About

Today we launch our fourth annual review of the European power sector – and for the second year in a row with Agora Energiewende. The key findings from the report are summarised below, but please download the report for the full picture, pieced together from a variety of European and national data sets.

The reports celebrates how for the first time, wind, sun and biomass overtook coal in supplying European electricity.

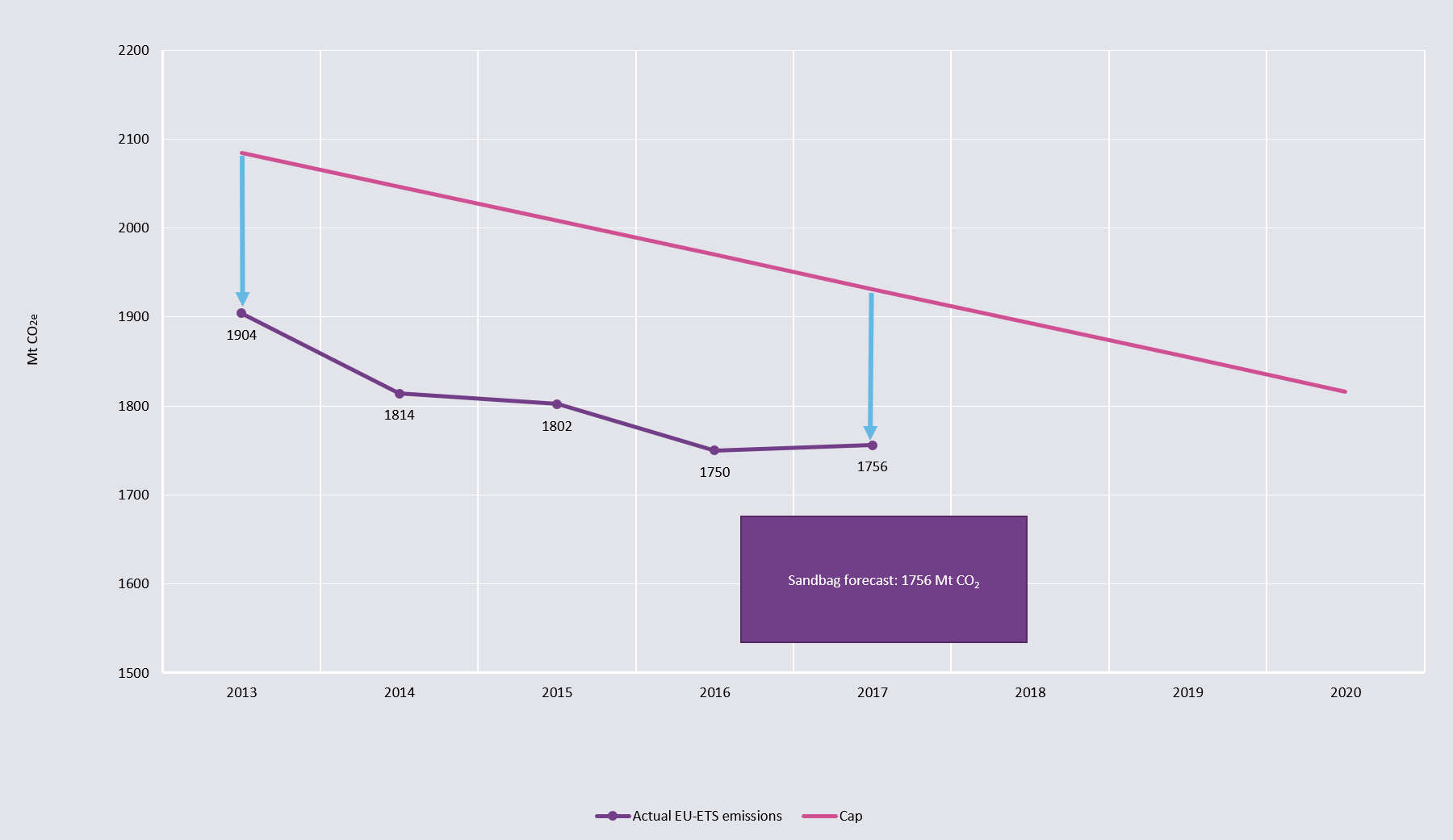

But there are worrying failings in the current electricity transition, not least that emissions reductions have stalled this year.

Supporting Material

Acknowledgements

Wilf Lytton