About

The report calculates emissions and subsidy and tax amounts for burning forest biomass i.e. wood, for electricity.

Executive summary

Should the UK end tax breaks on burning wood for power?

Analyst, Ember

Biomass power stations are in receipt of a huge tax break, based on an outdated assumption that burning wood is carbon neutral. Meanwhile renewables like offshore wind guarantee emissions cuts – for less than half the price of burning wood for electricity. Subsidies and tax breaks for biomass push up energy bills and taxes, without a clear benefit for the climate. As they continue to receive billions of taxpayer subsidy, the onus is now on the biomass industry to be transparent about the true emissions impact of their technology.

Analysis

Subsidies and tax breaks

In this chapter:

Solutions

Recommendations for policymakers

In this chapter:

- Biomass is not inherently carbon neutral, therefore, BECCS projects cannot be assumed to be inherently carbon negative.

- The government must only support BECCS projects when a full life cycle assessment demonstrates they are net carbon negative within Paris-relevant timescales (e.g. a decade) – and that the cost of negative emissions is equivalent to other options.

- Nature based solutions (such as afforestation and restoration) which do not burn wood can deliver negative emissions now at low cost and risk – the UK must begin to deploy at scale immediately.

Conclusion

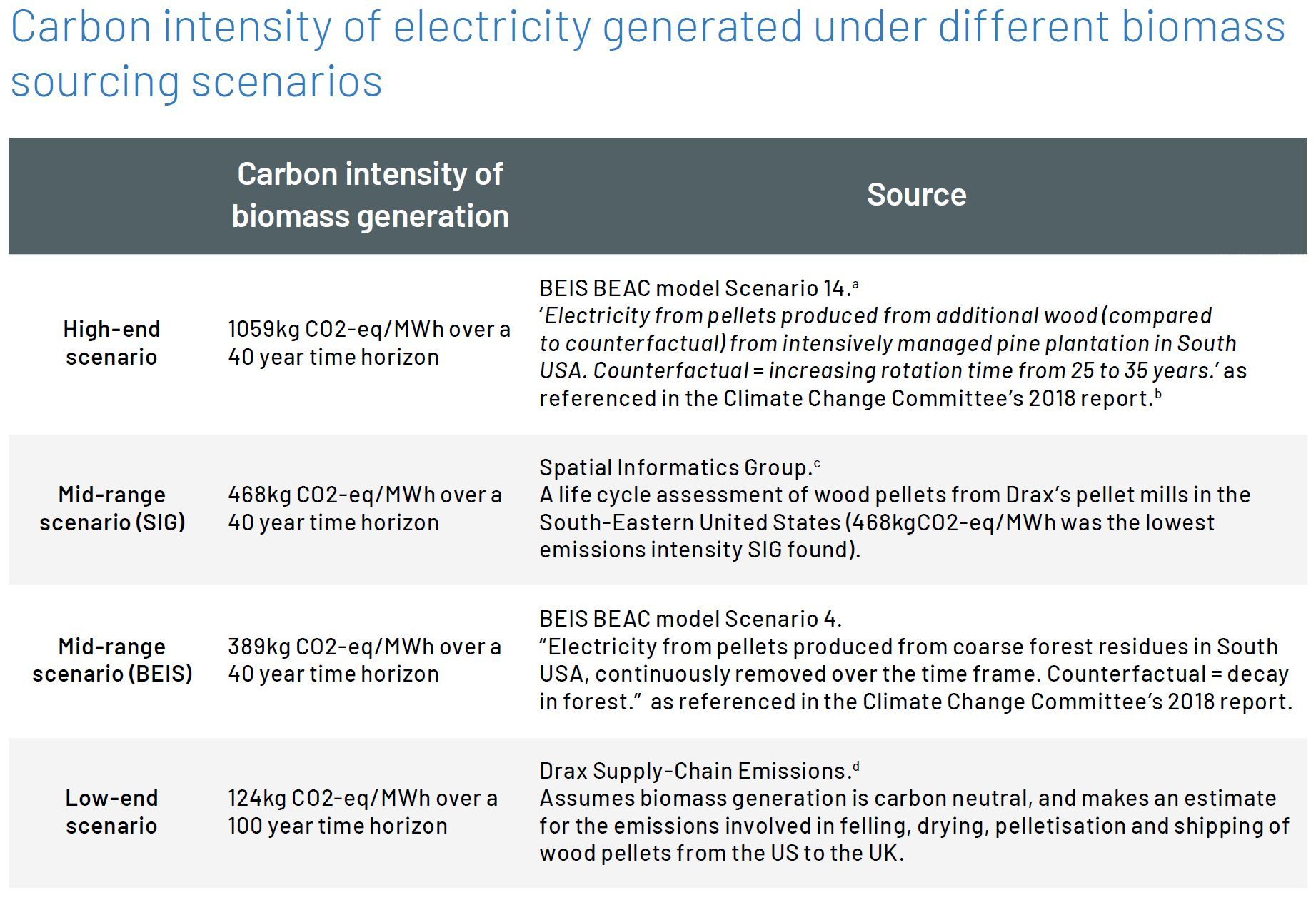

Biomass cannot be assumed carbon neutral

Substantial questions remain over the true lifetime emissions of biomass. The risk that high-carbon wood is being burnt in UK power stations is unacceptable given the availability of genuinely low carbon alternatives. The assumption of carbon neutrality for wood under the UK’s new carbon pricing regime prolongs a tax incentive that is no longer justified on a balance of risk and climate benefits.

Policymakers and investors considering biomass generation must become familiar with the concept of ‘carbon debt’ – that biomass emissions released into the atmosphere today create an immediate spike that may not be sequestered by growing forest for many decades. Given these concerns, further support for biomass generation is not guaranteed to reduce emissions, and we echo the CCC conclusion that the UK should transition away from the use of biomass for power generation without CCS.

When biomass contracts were initially agreed, biomass looked like a much better deal than it does now. In their 2005 Select Committee evidence, Drax stated that offshore wind was five times more expensive than biomass in terms of CO2 abated. The economics have now decisively shifted. The 2019 CfD auction results procured offshore wind at megawatt of power for £44 (£39.65 initial strike price), whilst Drax’s CfD currently provides a megawatt for £116.50 (£100 initial strike price).

Applying a carbon price for burning wood closes one loophole around the emissions produced by biomass generation. Moreover, as other countries consider biomass in an effort to follow the UK’s climate lead, we can send a vital signal internationally that biomass cannot be assumed to be carbon neutral.