Highlights

+17%

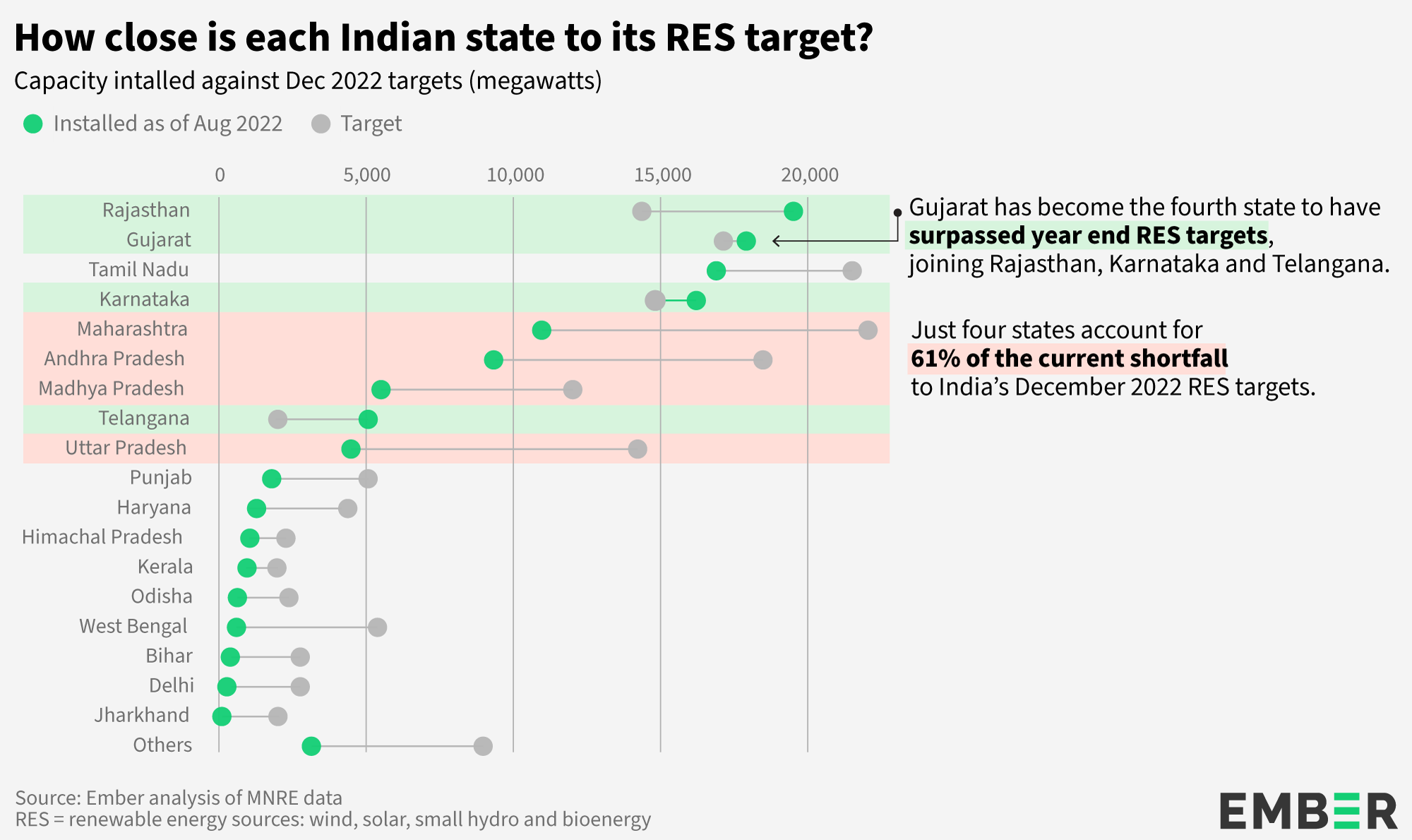

Increase in RES installed capacity in India in the first eight months of 2022, compared to the same period in 2021.

4

States already meeting their December RES target - Gujarat, Telangana, Rajasthan and Karnataka.

x2.5

Increase needed in current monthly build-rate to meet 2030 RES target.

About

This report is based on data from Ember’s Indian State RES Target and Progress Tracker that is also launched today. It tracks the monthly progress of Indian states and union territories on their 2022 RE targets. It uses the state-wise installed renewable energy (RE) capacity data, published monthly by the Ministry of New and Renewable Energy (MNRE). MNRE publishes this data only for the latest month, so internet archive machines were used to dig out and piece together month-by-month RE capacity additions since March 2019. The data is also available to download separately.

Good news and bad news

Gujarat is now the fourth state to meet RE targets for 2022, but four key states need to ramp up

Solar is driving India’s renewables growth

Aditya Lolla Senior Policy Electricity Analyst, Ember, Asia

India’s solar rush earlier this year shows how quickly change can come. It has even led to a record RE capacity addition of 3.5 GW in March this year. In order for India to achieve its ambitious 2030 RE and non-fossil capacity targets, the country needs to consistently hit such record numbers.

Conclusion

Making 2020s the renewables decade

It is unlikely for India to reach its 2022 target, but its 2030 targets of 450 GW renewables and 500 GW non-fossil capacity are well within reach.

India has shown good progress in the first half of the year, with renewables installations up by 17%. Over 99% of new RES capacity built was solar and wind: it’s clear solar and wind are set to become the backbone of India’s future backbone of electricity.

The question is how to raise these levels by 2.5 times as much, in order to hit the monthly build-rates needed to reach the 2030 targets.

First, India needs to unleash the power of solar. A substantial increase in the basic customs duty in March led to a collapse in imported solar panels this summer, before domestic solar production is able to fill this gap. While this may encourage domestic manufacturing in the long run, it has already significantly increased the cost pressure on under-implementation solar power projects adding up to 4.4 GW. What’s needed now is a plan or a roadmap to augment domestic capabilities while the domestic solar manufacturing sector becomes more competitive.

Second, wind capacity additions have fallen to very low levels for a few years. Although the biggest future growth is likely to be solar, wind still has a vital role to play.

Third, all states should be seizing this opportunity. The key states of Maharashtra, Uttar Pradesh, Andhra Pradesh and Madhya Pradesh built just 3%, 1%, 1% and 1% of India’s renewables that were installed in the first eight months of this year.

India’s renewables future is exciting, but it needs more national and local government focus to make it happen.

Supporting Material

Acknowledgements

Dave Jones, Rini Sucahyo, Nicolas Fulghum, Uni Lee, Chelsea Bruce-Lockhart

Header imageA solar engineer in the solar powered village of Tinginapu, in the Eastern Ghats of Orissa in India

Credit: Abbie Trayler-Smith / Panos Pictures / Department for International Development

Media Coverage

- The Times of India

- The Hindu

- The Economic Times

- News18

- Bloomberg's BQ Prime

- Business Insider

- Business Today

- Climate कहानी

- Daiji World

- Down to Earth

- Fresherslive

- Fresherslive

- Glamsham.com

- Prokerala

- Prokerala

- Sarkaritel

- Sarkaritel

- SAUR News

- SAUR News

- The Economic Times

- The Federal

- The Morung Express

- Times Now

- Verve Times