About

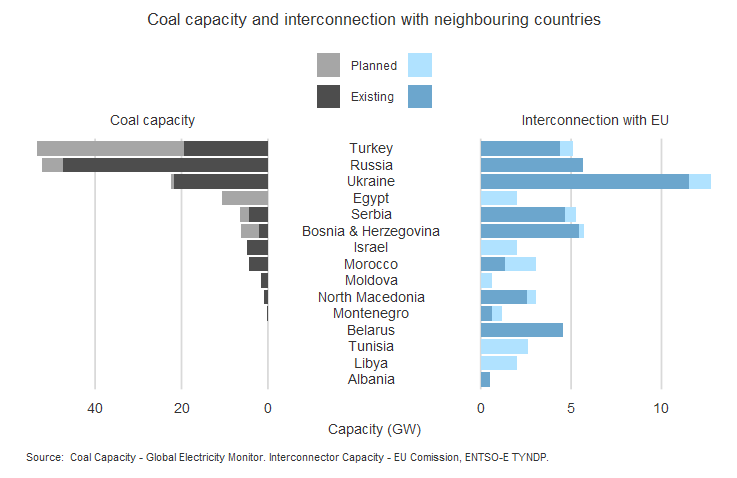

This report investigates how coal power plants just outside European borders are supplying electricity to the EU while avoiding the carbon price.

• How much CO2 leakage is there from electricity today?

• What growth in imports should we expect?

• Could a carbon border adjustment on electricity work to reduce carbon leakage?

Executive summary

Coal emissions are leaking into the EU

Ville Niinistö MEP, Finland, Committee on Industry, Research and Energy

In the Finnish context electricity from Russia is an issue of outsourcing emissions. We in the EU are on a clear path to a renewables based electricity system, and our neighbors should be as well. If we set up a carbon border tax for electricity, we would avoid exporting our emissions and bring our neighbors on board the shift to renewables.

Investigation

How electricity generated from coal is leaking into the EU

In this chapter:

Conclusion

A Border Carbon Adjustment on electricity

We propose that a border carbon adjustment is introduced for electricity entering the EU ETS region, until the trading partner in question implements an equivalent emissions trading scheme or carbon price of their own.

A BCA on electricity would:

- Defend the integrity of EU climate policy by preventing the offshoring of power sector emissions.

- Level the playing field for all generators operating in the same markets.

- Protect progressive investments of governments and companies. We have shown that some of the highest-ambition EU member states will remain exposed to imports of carbon intensive electricity, just when investment in low carbon alternatives is needed in order to achieve climate goals.

- Generate revenue for the EU. Revenue that could be used to support environmental projects or monitoring in neighbouring countries (generating political capital), or protect vulnerable customers from any

electricity price increases. - Incentivise carbon pricing in neighbouring countries. Rather than see revenue streams going to the EU, they may wish to redirect to themselves. This could instigate a domino effect of carbon pricing in EU neighbours.

Supporting Material

Acknowledgements

Report cover photo by Nikola Johnny Mirkovic on Unsplash

Other photos by Matthew Henry, and Charles Devaux.

Ember & ClientEarth submitted a joint response to the EU Commission’s request for feedback on the inception impact assessment for the EU border carbon mechanism. This response focused on the energy sector, and repeated our call – from The Path of Least Resistance – for power sector emissions to be included. The joint response can be viewed on the Commission’s website.