About

This joint report by the Institute for Energy Economics and Financial Analysis and energy think tank Ember evaluates clean electricity transition in Uttar Pradesh and presents options to ensure it doesn’t fall too far behind on its solar power targets.

Executive summary

Uttar Pradesh is at a crossroads in its electricity transition

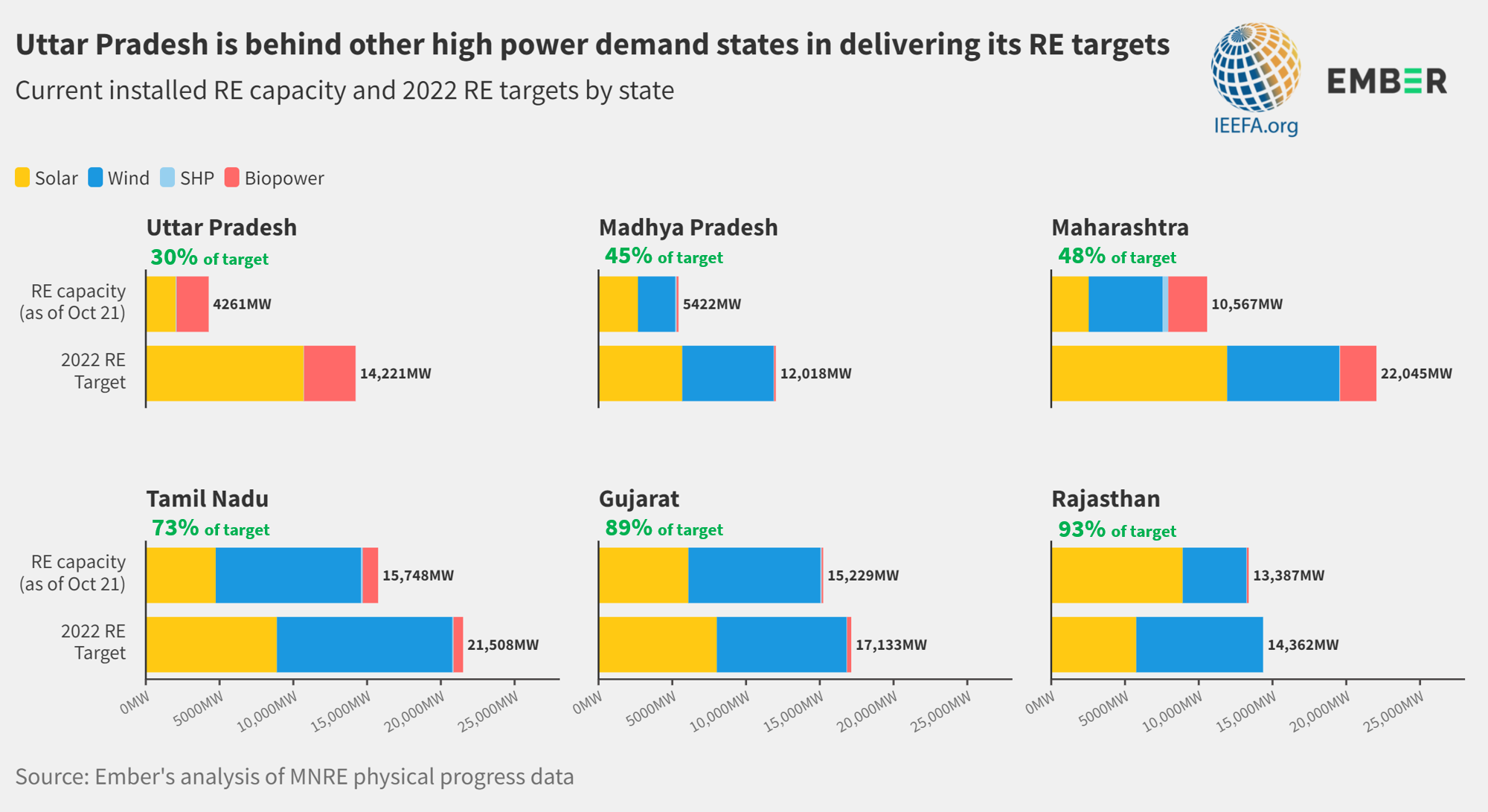

Uttar Pradesh has fallen behind other power-intensive Indian states in terms of delivering on renewable capacity targets. New research from IEEFA and Ember shows that solar is now key to meeting the state’s future energy demand.

Lolla and co-author IEEFA energy finance analyst Kashish Shah say Uttar Pradesh is now at a crossroads where the choices it makes about meeting future power demand growth could either speed up or slow down India’s decarbonisation journey.

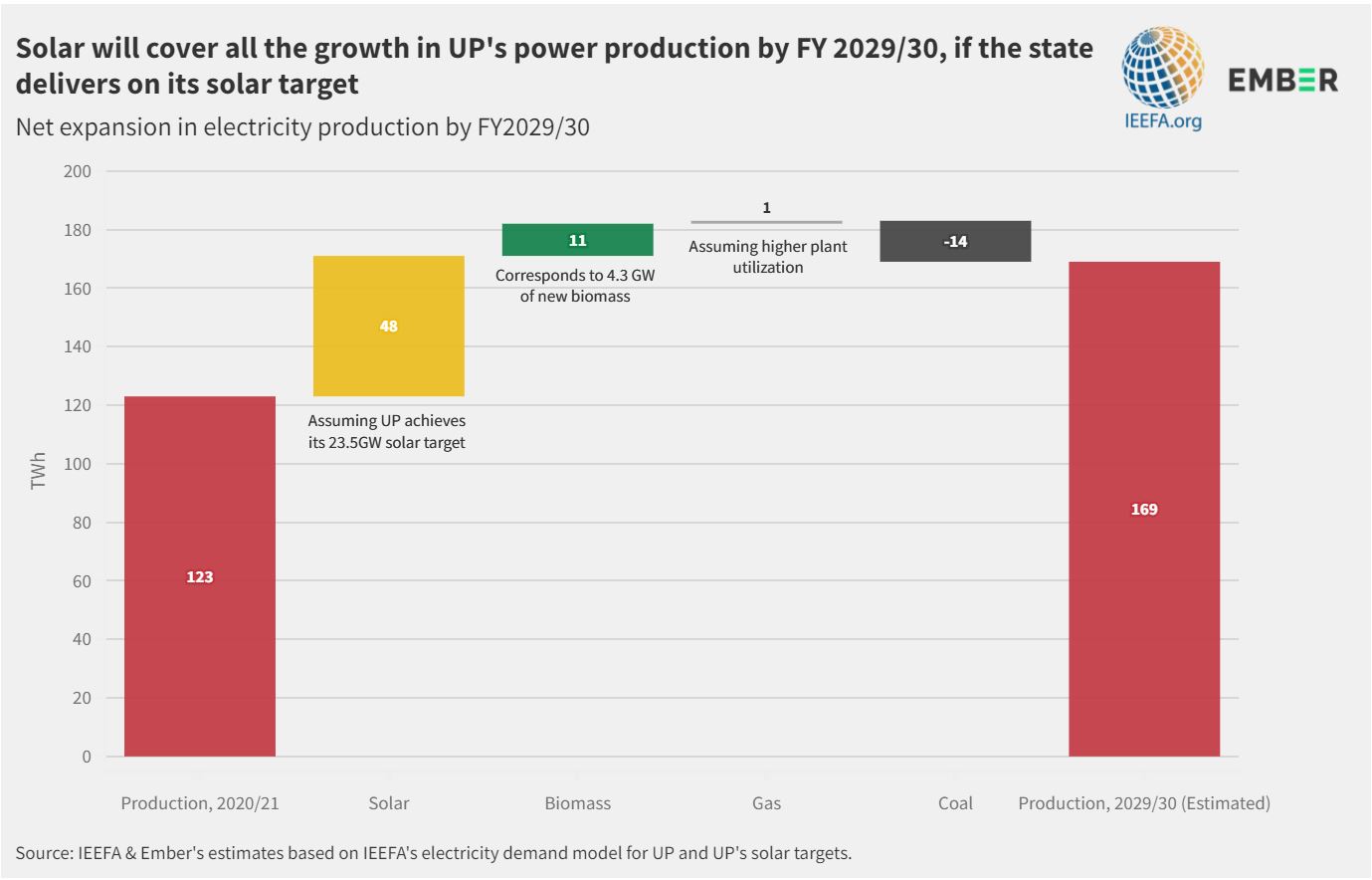

Meeting its 2030 solar target will allow Uttar Pradesh to avoid locking in resources to build new coal plants beyond those already under construction, says Shah.

“Building new coal-fired power plants is becoming increasingly unviable,” he says. “Capital for coal power projects is drying up. Apart from state-owned non-banking financiers – Power Finance Corporation (PFC) and Rural Electrification Corporation (REC) – there is no investor willing to finance coal projects in India.

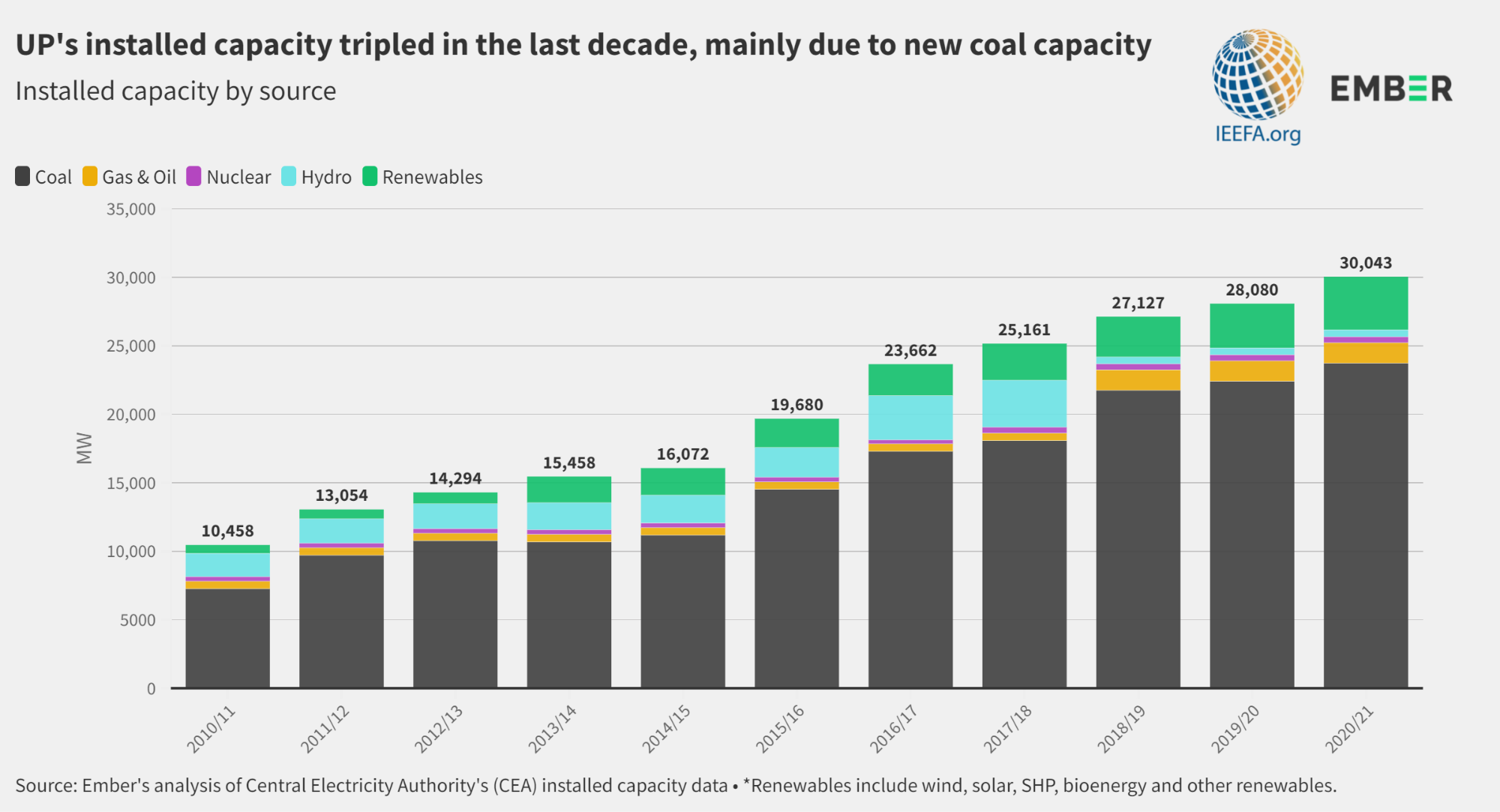

“In addition, coal power plant utilisation has been falling. The plant load factor of Uttar Pradesh’s 23.7GW coal fleet has dropped from 68% to 61% in the last five years.

“And heavy reliance on coal now leaves its power system vulnerable to any disruptions, even those caused outside the state.

“Coal shortages in India in October 2021 forced the state to purchase very expensive power at Rs22/kWh in the open market.”

The report highlights various barriers to solar uptake that need to be tackled urgently. These include the cancellation of renewable energy power purchase agreements (PPAs) in recent years by state electricity distribution companies (discoms) and the discoms’ increasingly high aggregate technical and commercial (AT&C) losses of above 30%.

Expensive and unreliable coal-fired generation has put tremendous pressure on the finances of discoms. In the financial year 2019/20 the Uttar Pradesh discoms incurred a loss of Rs4,917 crore (US$660 million), despite tariff subsidies of Rs10,120 crore (US$1.36 billion).

The report outlines a number of key recommendations for improving the discoms’ financial and operational performance, which, the authors say, is critical to transforming the state’s electricity sector:

- Reduce power purchase costs by retiring old thermal power plants, which consume more coal per kilowatt hour than modern plants and are more polluting, and replace expensive thermal power with cheaper renewable power. Further, promote distributed solar energy to help discoms avoid grid losses.

- Take advantage of the open market. Discoms can better manage peak demand and grid variability from renewable energy penetration by procuring power from day-ahead, term-ahead and real-time markets in open market platforms such as power exchanges or short-term bilateral contracts.

- Reduce the subsidy burden by reducing cross subsidies and improving the targeting of subsidies through direct benefit transfers to the lowest paying consumers.

- Invest in technology and modernisation of the grid. Installation of 1.1 million smart meters and a reduction in open access wheeling charges are progressive steps to turn around discoms’ weak performance.

Conclusion

Playing Catch-Up on Solar

Uttar Pradesh (UP) has seen strong growth in power demand in the past decade and now accounts for a tenth of the country’s total power requirements.

However, the state’s renewable energy (RE) capacity has grown at a snail’s pace and as a result, UP has fallen behind other large state electricity markets in terms of delivering on RE targets.

UP now needs to ramp up RE installations to not only meet its own RE targets but also to avoid holding back India’s performance on its targets of 175 gigawatts (GW) of RE capacity by 2022 and 500GW of non-fossil fuel capacity by 2030.

Supporting Material

Acknowledgements

Thanks to the co-author, Kashish Shah, Research Analyst, IEEFA

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)

PhotoPhoto © Abbie Trayler-Smith / Panos Pictures / Department for International Development