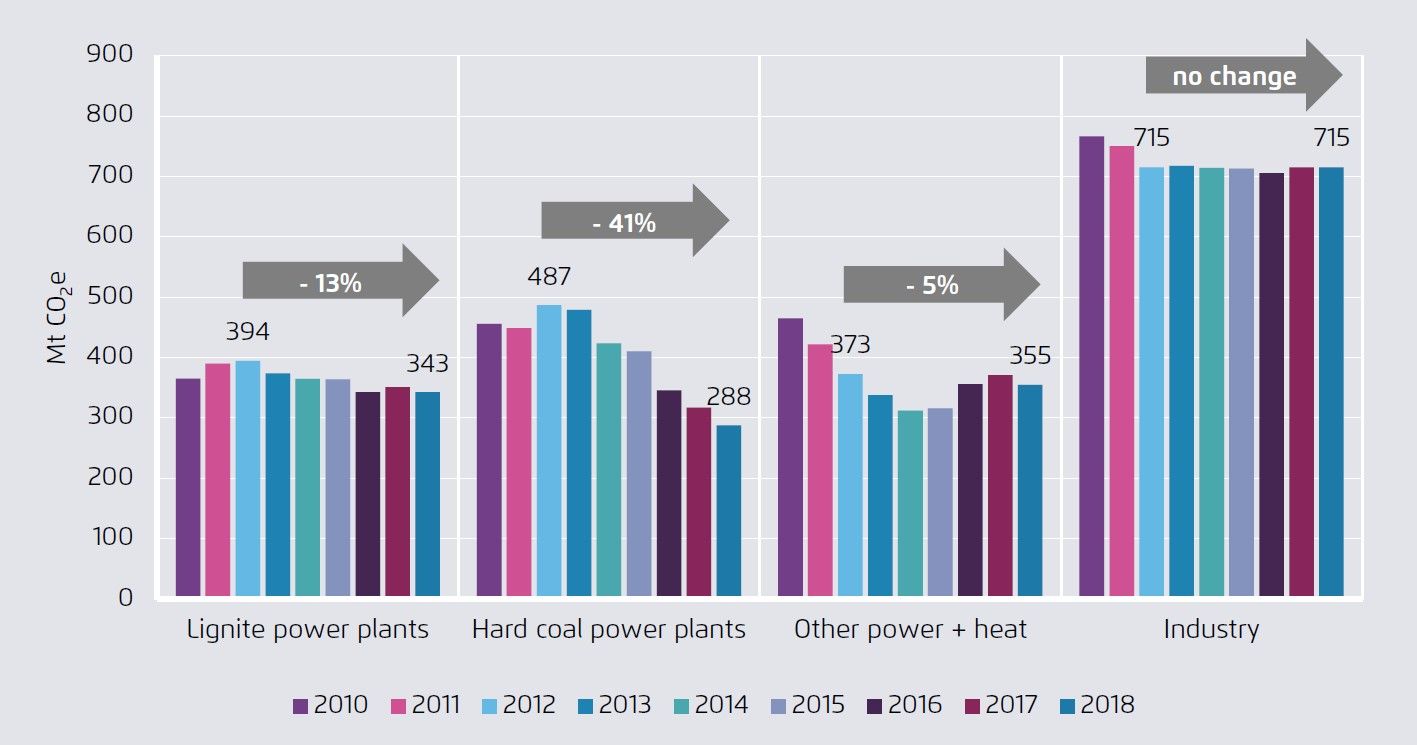

Europe’s coal phase-out is gathering pace as renewables continue to grow. EU total coal generation fell by 6 percent in 2018 and was 30 percent below 2012’s generation. But it’s a tale of two types of coal: most of the fall has been from hard coal, and not dirtier lignite. Europe’s phase-out of hard coal is gathering pace, but Europe’s phase-out of lignite is only just beginning.

2018 European Power Sector

A tale of two types of coal

Matthias Buck Head of European Energy Policy, Agora Energiewende

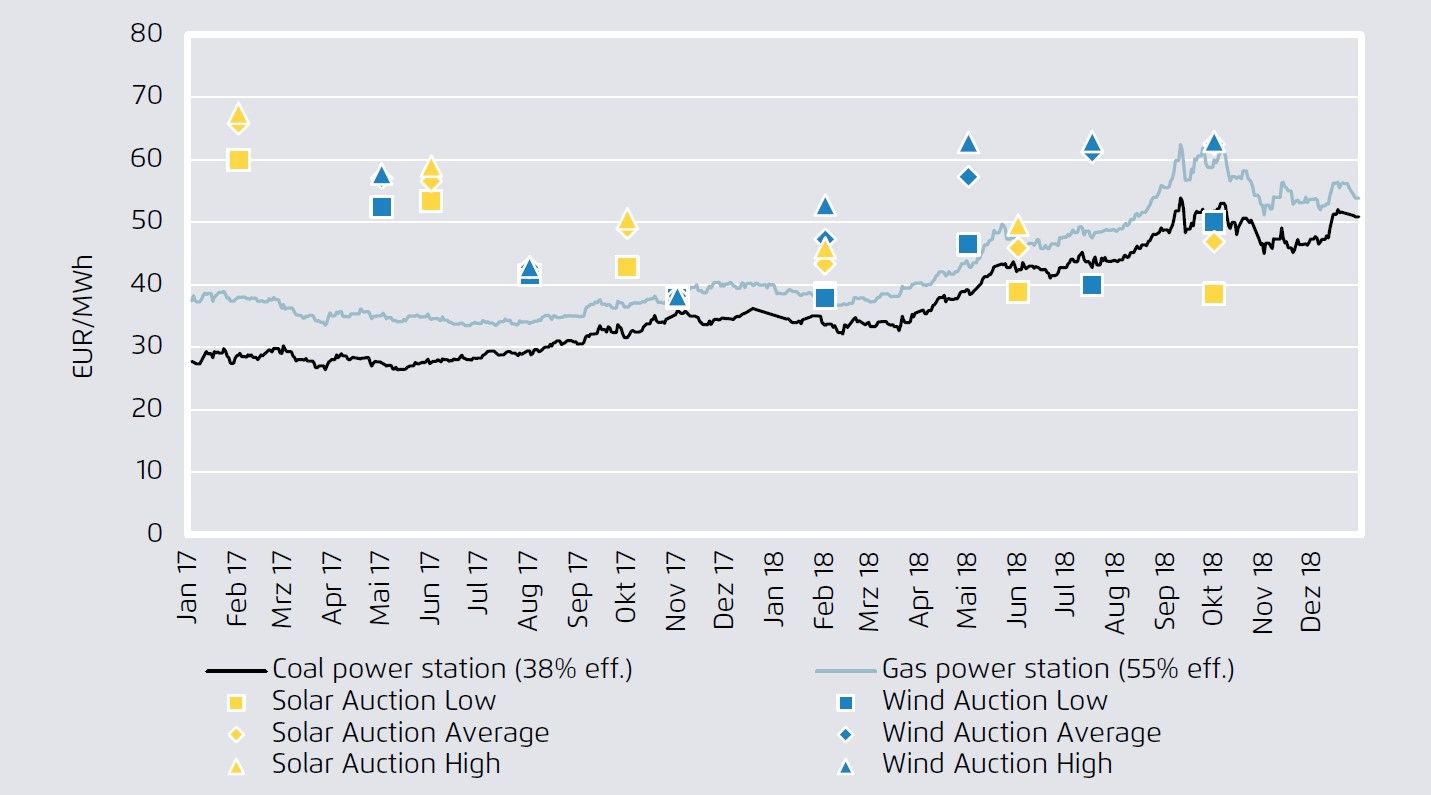

The EU so far largely missed the opportunity to profit from the very favourable solar module prices, which mean that solar power from new plants is now often cheaper than electricity from conventional power plants. On the positive side, however, three countries – Spain, France and Italy – are now aiming for solar outputs of 45 gigawatts and more. This makes the potential very clear and will set an example.