About

Biomass subsidies could actually be slowing decarbonisation in Europe, regardless of sustainability questions around biomass sourcing.

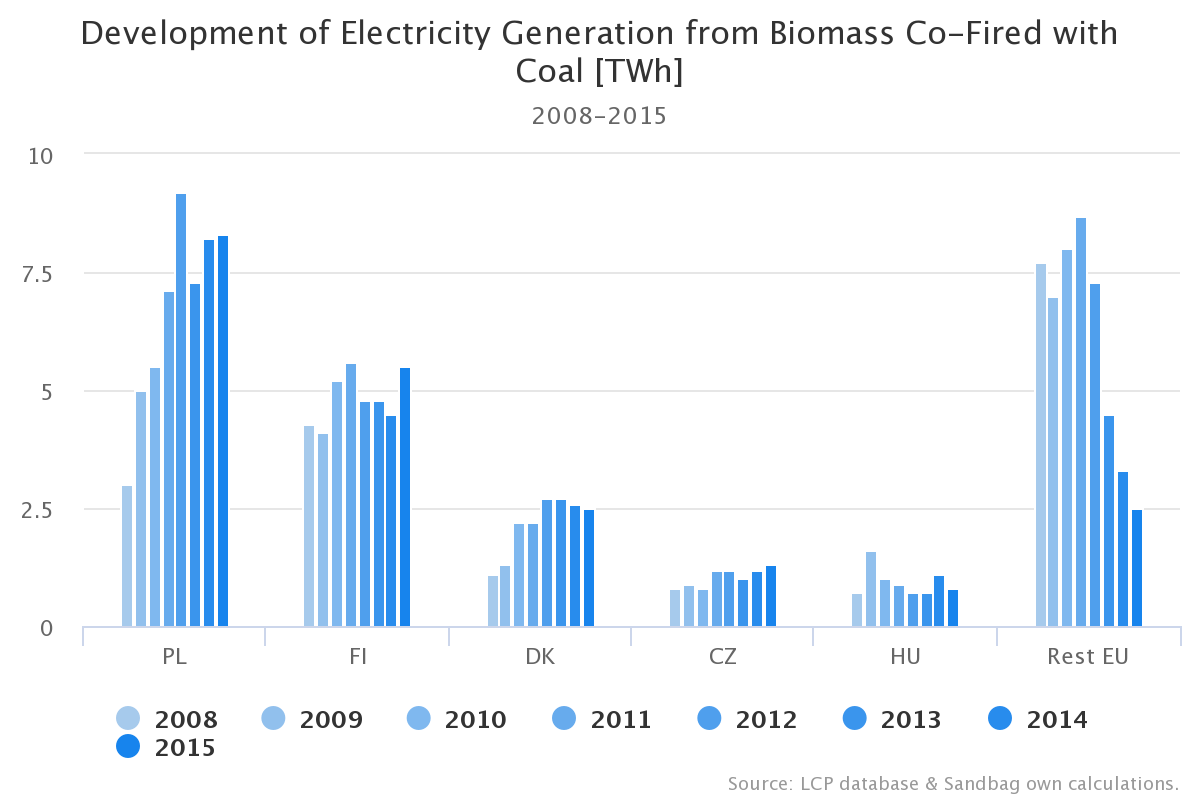

This report sets out to investigate the complex relationship between biomass and coal. We examine the magnitude of co-firing, review the subsidy mechanisms in place and shine a light on Europe’s coal-to-biomass conversions.

To reach the “below 2 degrees” goal agreed at Paris, the IEA’s modelling shows that unabated coal in Europe must fall to zero by 2030[1]. Any biomass cross-subsidy must be stopped if Europe is to rapidly phase out coal and play its part in avoiding dangerous climate change.

Executive summary

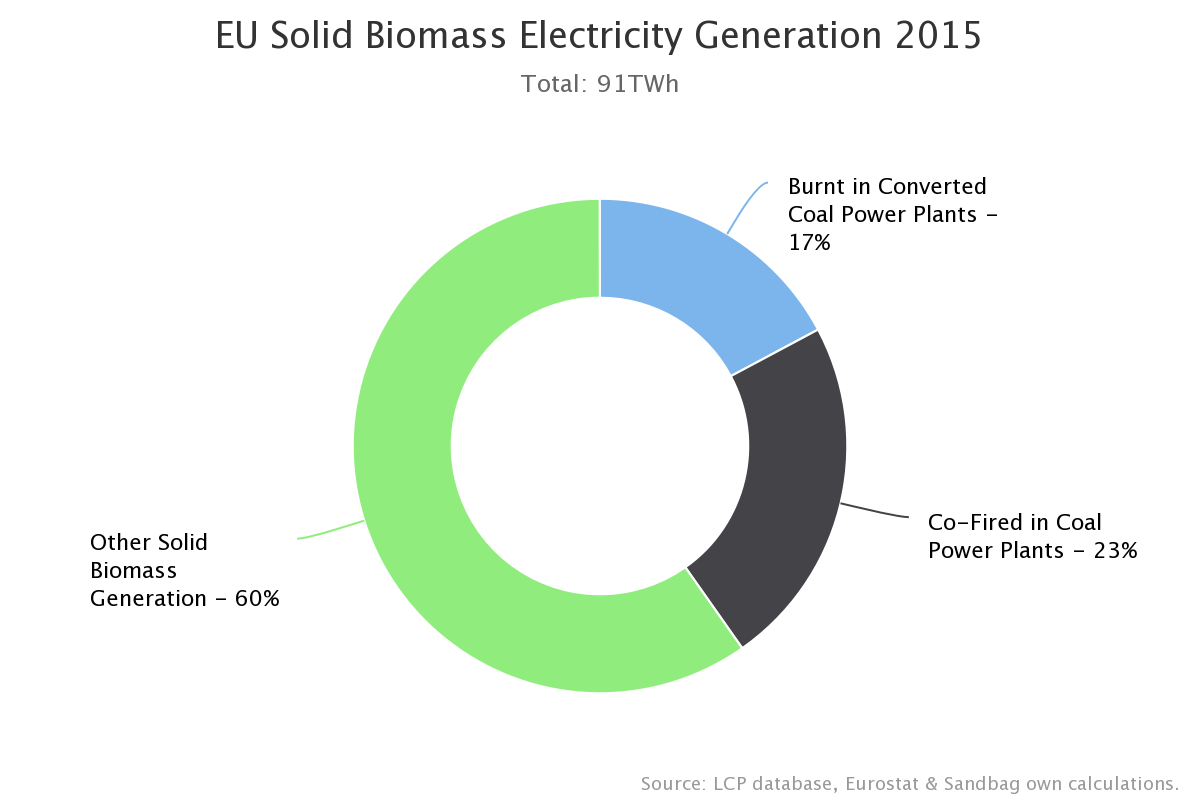

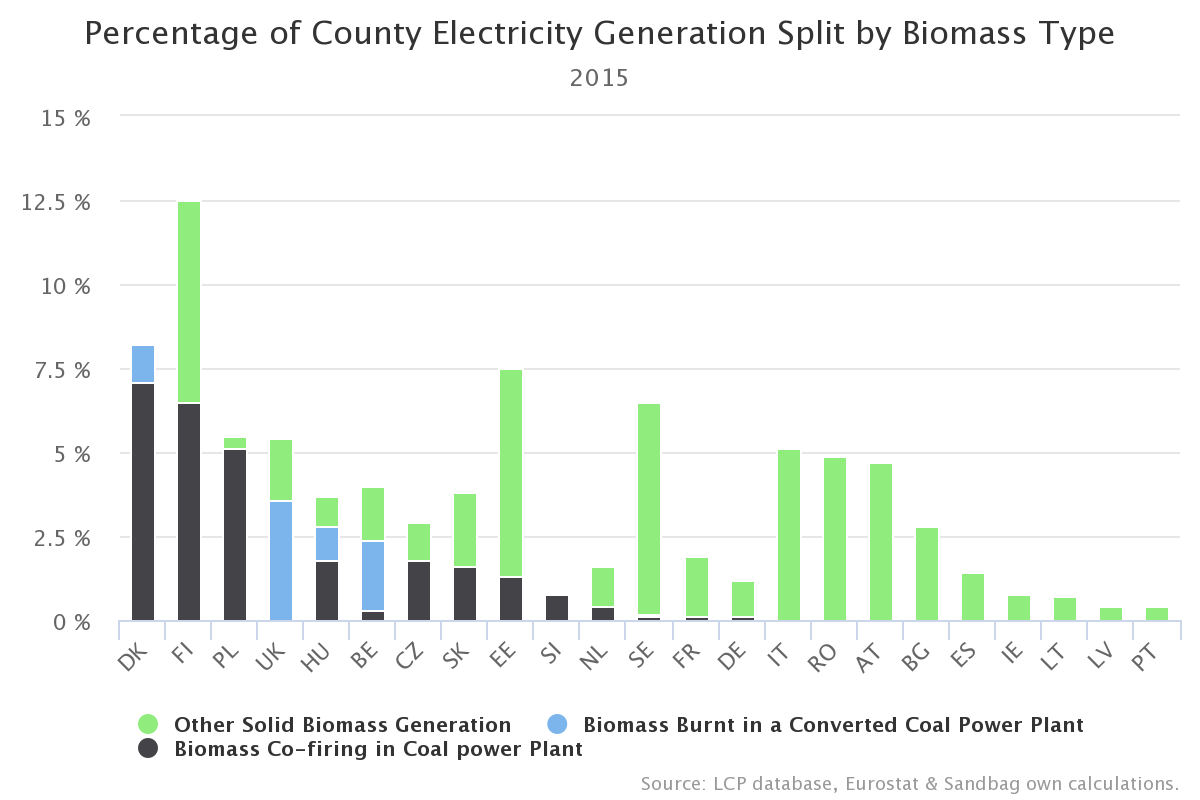

Solid biomass (e.g. wood pellets, sawdust, etc.) accounted for 58% of EU electricity generation from biomass in 2015.

40% of this biomass was burned in coal power plants.

In this chapter:

The EU should immediately move to outlaw biomass subsidies for co-firing with coal to remove this direct fossil-fuel subsidy.

This can be achieved through an amendment to article 26, paragraph 8 of the European Commission’s proposal for a revised Renewable Energy Directive. Amendments to this effect have been tabled and are currently under discussion. The ENVI committee is due to vote on the amended proposal on the 23rd of October 2017.

We are concerned at the continued use of subsidies to support the conversion of old coal plants to burn biomass. The main reasons are as follows:

- Converted coal plants are likely to have lower efficiencies than dedicated biomass units, their scale makes sourcing biomass locally and sustainably challenging.

- Subsidies can also financially support coal units on the same site, prolonging their lifetime and ironically leading to higher coal burn and emissions.

- Converted coal boilers also show worse environmental performance on other air pollutants such as NOx and Dust, which can be worsened with higher biomass use.

Without safeguards put in place, the conversion of a coal unit to burn biomass could become a “quick-fix” for old and inefficient coal units. Biomass is a scarce resource and should be utilised in the most efficient manner. Therefore we support the European Commission’s view in the revised Renewable Energy Directive that biomass subsidies should only be available to power plants applying high efficient cogeneration technology as defined under Article 2(34) of Directive 2012/27/EU – in fact, we would go a step further and propose that a minimum net fuel utilisation efficiency threshold of 85% should be introduced to qualify for biomass subsidies.

We think it is important to explicitly state the required efficiency (85%) due to the weakness of the definition of high efficiency cogeneration under Article 2(34) of Directive 2012/27/EU – which only requires a 10% primary energy saving as compared with the references for separate production of heat and electricity.

Supporting Material

Methodology

Methodology

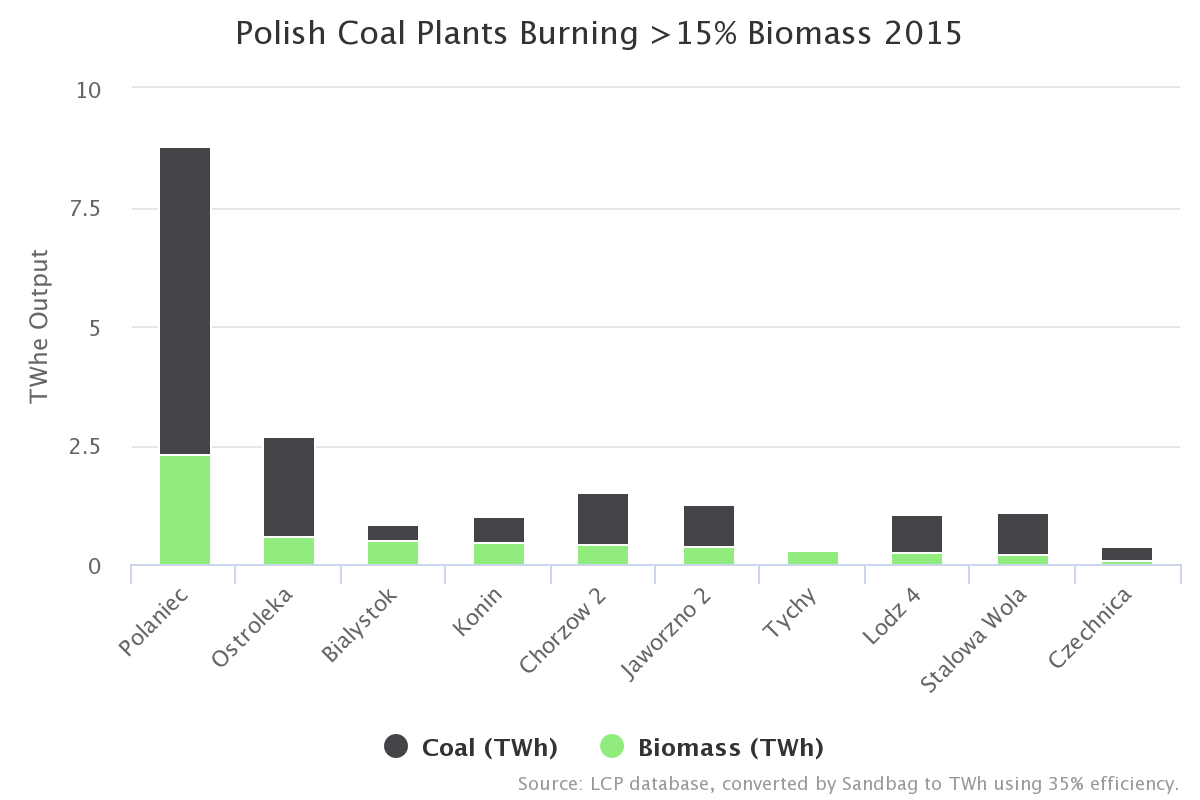

In July 2017, the European Environmental Agency published 2015 data for every large combustion plant in Europe[2]. This data included the amount of fuel burnt in each installation larger than 50MWh, split by “biomass”, “gas”, and “solid fuel”, which can include coal, lignite and peat. For the purposes of this report, we will henceforth refer to “solid fuel” as coal, however, it is worth emphasising that environmental impacts will vary by country depending on the particular fuel used, for example, the co-firing of biomass with peat in Finland is a particular problem.

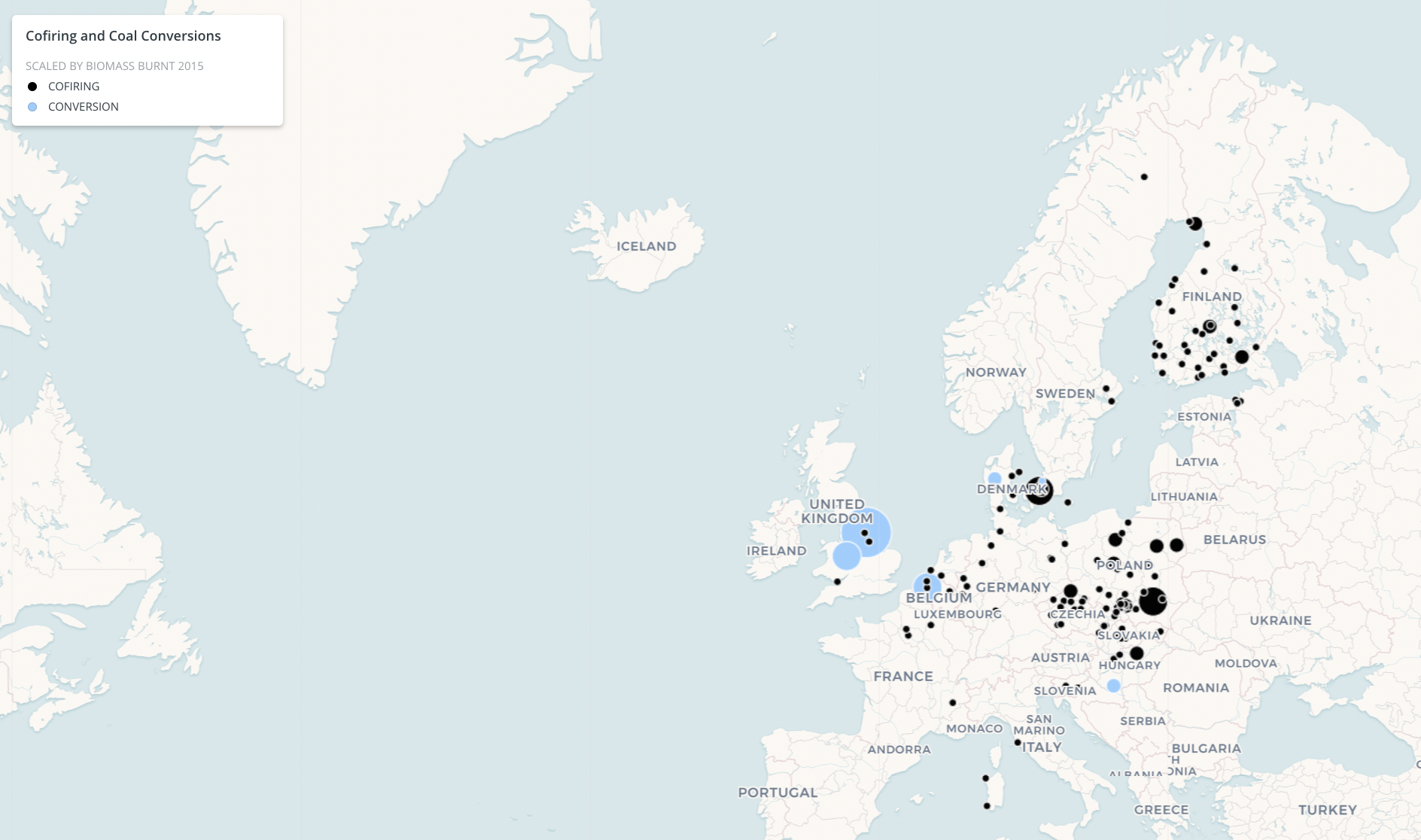

From this data set, we extracted two classes of plant as follows:

- Installations that burn biomass for electricity generation and burn at least 20% coal are classified as co-firing.

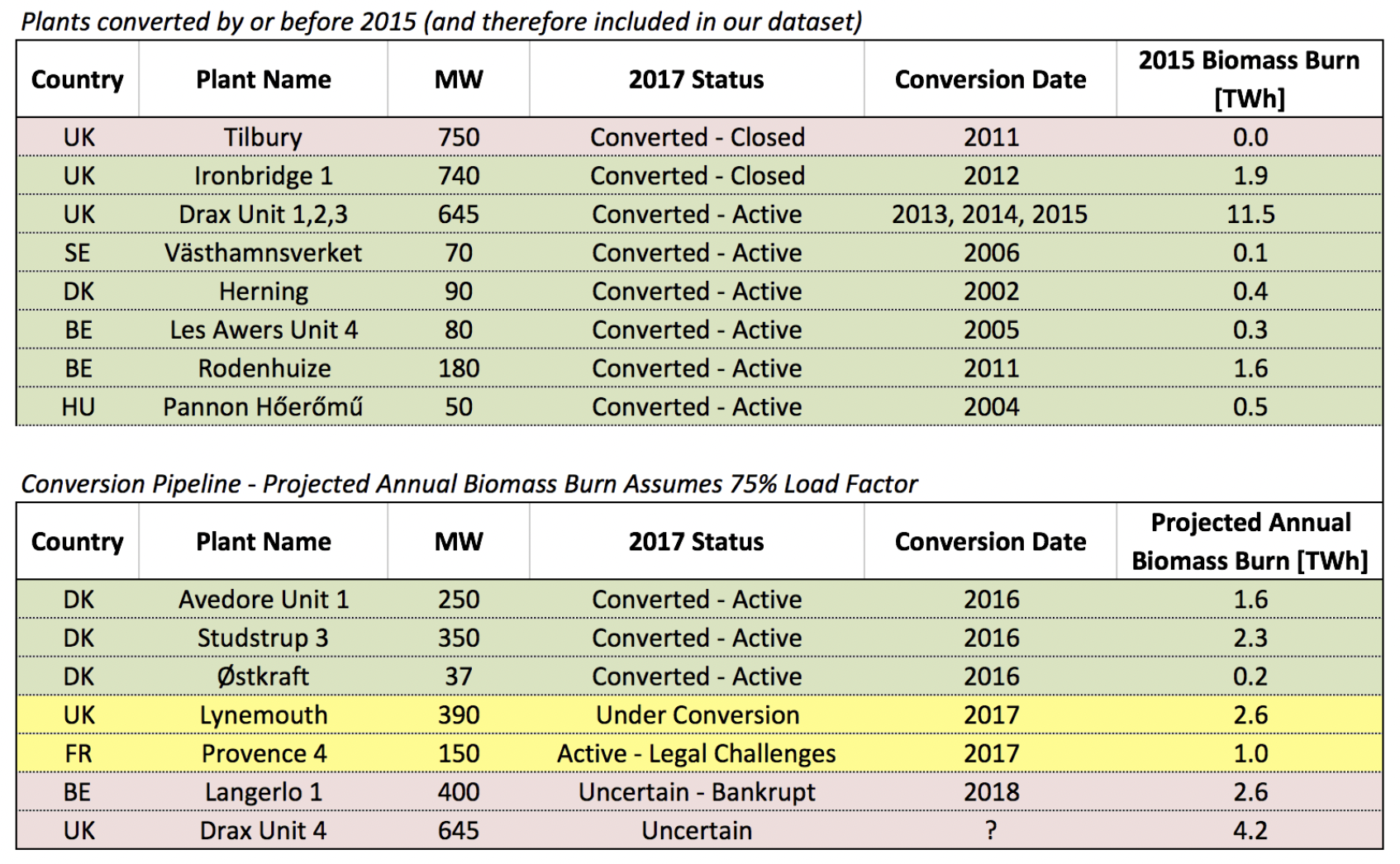

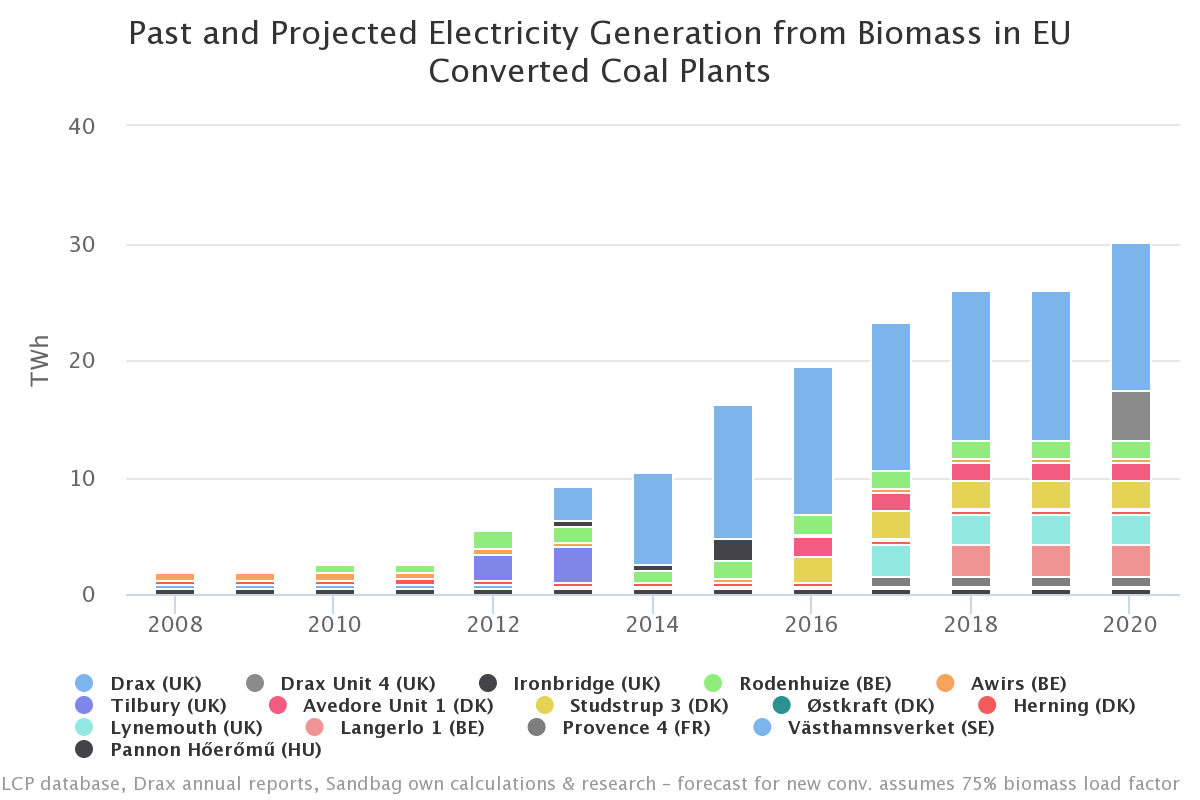

- Former coal power plants that were converted to burn purely biomass are classified as converted.

An installation is only flagged as converted if there is no coal burnt at the plant. This means there are a handful of units that have been converted to 100% biomass, but appear in this report as co-firing, because they are likely acting to subsidise continued coal generation. The exception to this rule is Drax which we have included as a conversion due to the low load factor of its coal units, their likely closure by 2025 under the UK’s coal phase-out commitment and a less generous subsidy regime for co-firing vs. dedicated biomass.

To align with Eurostat data on electricity generation we have removed plants tagged as district heating or iron & steel. These categories only account for a small proportion of biomass burnt in large combustion plants (4% in 2015).

We then converted the gigajoule fuel input data into terawatt-hours of electricity generation. To do this, we needed to make some assumptions on efficiency: 37.5% for biomass conversions and 35% for co-firing (in line with the average 1970’s coal power plant).

Our findings focus on solid biomass which accounts for 58% of EU electricity generation from biomass. The remainder is generated from biogas (39%) and liquid biofuels (3%)[3].

References

- See https://www.iea.org/etp/etp2017/

- See https://www.eea.europa.eu/data-and-maps/data/lcp-3

- Eurostat Gross Electricity Production – http://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=nrg_105a&lang=en

- Towarzystwie Obrotu Energią – http://www.toe.pl/pl/wybrane-dokumenty/rok-2016?download=1462:electricity-and-gas-market-in-poland-status-on-31-march-2016-toe-report.

- Finnish Energy Authority – http://www.energiavirasto.fi/en/web/energy-authority/feed-in-tariff

- See https://tuotantotuki.emvi.fi/Installations

- See EU-EUTL data https://www.eea.europa.eu/data-and-maps/data/european-union-emissions-trading-scheme-2

- Danish Energy Agency – https://ens.dk/sites/ens.dk/files/contents/service/file/memo_on_the_danish_support_scheme_for_electricity_generation_based_on_re.pdf

- See EU-EUTL data https://www.eea.europa.eu/data-and-maps/data/european-union-emissions-trading-scheme-2

- See page 9 of their H1-2017 results. http://www.rwe.com/web/cms/mediablob/en/3798674/data/105818/6/rwe/investor-relations/RWE-interim-report-H1-2017.pdf

- Courtesy of Argus Media – http://view.argusmedia.com/rs/584-BUW-606/images/Outlook%20for%20biomass%20co-firing%20UPDATE.pdf

Acknowledgements

Special thanks to Małgorzata Smolak (Client Earth), Alex Mason (WWF), Christian Schaible (EEB) & Almuth Ernsting (Biofuelwatch) for their input and suggestions on the report.

ImagesAll images used under a Creative Commons Licence. Thanks to:

- Viktor Kiryanov – Coal Power Plant at Golemo Selo, Bulgaria