About

Every January since 2015, Ember (formerly Sandbag) has published an update on Europe’s Power Transition, and for the first time, we provide a 6-month mini-review to help explain the extent and reasoning of the huge fall in Europe’s coal generation in 2019. To do this, Ember curated 20 gigabytes of power operator data from ENTSO-E, and then condensed the most important data to a handy 2MB excel to download from our website so you can also analyse it yourself – please let us know what you find!

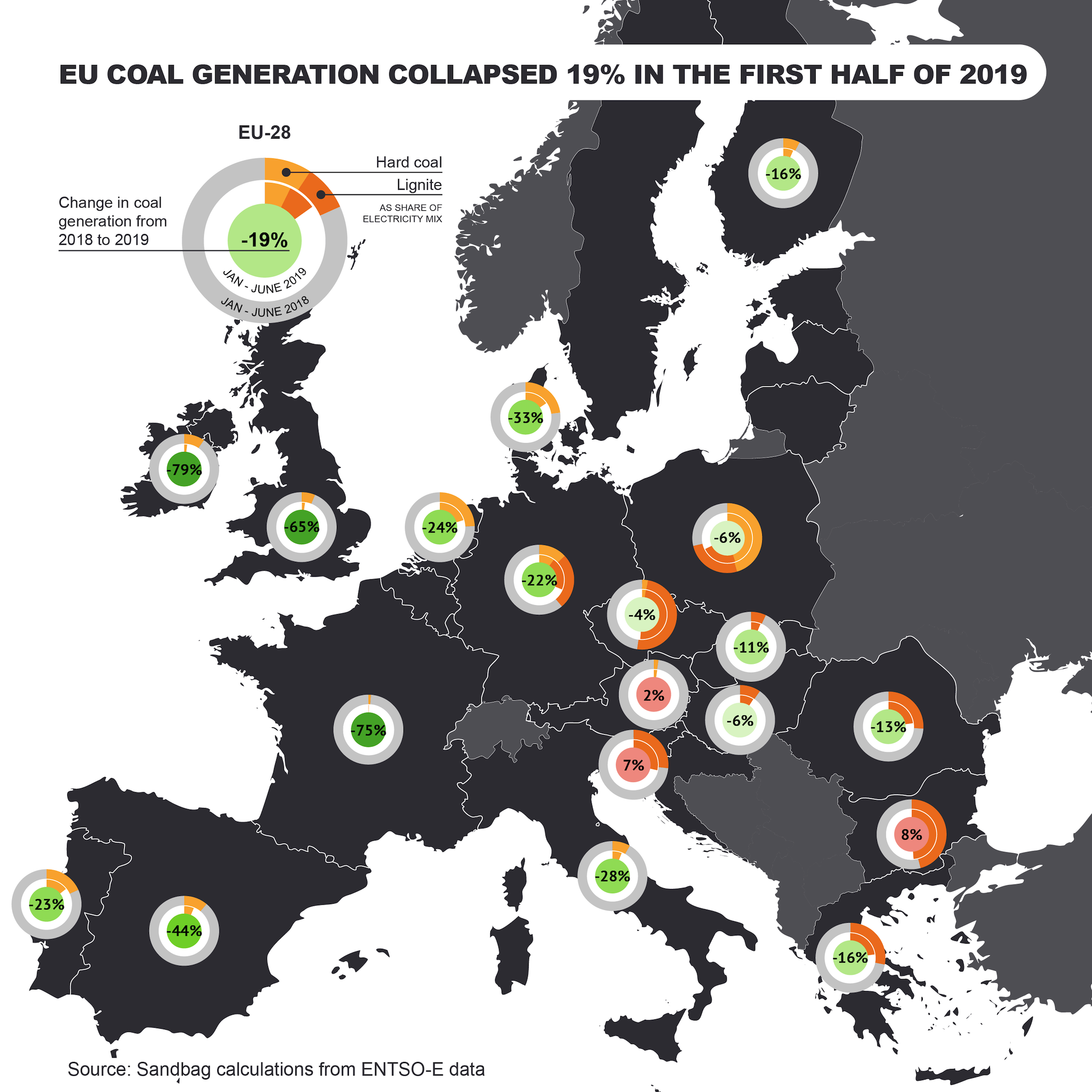

Coal generation in the EU collapsed by 19% in the first half of this year, with falls in almost every coal-burning country.

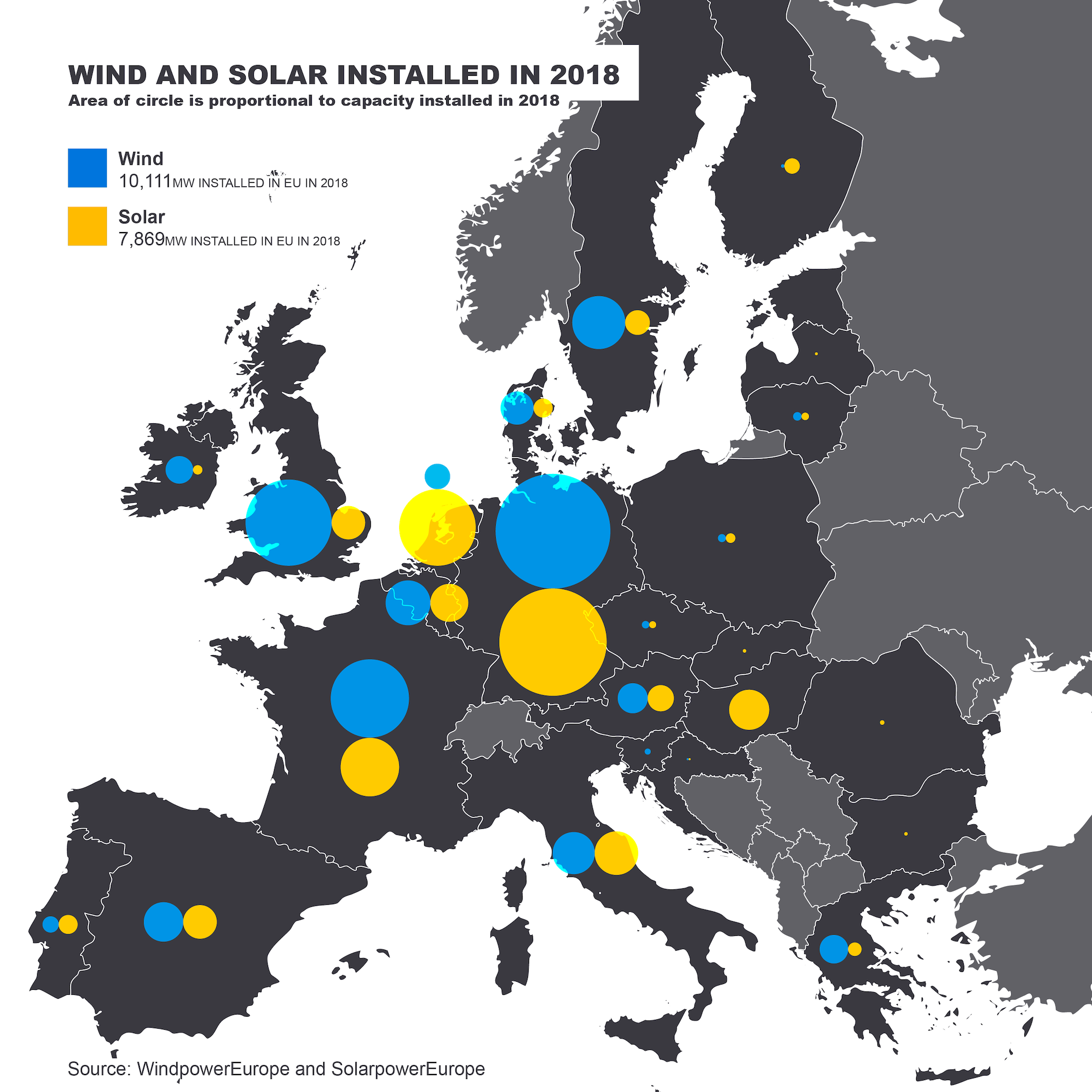

Half of coal’s fall was replaced by wind and solar, and half was replaced by switching to fossil gas. If this continues for the rest of the year it will reduce CO2 emissions by 65 million tonnes compared to last year, and reduce EU’s GHG by 1.5%. Coal generation already had fallen 30% from 2012 to 2018.

However, even if these falls continued in 2019, coal generation is still likely to account for 12% of the EU’s 2019 greenhouse gas emissions.

Where did coal collapse?

Coal generation in the EU collapsed by 19% in the first half of this year

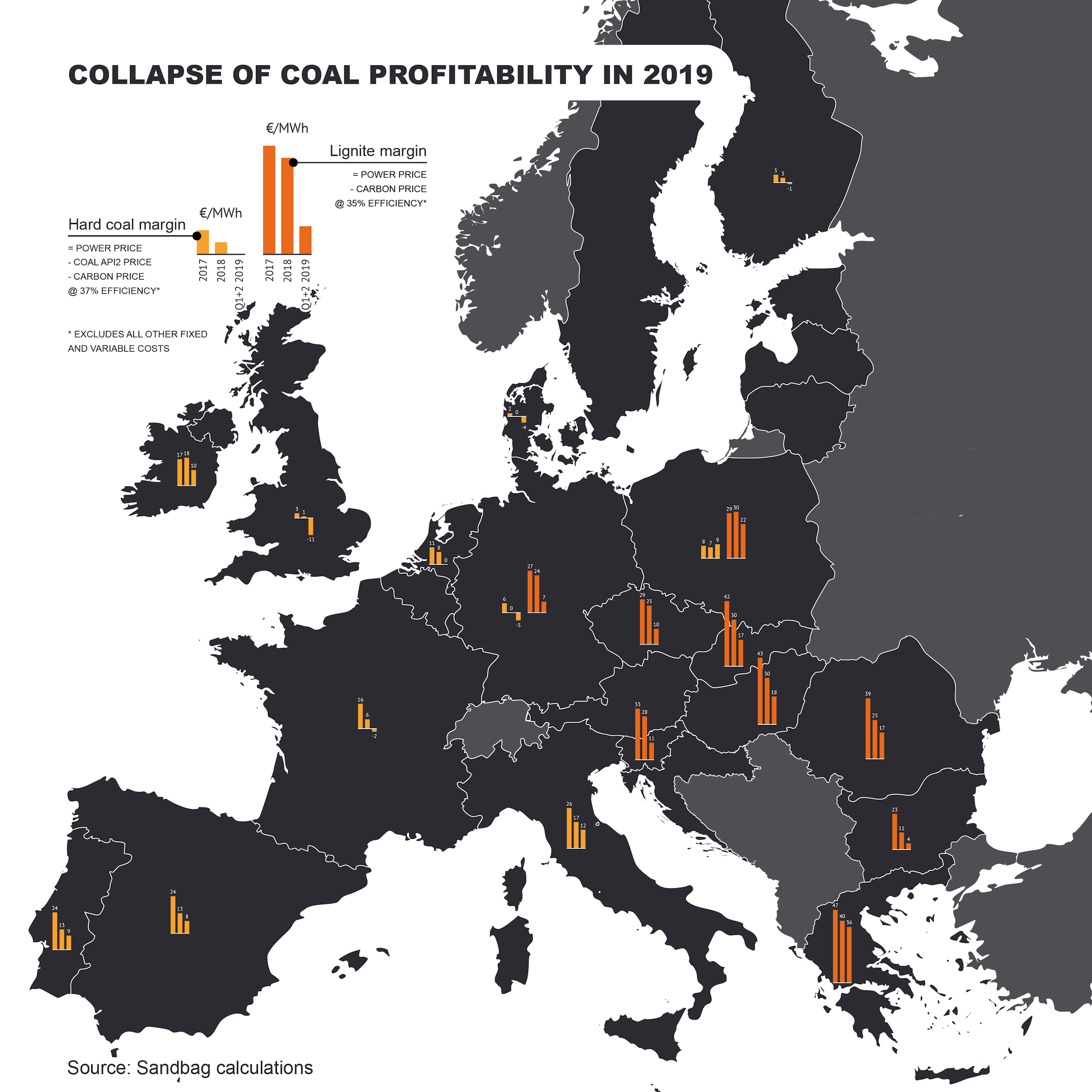

Why did coal collapse?

Coal collapse: the 3 primary drivers

Only 3% of coal plants closed in 2018, despite many countries planning to phase-out coal in the coming years. Most of these closures were limited to the UK and Germany, so the rate of closures elsewhere was near-zero.

The only mandated plants closed were German lignite units at Niederaussem and Jaenschwalde, which led to a large reduction of 4TWh of inefficient lignite generation.

The remaining plants broadly closed due to “poor economics”. Government policy plays a critical role in power plant economics. For example, all the following are likely to have played a role in the UK’s Eggborough’s plant closure in 2018:

- Knowing retrofit isn’t a viable option because of the UK’s 2025 coal phase-out date

- Reduced running due to more wind and solar

- A higher carbon price

- Tighter power plant emissions standards

- Lower capacity payments as new batteries outbid coal in the capacity mechanism

Outlook

Unfortunately, 2019’s coal collapse is not the ‘new norm’ unless there is a strong policy push

Coal-gas switching has most likely reached its peak. 2019 has likely already seen full coal-gas switching for hard coal, so the economics could only reverse back to more coal again. The biggest concern is that the carbon price is robust to the collapse in coal generation: 35% of EU ETS emissions were from coal power plants in 2018, so more ETS tweaks might be needed to keep carbon price from falling. Having said that, lignite-gas switching hasn’t reached its full potential yet in Germany, so a continued rising carbon price would result in a speedier lignite phase-out.

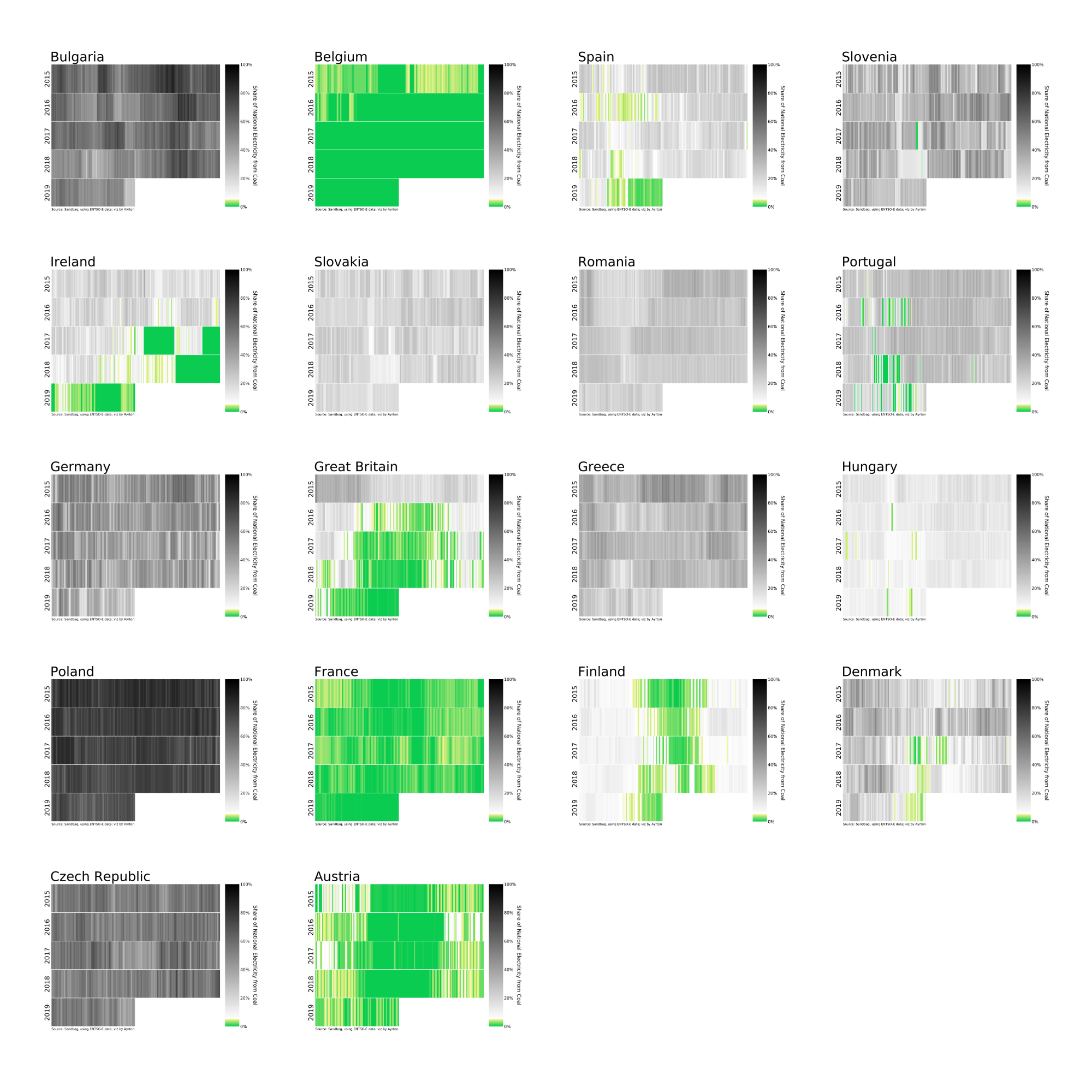

Wind and solar deployment is not fast enough in key lignite countries. The key lignite countries of Poland, Czechia, Romania, Bulgaria and Greece will not see falling generation unless they speed up wind and solar deployment. Additionally, as electricity consumption begins to rise from electric cars and other electrification, renewables will need to be deployed at double-speed in all countries, to ensure that coal falls at the same historical rate.

Coal plants need to close faster. Only 3% of coal plants closed in 2018. However, big progress is being made behind the scenes in many countries in planning for a coal phase-out. All countries in western Europe have a date by which to phase-out coal, and this is needed also for eastern countries. But many other preparations are also needed:

- All stakeholders must work together with workers to ensure a just transition and a speedy transition. If compensation must be paid to close coal plants, it should recognise that these coal plants are unlikely to be profitable today, and likely to be even more-so tomorrow.

- Governments need to tilt the playing field away from coal, by tightening air pollution limits, embracing higher carbon pricing, and not subsidising coal through capacity payments. Unsustainable coal-to-biomass conversions continue to be a threat in the future; inefficient coal plants need to be closed not converted to burning trees.

- Governments must encourage investment not only into wind and solar, but also electricity storage, interconnectors and demand response, and engage grid operators to speed the phase-out of coal.

So will governments embrace the swing in economics from coal to clean, and accelerate their coal to clean revolution?

Supporting Material

Methodology

Footnote on data quality

This report is primarily based on data from ENTSO-E, which collects data from national grid operators. Ember (formerly Sandbag) has curated this data, but this is very hard: ENTSO-E make the data very difficult to collate, and the national grid data supplied is sub-standard. We have done our best to give an accurate picture of the data in the best way possible, but small mistakes will still exist.

Please do access the data yourselves that we have provided, so you can pull out other insights relevant for your line of work. We hope you enjoyed our analysis.