Highlights

1%

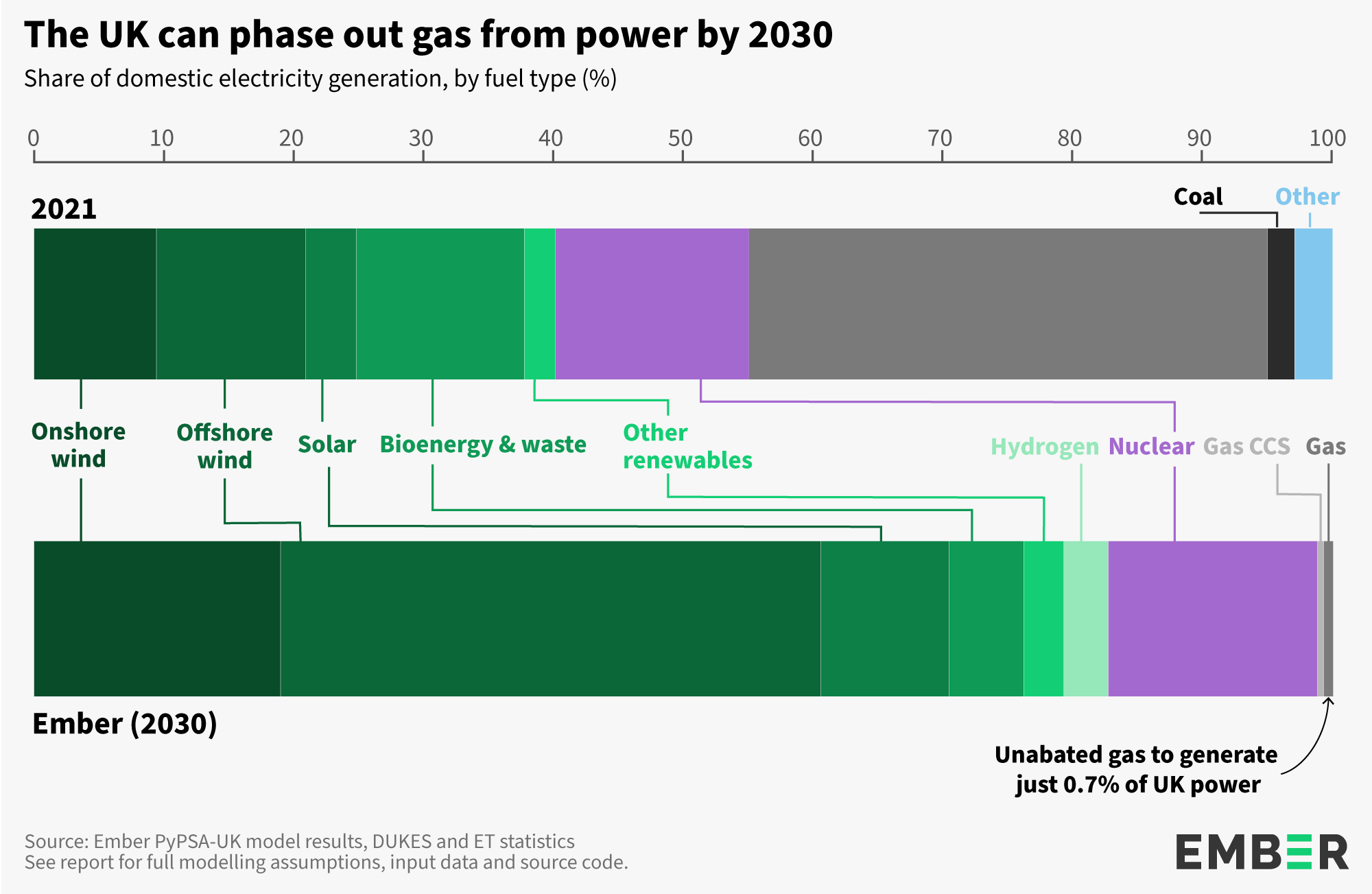

The UK power sector can transition from ~40% gas reliance to just 1% by 2030

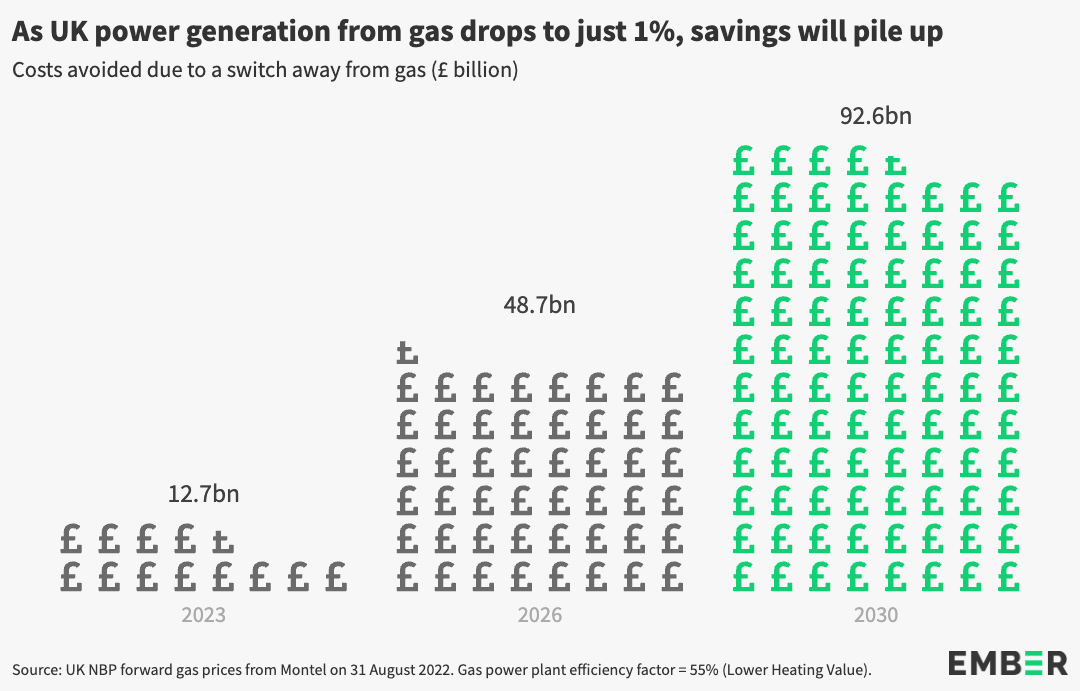

£93bn

Potential cost saving through avoided fossil gas consumption

About

The report sets out a potential pathway the UK could take to drastically reduce gas consumption in the power sector by 2030.

It analyses cost savings from a timely transition from gas to a clean power system, as well as discussing energy security considerations and recommendations for policy support. Ember’s own power sector model is described and compared against other leading studies on the UK’s energy transition.

Authors: Phil MacDonald, Pawel Czyzak, Harriet Fox, Sarah Brown

Executive summary

The UK can phase out gas power this decade

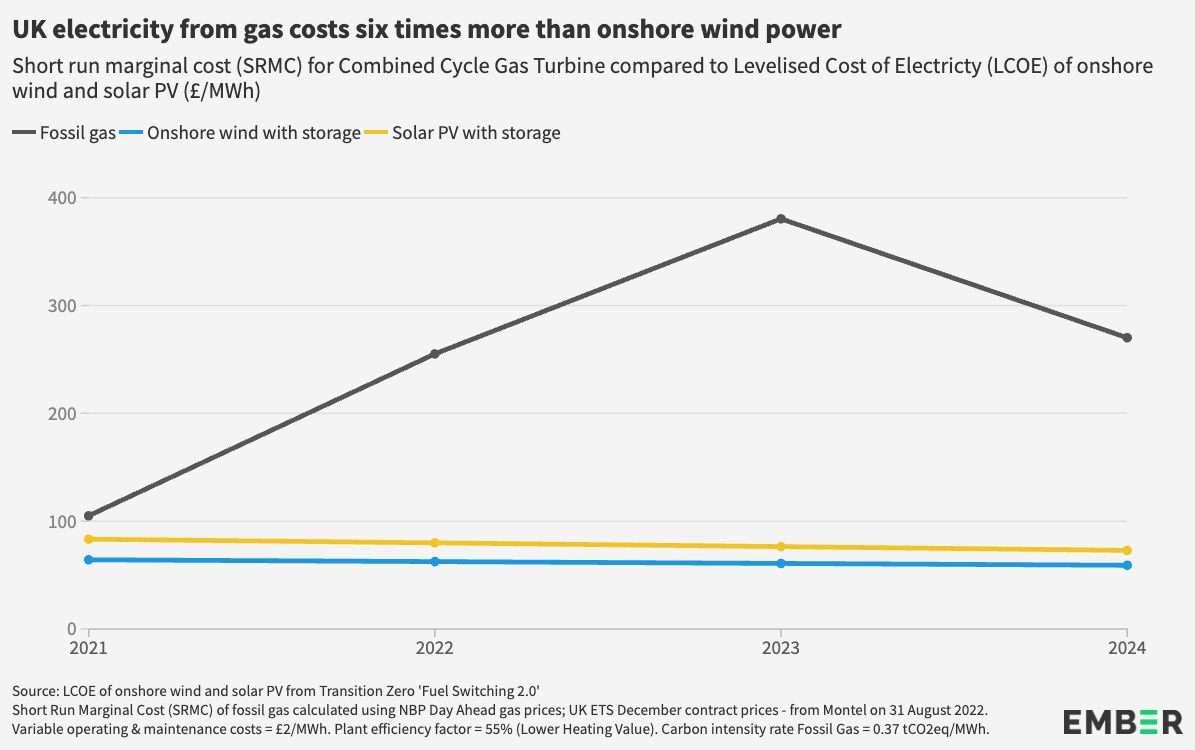

The global gas crisis has given new impetus to replace fossil gas with clean power generation. Britain’s extraordinary offshore wind resource and the rapid cost reduction in the technology gives an opportunity to phase out expensive gas imports from the power system this decade, and quickly enjoy the benefits of a cheaper domestic energy supply.

Chief Operating Officer, Ember

Russia’s invasion of Ukraine and the global gas crisis add new urgency to ending the UK’s fossil gas addiction in as many sectors as possible. With abundant and cheap offshore wind, the UK has an opportunity to move even faster in the power sector whilst driving economic growth. Rapidly reducing dependence on expensive gas power will enhance the United Kingdom’s energy security and geopolitical security - and bring down spiralling energy bills for households and businesses.

Modelling 2030 clean power

UK can achieve 2030 clean power

Ember’s model shows the UK reaching 99.3% clean share in the power mix in 2030, with 70% of the UK’s electricity provided by wind and solar.

In this chapter:

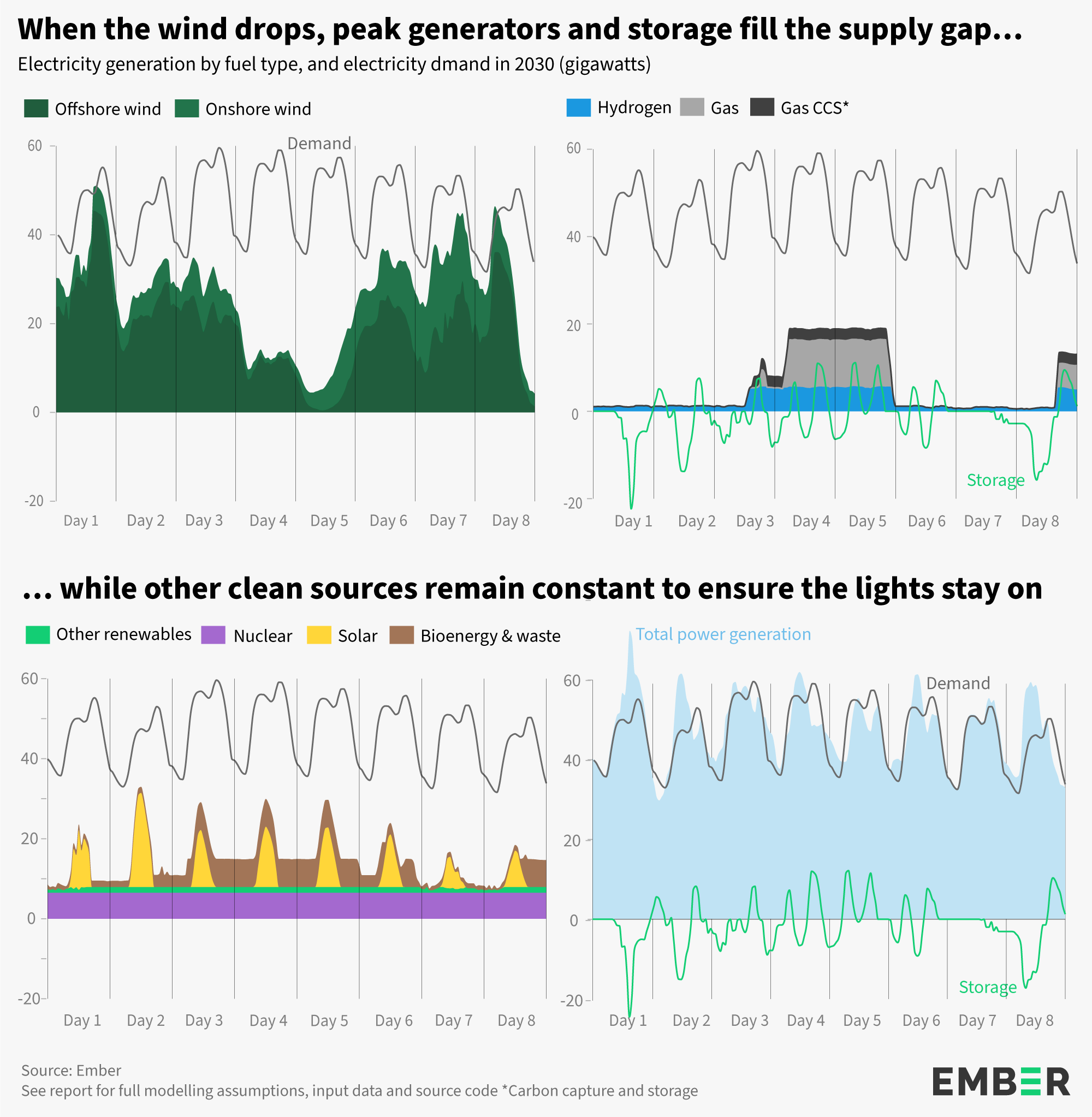

Even with wind generation dropping to nearly zero, Ember’s modelled system can still provide a stable power supply.

An analysis of a peak stress week shows that with almost no wind, demand can be met by using nuclear, bioenergy and storage, and ramping up backup generators: gas, gas with CCS and hydrogen.

Further security can be provided by demand-side response, with consumers volunteering to shift their demand in exchange for compensation, and electricity imports, with National Grid planning for an impressive 20 GW interconnector capacity by 2030. These interconnectors were switched off in Ember’s model to prove that the UK can balance its demand even without foreign support, but the benefits of electricity trade are undeniable and proven many times by grid operators, leading to lower prices and curtailment, easier balancing and increased security.

Delivering clean power

The UK is already moving towards clean power

But a more committed energy transition will bring bigger benefits, faster.

In this chapter:

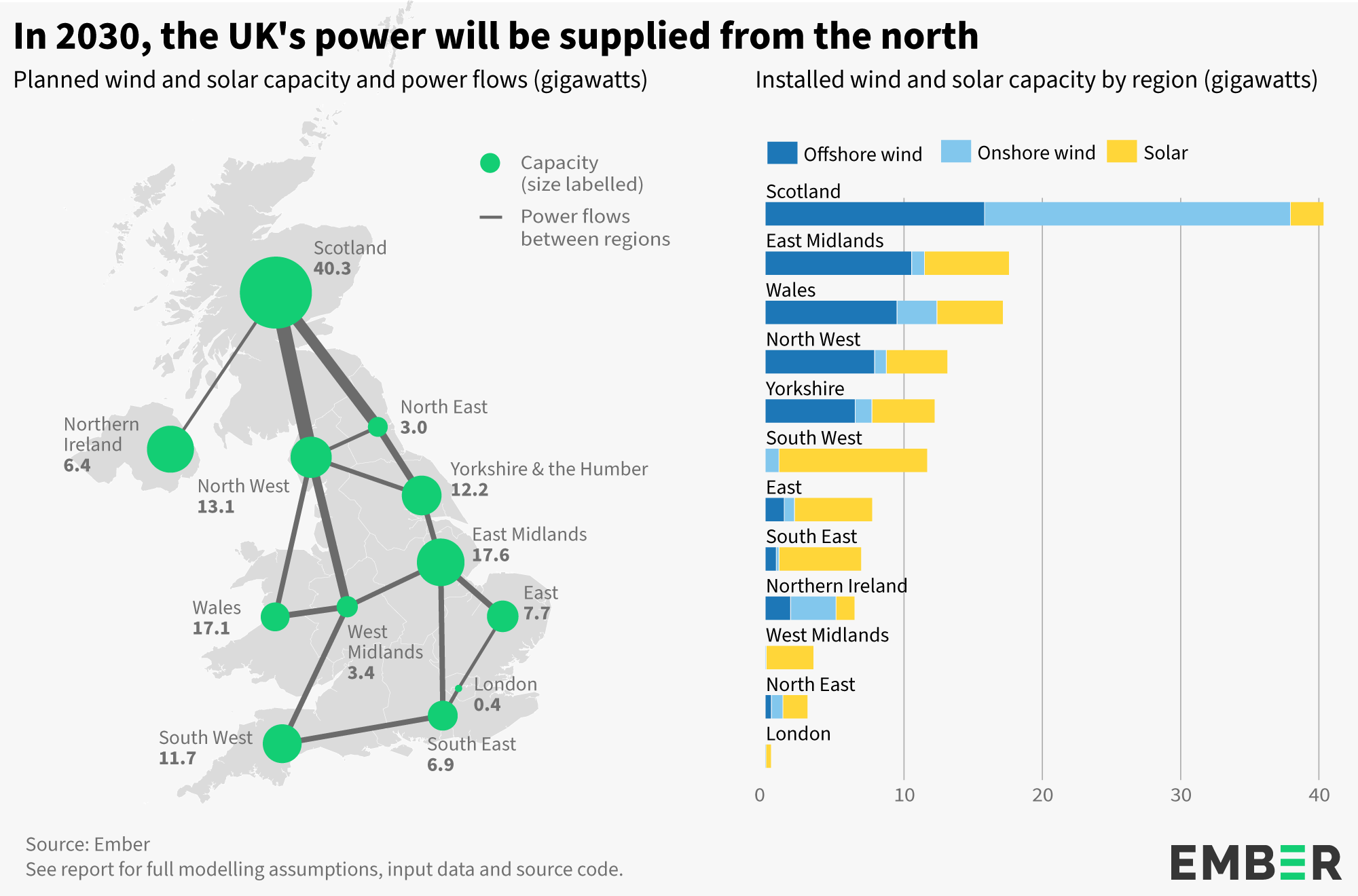

However, it also puts a lot of strain on the north-south power grid, requiring accelerated investments in the transmission network. The UK’s electricity demand concentrates in the south, with London and the South East regions alone responsible for almost 30% of the country’s electricity consumption. This power will be supplied in large from Scottish wind farms.

National Grid rightly acknowledges the need to execute more infrastructure investments, already planning to invest £10 billion in the transmission grid by 2026. It is critical that the planning of the UK’s future energy system takes those into account, allocating enough funding to modernise the grids on time.

Recommendations

2030 clean power

Cutting gas from the power sector will reduce energy bills and make the UK safer

Phasing out gas this decade will require a heroic push from government policy and support, acceleration of the private sector’s already ambitious deployment plans, and continued technological innovation.

While there are different possible pathways to eliminate UK gas power reliance, there are some commonalities in power sector modelling. Hydrogen and CCS will likely both be essential sources of dispatchable power – the technologies exist but are not yet deployed at scale. Nuclear will provide essential firm supply, both from new plants and lifetime extensions where possible. To reduce risks of one technology failing to deliver, the government should pursue an ‘all-of-the-above’ strategy for clean energy. But the backbone of the British electricity system is fast becoming wind power, especially offshore wind, which is cheap, quick to build, and reliable.

Ember’s research agrees with National Grid and the Climate Change Committee: by the end of the decade, wind and solar together will supply around three quarters of British electricity demand.

The imperative to get off gas does not just come from threats to energy security and energy costs. The UK renewables industry is already world leading in many respects and the country now has the opportunity to drive reindustrialisation as the government backs other low-carbon technology, including hydrogen power, innovative long-term storage and carbon capture and storage.

Finally, producing electricity without carbon emissions is the essential step towards reaching a full net zero economy. According to the International Energy Agency, all Advanced Economies need to have reached clean power by 2035. The UK government has already committed to decarbonise the power system by 2035, but the global gas crisis and further falls in the price of renewables suggest that the country may be able to seize the opportunity of clean power even earlier, and continue to lead the world on climate change.

Annex

Ember's modelling compared to other scenarios

Other renewables such as marine, tidal, and geothermal energy are mainly in the early stages of commercialisation, require significant R&D, and make a minor contribution to generation in 2030. Ember matches the capacity available in National Grid’s scenario.

Supporting Material

Methodology

Ember’s power system model

The analysis presented in the report uses Ember’s in-house power system optimization model PyPSA-UK, that is publicly available along with all input data under the MIT licence, allowing for all analysts to replicate our results or build their own scenarios for the UK’s future energy system. PyPSA-UK is based on the PyPSA framework, a Python-based ‘open source toolbox for simulating and optimising modern power systems’, used globally in research and policy applications.

Ember’s implementation of PyPSA uses 2030 capacity and demand expectations from National Grid’s Future Energy Scenarios (FES – Leading the Way pathway), expanding the geographical scope to cover Northern Ireland.

The model is run for each hour of the year, with 12 nodes representing the regions of the UK. Current and planned power station locations are used (based on DUKES data, planned hydro pumped-storage units, the REPD database, among others), with some generators being decommissioned and some upgraded e.g. a gas combined-heat-and-power plant (CHP) becomes a green hydrogen unit. Adequate green hydrogen supplies are secured through the conversion of otherwise curtailed wind and solar energy in electrolyzers – the estimated potential of H2 production is 2.1 million tonnes, with only 0.64 utilised in the planned hydrogen turbines.

The model runs the capacity projections against ‘worst case scenario weather years’, following a methodology used by European grid operators in their planning. The European Network of Transmission System Operators (ENTSOE) prepares Ten Year Network Development Plans (TYNDP) and the European Resource Adequacy Assessment (ERAA) to assess the safety of the European power system, the availability of generators against the demand, grid expansion needs, etc. Both processes use the Pan-European Climate Database (PECD) to estimate the demand and variable renewables feed-in under different climatic conditions, with the TYNDP pathways checked against 1995, 2008 and 2009 (the baseline year) weather profiles as the worst case years.

Using the ENTSO-E’s methodology ensures the model maintains energy security, with supply matching demand on an hourly basis, even in high stress situations (for example, dunkelflaute, or mid-winter wind lulls). To emphasise the security aspect, interconnectors are switched off in Ember’s model, with the UK being fully self-sufficient in terms of electricity supplies.

A merit-order scheme is resembled, in which the dispatching is optimised based on short-run marginal costs. Where available, National Grid’s fuel and CO2 price forecasts were used, except for 2030 gas prices that were estimated based on forward contracts. The running costs of other generators were set to represent their dispatching priority in the merit order. The model was calibrated using 2019 weather and demand data to ensure the cost assumptions correctly represent reality. A generic CHP running profile was calculated from 2019 hourly generation profiles for the CHP units available in BMRS and the dispatching of CHP units across all technologies (biomass, waste, gas, hydrogen) was not optimised to ensure adequate heat supply. A minimum load of 40% for nuclear plants was assumed based on ENTSO-E’s ERAA input data. No ramp up/down limits were introduced due to their impact on model solving times, but these can be added in future works based on PyPSA-UK.

The outputs produced by the model give an indication of the resources needed to fulfil the power demand in the future, as well as the emissions intensity, load balancing needs across regions, storage requirements, among other metrics.

Gas cost assumptions and calculations

Gas currently accounts for 40% of total UK power generation. A gas plant efficiency rate of 50% (gross calorific value/higher heating value) was used. A carbon intensity of 0.37 tCO2eq/MWh was applied. Variable operating and maintenance costs were estimated at £2/MWh for gas plants. UK National Balancing Point (NBP) fossil gas prices on 31 August 2022 were used for current and forward prices and to calculate gas cost savings. The 2028 calendar year NBP gas price was used for 2029 and 2030. The ICE UKA carbon allowance price is only quoted out to 2024 for the December contract so that price has been applied for 2025 to 2030. The levelised costs of generating electricity from onshore wind and solar PV for 2021 to 2024 include storage costs and were taken from analysis by Transition Zero.

Hydrogen generation assumptions

In National Grid’s FES Leading the Way scenario, deployment of hydrogen generation capacity begins in 2028 and reaches 1 GW of total capacity by 2030. However, analysis from the CCC finds that 1 GW/yr of hydrogen generation capacity could be deployed in the second half of the 2020s with deployment rates rising to 3.5 GW/yr between 2030-2035, achieving up to 20 GW of total capacity by 2035. These buildrates are consistent with buildrates of gas-fired plants across the 1990s and are therefore considered realistic. In this model, Ember has therefore assumed an accelerated rate of hydrogen generation deployment to 2030 compared with National Grid to more closely align with the CCC’s analysis.

Wind and solar: curtailment and exports

The wind and solar feed-in in Ember’s scenario is lower than in the FES due to two factors: the much higher nuclear generation and the lack of energy exports. While a later nuclear decommissioning schedule reduces gas consumption, the limited flexibility of nuclear reactors means they are not able to lower their output when renewable feed-in is high, leading to increased curtailment. Similarly, the significant interconnection capacity in FES means that surplus electricity from wind and solar can be sold to neighbouring countries (assuming they will want to buy it). From all the energy curtailed in Ember’s scenario (133 TWh) up to 108 TWh can be used to produce 2.1 million tonnes of green hydrogen (assuming the 10 GW electrolyser capacity).

Renewable applications and permitting

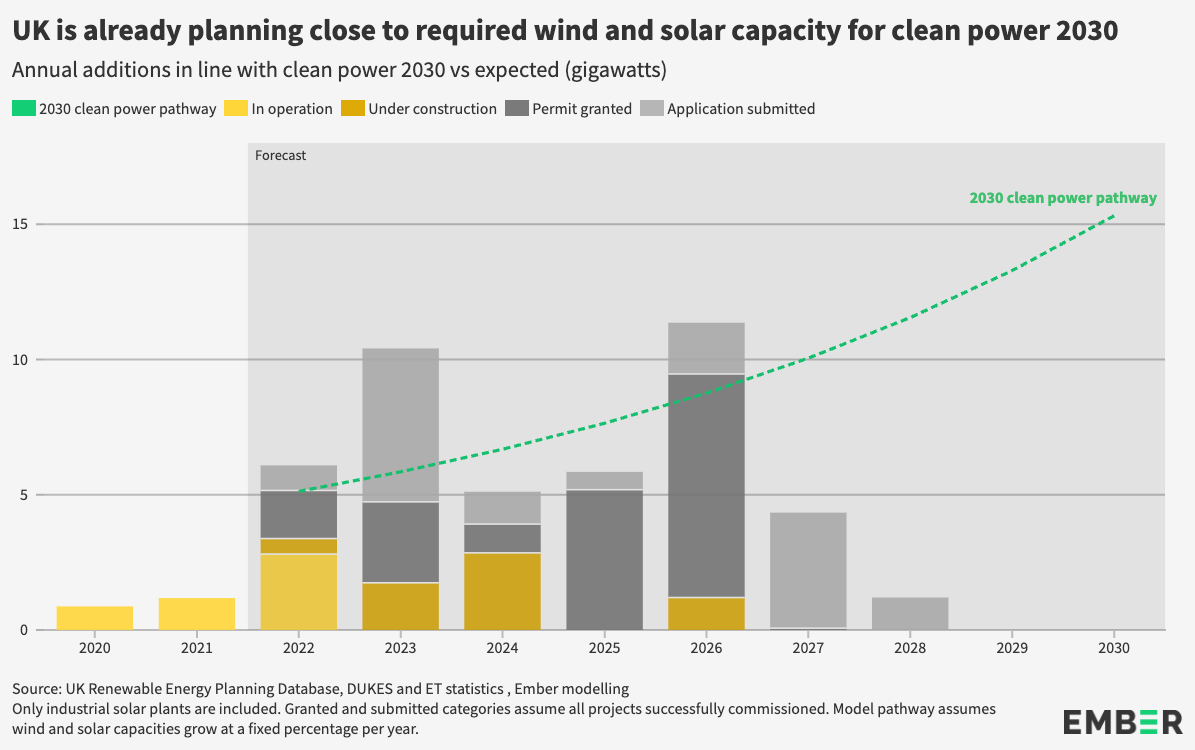

So far this year, the UK has brought online more than double the volume of wind and solar capacity compared to 2021, with a further 0.6 GW under construction due for completion by the end of the year. Around 15% (6 GW) of projects in the assessed pipeline are currently under construction, the majority of these being large offshore wind projects due to begin operation in the next one to three years.

Projects with permits already granted account for half the pipeline capacity (19 GW).Timely construction of these projects will be essential to reach the wind and solar additions required by mid-decade to align with Ember’s modelling.

More than 6 GW of solar projects have submitted planning applications and, if successful, these could be expected to come online by the end of 2023. Onshore and offshore wind projects with planning applications submitted total almost 10 GW of capacity. The majority of these could come online between 2025 and 2028 if they are approved, based on average timescales of previous projects.

Average project timelines estimated from the UK Renewable Planning Database show that solar PV projects can progress from planning application to operation in less than 2 years. For onshore wind this timeframe is around 5 years, whilst offshore wind projects take more than 6 years to pass through all planning stages. The UK’s decision in February to move to annual Contracts for Difference (CfD) auctions should help ensure sufficient renewable capacity enters the pipeline of projects up to 2030, but the different timeframes of solar and wind must also be taken into account.

Acknowledgements

Alan Dawson / Alamy Stock Photo. Oil, gas rig being towed past Teesside Offshore Wind farm at Redcar on its way to Able UK yard near Hartlepool.

Power system modelEmber’s power system model is based on the PyPSA framework: T. Brown, J. Hörsch, D. Schlachtberger, PyPSA: Python for Power System Analysis, 2018, Journal of Open Research Software, 6(1), arXiv:1707.09913, DOI:10.5334/jors.188

ThanksThe authors would like to thank National Grid, the Climate Change Committee and SSE for conversations which contributed to this work.