Highlights

22%

Rise in ASEAN electricity demand from 2015 to 2021.

39%

Share of electricity demand met by clean energy.

4%

Share of ASEAN electricity supply from solar and wind in 2021.

11%

ASEAN electricity supply from solar and wind in 2030, according to latest national plans.

About

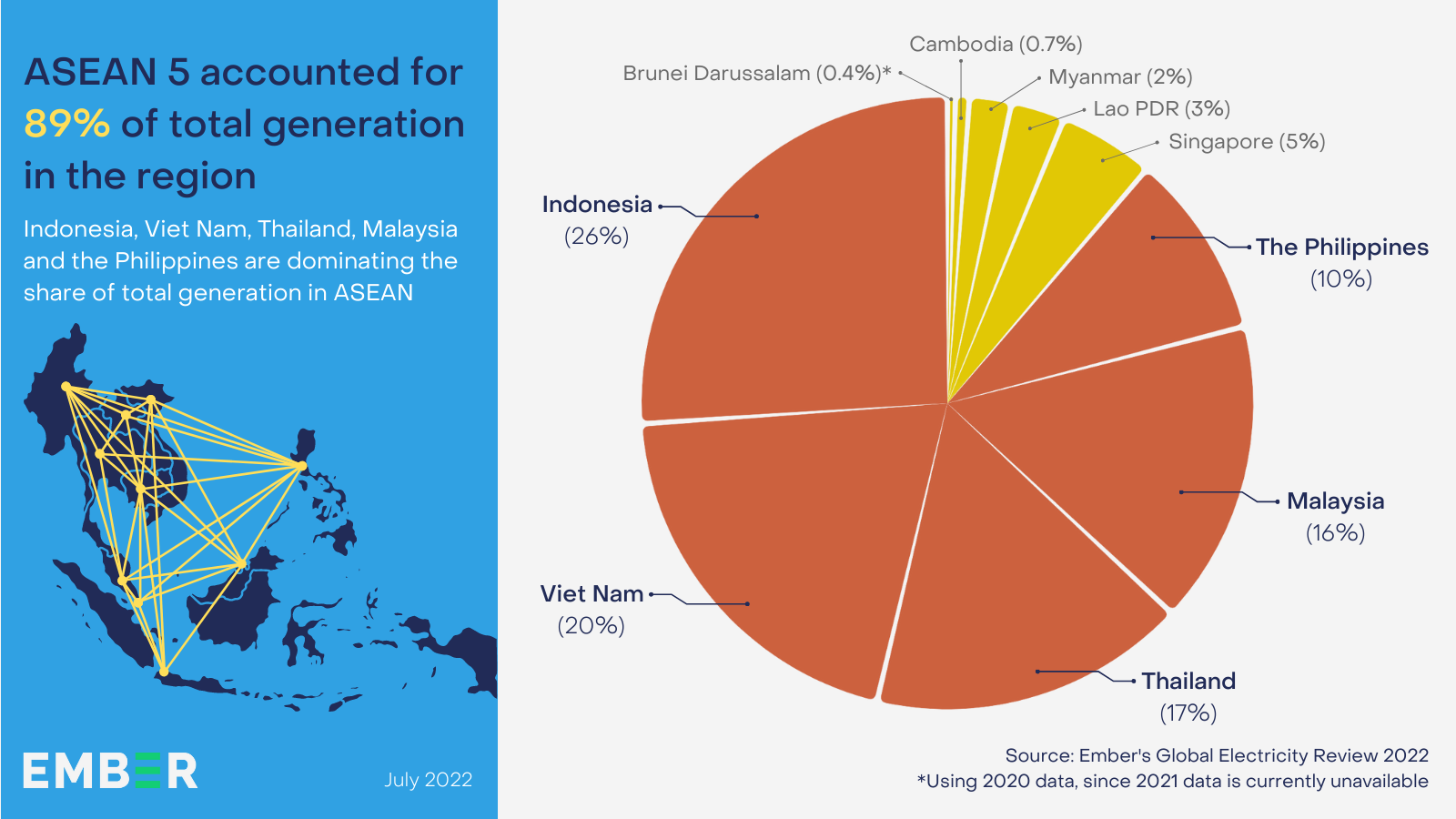

Among 10 ASEAN (the Association of Southeast Asian Nations) member states, five countries dominate the region’s total electricity generation (covering 89% generation). These major countries consist of Indonesia, Malaysia, the Philippines, Thailand and Viet Nam. The contribution of these major countries will be essential to achieving the electricity transition towards clean energy in the region.

This report analyses the latest electricity data in these five major ASEAN countries. Furthermore, it aims to link the progress of clean energy development and the future renewable energy target to the IEA Net Zero pathway.

Executive summary

ASEAN yet to unleash the potential of solar and wind

Current plans for solar and wind fall short of a road map to limit global temperature rise under 1.5 degrees.

Achmed Shahram Edianto Asia Electricity Analyst, Ember

Governments should unleash the power of solar and wind, as is happening already in China, India, and across much of the world. As fossil fuels prices soar through the roof, solar and wind prices remain low, providing affordable, homegrown energy. Solar and wind are progressing across Southeast Asia, but more aggressive targets and timely execution are needed to utilise the vast potential. Governments need to redress 2030 energy plans.

ASEAN electricity demand is rising fast

Electricity demand grew almost 22% in the last 7 years

Indonesia and Thailand’s demand slightly outpaced the world average, while almost doubling in the Philippines and Viet Nam.

Progress on solar and wind

Solar and wind lag in ASEAN 5, compared to the rest of the world

Solar and wind generated only 4% of the ASEAN 5’s electricity last year, lagging behind peers like China (11%) and India (8%). Among the ASEAN 5, only Viet Nam (11%) exceeds the world average in solar and wind, which generated 10% of global electricity for the first time in 2021. The rest is still below 5%.

Uni Lee Asia Electricity Data Analyst, Ember

Under current policies, solar and wind are projected to supply only one tenth of total electricity generation in 2030. This is not nearly enough to meet the rapidly growing power demand. This will make coal phase-out and gaining energy independence very difficult for this region. Rapid scaling-up of solar and wind and grid modernisation is going to be a crucial piece of the puzzle to solve the climate and energy crisis in this region.

Conclusion

More ambitious solar and wind deployment plans are needed

Solar and wind will be the backbone of the world’s future electricity system, but electricity plans in ASEAN countries do not currently reflect this.

-

01

Raise ambition

Raising clean energy development targets, especially for solar and wind, is a reasonable step that should be taken. The existing trend shows that if the respective country’s targets are not increased, high demand growth will be met by coal.

-

02

Reconfigure the electricity grid

Raising ambition alone is not enough. For developing countries, maintaining supply sufficiency of electricity is also essential. Limited grid capacity, for instance, may affect efforts to attain higher levels of wind and solar penetration while ensuring supply reliability and affordability. This is illustrated by Viet Nam and Indonesia’s experiences with grid capacity. Although both countries have strategies that support the acceleration of solar development through supportive policies, the limited capacity of grid transmission is hindering the implementation of the target.

Reconfiguring the electricity system to ensure that the grid infrastructure can accommodate the penetration of various renewable sources is important to accelerate solar and wind deployment.

-

03

Multilateral cooperation

Promoting and accelerating cross-border power connectivity among ASEAN countries could support the region to better allocate their energy resources and to meet the energy demand. For example, the first multilateral cross-border electricity trade involving Lao PDR, Thailand, Malaysia and Singapore, which will provide 100 MW renewable energy from Lao PDR to Singapore. This power integration project will not only contribute to Singapore’s sustainability goals, but also ensure electricity supplies and enhance cost-competitiveness of the power sector in the region.

Supporting Material

Methodology

Scope of study

This study focuses on 5 ASEAN countries (Indonesia, Malaysia, the Philippines, Thailand and Viet Nam), which make up 89% of the total electricity generation in ASEAN. From a climate mitigation perspective, clean electricity transition in these countries will significantly contribute to the region’s emissions reductions. However, contributions from Singapore, Lao PDR, Myanmar, Cambodia and Brunei Darussalam are equally important for the region to achieve their climate goals.

Draft of PDP 8 Viet Nam

Our analysis on Viet Nam is based on the most recent update of PDP 8 version 29/4/2022 (letter 2297/tt-bct) as presented by Vietnam Initiative for Energy Transition (VIET), a local independent think tank, in ADB’s Asia Clean Energy Forum (ACEF) session 1.1 on 14 June 2022. The presentation material can be accessed by all participants on the ACEF website.

Acknowledgements

Co-author:

- Uni Lee, Asia Electricity Data Analyst, Ember

Data and analysis:

- Dave Jones, Global Programme Lead, Ember

- Muyi Yang, Asia Senior Electricity Policy Analyst, Ember

- Maciej Zielinski, Junior Data Analyst, Ember

- Matt Ewen, Junior Electricity Tracking Analyst, Ember

Editorial and proofreading:

- Rini Sucahyo, Asia Communications Manager, Ember

- Alison Candlin, Strategic Communications Officer, Ember

Media Coverage

- Eco-Business

- CNN Indonesia

- ANC 24/7

- CNBC Indonesia

- GMA Network

- Business World Online

- Katadata

- Kumparan

- MSN Philippines

- TechiLive.in

- Antara News

- Eco-Business

- Malaya

- MSN Indonesia

- Energy Central

- First Investors USA

- Fortune Indonesia

- Dunia Energi

- Petrominer

- Majalah Ekonomi Peduli Lingkungan

- Worldakkam

- BusinessMirror

- OG Indonesia

- Obligasi

- ICSC

- SoundCloud

- Head Topics - Indonesia

- Head Topics - Philippines

- Head Topics - Philippines