About

Analysis by Ember and Climate Risk Horizons (CRH) shows that 27 GW of pre-permit and permitted new coal power plant proposals are now superfluous to requirements and will likely end up as “zombie” plants— assets that will be neither dead nor alive.

These surplus plants, if built, will suck in scarce resources and impede India’s renewable energy (RE) ambitions. But they can be cancelled without needing to sacrifice the power system’s ability to meet future demand.

Executive summary

27 GW of unnecessary planned coal power plants threaten India’s RE goals

Ashish Fernandes CEO, Climate Risk Horizons

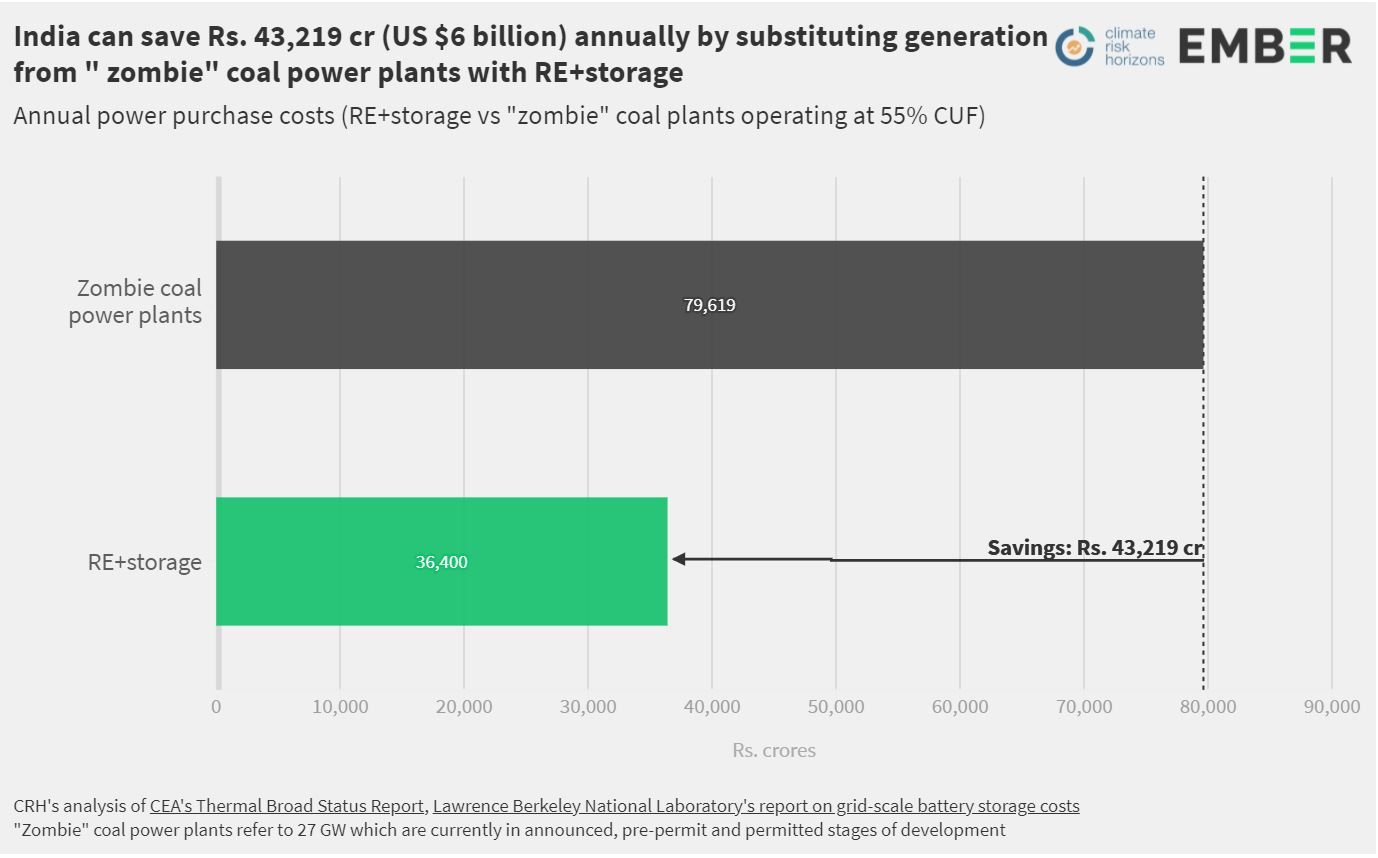

The 27 GW of new coal being proposed at an investment value of 250,000 cr ($33 billion) represent a significant threat to the Indian economy, not just in terms of misallocation of scarce capital, but also due to the lock in effect of expensive electricity and ancillary impacts on the renewable energy industry. This must be avoided especially as the Indian financial sector is yet to recover from the Non Performing Asset crisis created by excessive coal construction in the last decade.

The Zombie Coal Threat

Unnecessary planned coal could undermined India's RES goals

Conclusion

The risk of zombie coal

The economics of India’s electricity generation sector have changed drastically in the last five years. Clearly, many parts of the electricity system have yet to adapt to that change: system inertia on the part of coal power players (both government and private) and regulators has meant that new coal power proposals have continued to move through the system. This raises the risk of creating 27 GW of coal “zombies”: power plants that if built will waste public finance, lock consumers into expensive contracts and threaten India’s ambitious RE targets.

Supporting Material

Methodology

About the report

This report estimates electricity requirements by the end of this decade and compares it with the Central Electricity Authority (CEA’s) Optimal Generation Capacity Mix (OGCM) report forecasts. It examines whether India needs more new coal power plants under the current circumstances to meet its power requirements in FY 2030 and estimates savings that can accrue by investing in clean energy technologies better suited to address India’s growing electricity demand instead of unnecessary new coal plants. The analysis in this report was done based on the electricity generation data and broad thermal power status reports from the CEA database, peak demand data from the Ministry of Power (MoP) and the data on future RE+storage costs from Lawrence Berkeley National Laboratory.

Acknowledgements

Aditya Lolla, Senior Electricity Policy Analyst, Ember.

Ashish Fernandes, CEO, Climate Risk Horizons.

Abhishek Raj, Analyst, Climate Risk Horizons.

Wilf Lytton