About

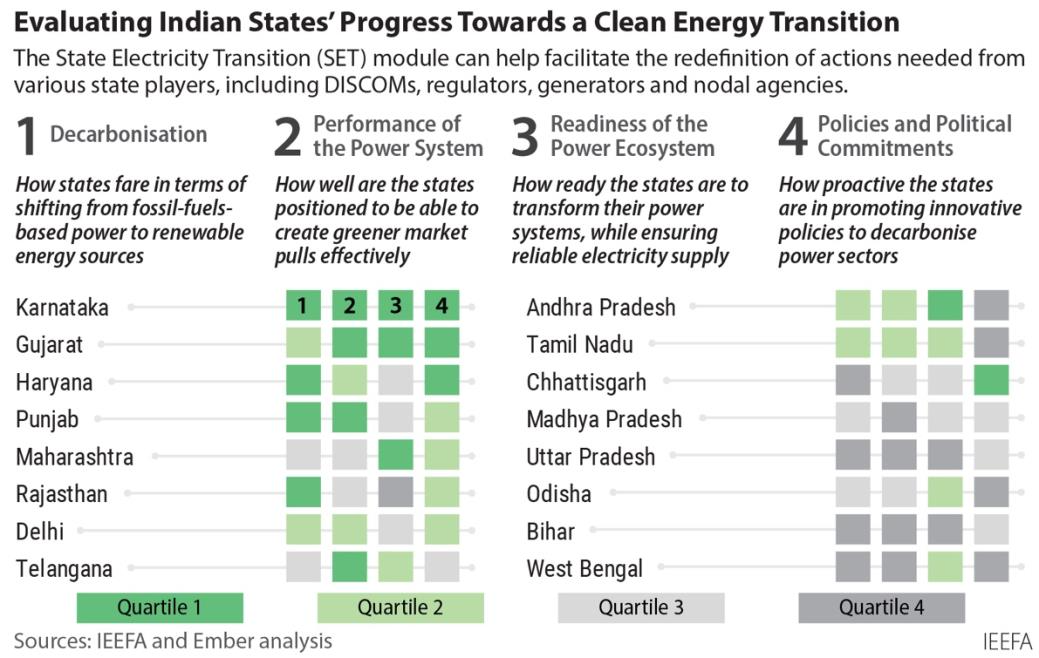

The joint report by the Institute for Energy Economics and Financial Analysis (IEEFA) and Ember analyses 16 Indian states, which together account for 90% of the country’s annual power requirement, across four dimensions. The dimensions track a state’s preparedness to shift away from fossil-fuel-based power, its ability to incentivise greener market participation, its power system’s reliability and its policies pushing for power sector decarbonisation. Based on this analysis, the report authors devised the States’ Electricity Transition (SET) scoring system, which measure the performance of these states relative to each other in the transition to clean electricity.

Executive summary

India is on the right path, but it needs the cooperation of its states

Multi-dimensional efforts are needed to ensure an effective and sustainable electricity transition.

In this chapter:

Key findings

-

01

Karnataka and Gujarat made the most progress

Karnataka and Gujarat made the most progress towards clean electricity transition. Haryana and Punjab are best positioned to further this transition.

-

02

Bihar, Uttar Pradesh and West Bengal must maximise their potential

Bihar, Uttar Pradesh and West Bengal must ramp up efforts to maximise their renewable energy generation potential and increase clean electricity transition commitments.

-

03

Rajasthan and Tamil Nadu need to improve the readiness of their power systems

Rajasthan and Tamil Nadu have started on their clean electricity transition programme but their progress is not uniform across all areas.

-

04

States need to ensure implementation of clean electricity transition policies

States should ensure effective and timely implementation of clean electricity transition policies like no coal, green manufacturing, green market participation, direct benefit transfers, green energy open access and more.

While India’s revised Nationally Determined Contribution (NDC) targets put it on the right path for transitioning its electricity sector, it needs the cooperation of its states. We find that renewable energy-rich states are not utilising their renewable energy generation potential. To fix this, states need to set well-defined renewable energy targets. States rich with renewable energy have the potential to act as export hubs and help other states meet their clean energy targets. At the same time, state energy departments also need to strengthen electricity infrastructure for better integration of renewables. States must also increase participation in green market mechanisms and have more favourable policies for the same. States must also improve data transparency for better evaluation of their progress to take corrective measures. Finally, states must also bridge the gap between electricity transition policy intent and implementation.

The global electricity economy is changing fast. Despite the Russian invasion of Ukraine highlighting continued heavy dependence on fossil fuels, the world will add as much renewable energy in the next five years as it did in the previous 20 years.

India, now with the G20 Presidency, will be key to the electricity transition. It ranks 8th in the Climate Change Performance Index (CCPA) 2023 and earned high ratings in the Green House Gases (GHG) Emissions and Energy Use categories, as well as a medium for Climate Policy and Renewable Energy.

Decarbonisation, decentralisation, and digitisation are widely regarded as the three pillars of achieving net zero targets. We find that while India is on the right path with revised Nationally Determined Contributions (NDC) targets, the absence of roadmaps and concrete action plans hampers it from achieving the targets. In addition, India also needs its states’ cooperation and leadership to achieve ambitious national and state climate targets.

To help chart the roadmap and identify the areas that require action and attention, we devised the States’ Electricity Transition (SET) Scoring system. We analysed 16 Indian states that account for 90% of the country’s annual power requirement on four key dimensions of electricity transition. We identified and finalised these dimensions through several expert consultations. The dimensions are: 1) Decarbonisation (state’s preparedness to shift away from fossil-based power), 2) Performance of the power system (state’s ability to incentivise greener market participation), 3) Readiness of the power ecosystem (state’s power system reliability to ensure electricity supply for the transition), and 4) Policies and political commitments (state’s policies to push for power sector decarbonisation).

Key messages

-

01

Indian states have shown notable clean electricity transition performance.

The performance of states like Karnataka, Gujarat, Haryana, and Punjab, which have demonstrated considerable efforts in overall preparedness and committed capabilities to promote clean electricity, indicates the progress of Indian states towards a clean electricity transition.

Karnataka is the only state that scored well across all the dimensions of clean electricity transition identified in this study. It was the best-performing state in decarbonising its power sector, the performance of its power system and the readiness of its power ecosystem. It also has conducive policies and political commitments for a smoother transition. Gujarat was a little behind Karnataka in terms of decarbonising its electricity sector. Similarly, Haryana and Punjab have shown promising preparations and implementations for electricity transition in their respective states.

-

02

States must still ramp up their efforts to maximise renewable potential.

Bihar, Uttar Pradesh, and West Bengal must expand on their potential and transition commitments as they have many areas to improve upon to strengthen their clean electricity transition performances.

The three states fared lower than their counterparts in decarbonising their power sectors and the performance of their power systems. The power systems in Bihar and Uttar Pradesh require further improvements to support a clean transition. For West Bengal, while its power system showed better performance than the other two states regarding readiness to transition, a move away from a fossil fuel-intensive power sector requires more proactive policies and political will.

-

03

Rajasthan and Tamil Nadu have started their clean electricity transition, but progress has not been consistent across all the dimensions.

As the long-considered front-runners in building new renewables capacity, Rajasthan and Tamil Nadu, unsurprisingly, showed promising progress in decarbonising their power systems. Still, they fell short in their respective power sectors’ relative performance and readiness to transition to clean electricity.

Saloni Sachdeva Michael Energy Analyst, IEEFA

Bihar, Uttar Pradesh and West Bengal have work to do to strengthen their clean electricity transition performances. These three states should maximise their renewable energy generation potential, and at the same time increase their commitment to moving away from fossil-fuels-based electricity.

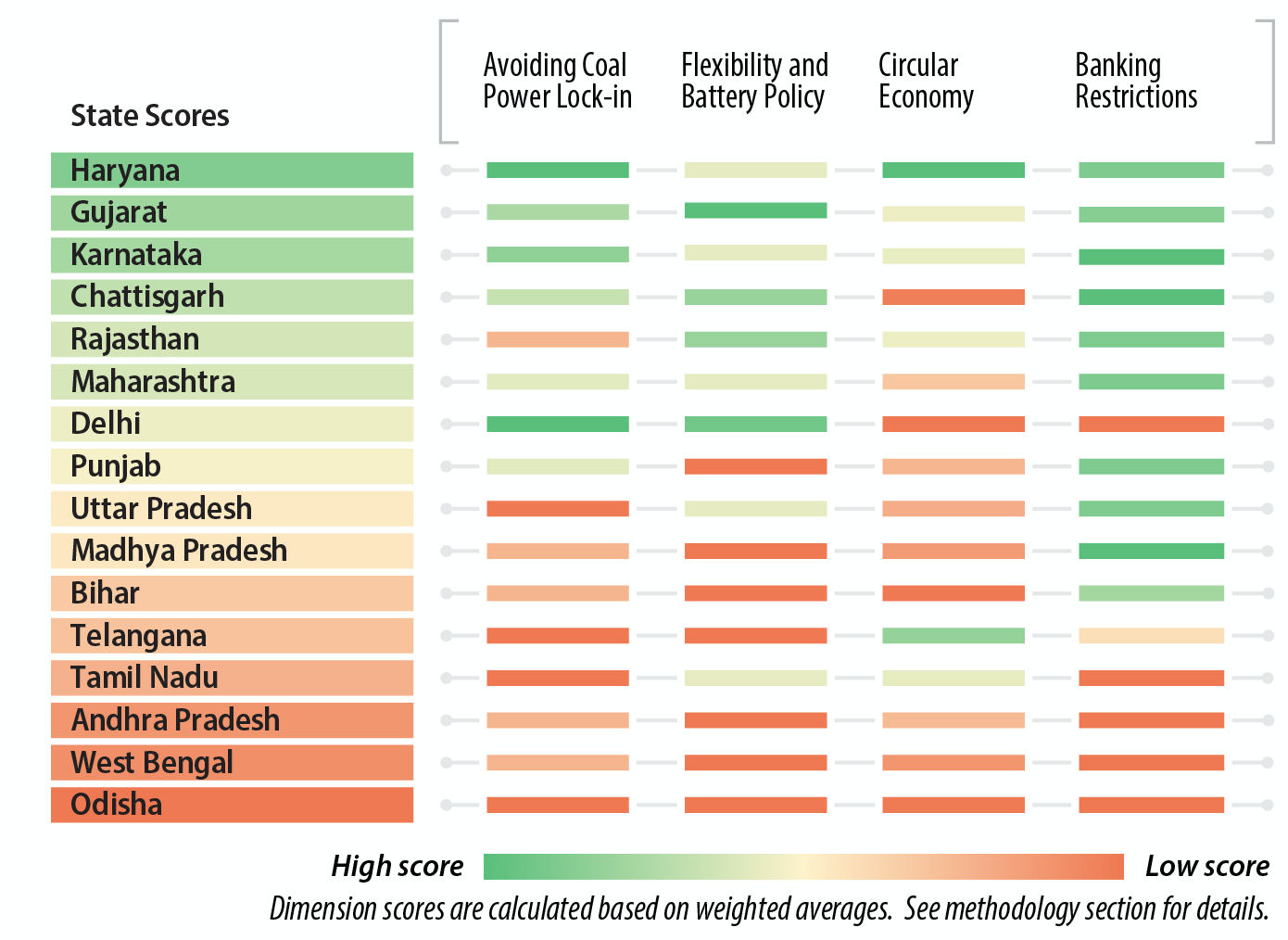

We provide a snapshot of our SET Score analysis in Figure 1. The intention of the SET Scores was not to rank states but to analyse their performance, acknowledge their efforts and highlight their challenges.

This analysis concludes with the following recommendations to accelerate the sub-national electricity transition. A snapshot of the recommendations are:

- Multi-dimensional efforts are needed to ensure an effective and sustainable electricity transition. Efforts are required to decarbonise the supply-side through more renewable deployment and revamp the demand side through energy efficient intervention. In addition, strengthening of transmission infrastructure is crucial for better integration of renewables.

- States should increase participation in green market mechanisms through more favourable policies like open access and banking of power. Innovative bilateral financial markets mechanisms like Virtual Power Purchase Agreements (VPPA) and Contracts for Difference (CfD) have huge potential to open the market.

- State-level data availability and transparency need improvement to measure and track progress. The centre and states need to coordinate better to regularly capture state-level data updates on existing national portals.

- States should ensure effective and timely implementation of clean electricity transition policies like no coal, green manufacturing, direct benefit transfers, green energy open access and more.

Introduction

Transitioning the electricity sector in India

Setting clear pathways for India’s climate actions is critical now.

At the 26th United Nations Climate Change Conference of the Parties (COP26), held in Glasgow in November 2021, India displayed its climate stewardship with its ‘Panchamrit’ commitments:

- Install 500 gigawatts (GW) of non-fossil electricity capacity by 2030

- Generate about 50% cumulative electric power installed from non-fossil fuel resources by 2030

- Reduce carbon emissions by 1 billion tonnes from now till 2030

- Reduce emissions intensity of its gross domestic product (GDP) by 45% by 2030

- Achieve net zero by 2070

Decarbonisation, decentralisation, and digitisation are widely regarded as the three pillars of achieving net zero targets. Achieving these targets will, however, require tackling much stiffer challenges at the national and sub-national levels. The electricity sector is the low-hanging fruit and is considered the first tree to spread green roots. Most of the Nationally Determined Contributions (NDC) targets have the electricity sector as the foundation. Hence, it is important to set crystalised pathways for transitioning the electricity sector in India.

Saloni Sachdeva Michael Energy Analyst, IEEFA

It is important to set crystalised pathways for transitioning the electricity sector in India.

Electricity transition refers to the shift from fossil-based power production and consumption to renewable energy sources by transforming the electricity sector through innovative policies, efficient technologies, and greener market pulls while ensuring reliable supply with effective closed-loop systems in place.

An effective clean electricity transition requires a timely switch towards a clean power-fuelled, economically feasible, politically viable and secure system that can create value for business and society.

India has taken centre stage with its ambitious clean energy targets, supportive policies and regulations, political commitments, and impact-driven initiatives. The country is steadily boosting its green production capacity through wind, solar and hydro projects. In doing so, it is reducing its dependence on fossil fuels. Furthermore, the work on 100% electrification of railways is also progressing at a fast pace, with the Indian Railways setting a target of becoming a ‘Net Zero Carbon Emitter’ by 2030. The country also emphasises a circular economy, and its Vehicle Scrap Policy is a case in point.

Another example of the government’s supportive policies for energy transition is its approval of the Intra-State Transmission System – Green Energy Corridor Phase-II for laying the infrastructure for connecting electricity generated from renewables with the power grid in seven states. The corridor scheme, with a total estimated cost of Rs120.31 billion (US$1.4bn), would receive 33% central financial assistance, or Rs39.7 billion (US$0.48bn). This is crucial to create green market mechanisms for inter- and intra-state renewable energy trading.

To facilitate large-scale grid-connected solar power projects, the central government is implementing a scheme for “Development of Solar Parks and Ultra Mega Solar Power Projects” with a target of 40 GW capacity by March 2024. So far, the central government has sanctioned 50 solar parks with a combined capacity of 33.82 GW in 14 states. Developers have already commissioned solar power projects with an aggregate capacity of around 9.2 GW in these parks.

In addition, the central government expects electric vehicle (EV) sales penetration to be 30% for private automobiles, 70% for commercial vehicles, and 80% for two- and three-wheelers by 2030. This would further increase electricity demand at the state level. Meeting this demand will require higher renewable energy deployment as well as effective energy efficient and demand-side interventions (smart metering, direct benefit transfer, etc.) to ensure proper monitoring and tracking of electron flow. Progressive policies like net metering, banking of power and feeder segregation under the ‘Kisan Urja Suraksha evam Utthaan Mahabhiyan Yojana (KUSUM)’ scheme and more are crucial to accelerating the aimed electricity transition.

Vibhuti Garg Director, South Asia, IEEFA

India’s revised Nationally Determined Contribution (NDC) targets have put the country on the right path for transitioning its electricity sector. To achieve those targets, the centre now needs the cooperation of the states to move faster in their clean electricity transitions. This means states redoubling their efforts to walk the electricity transition pathway, and both central and state governments tracking progress and taking corrective measures as required.

Objectives of the Report

While India has made strides in clean energy transition, achieving the ambitious NDC targets requires further leadership by the government, with focused implementation at the state level. Hence, setting clear pathways for India’s climate actions is critical now.

But before charting a new path, it is crucial to know where one stands. This report aims to provide the progress and performance of Indian states on various aspects of the clean electricity transition to help identify the areas that need an impetus.

This report acknowledges that the clean electricity transition involves complex undertakings. Its planning, management and governance require bringing together diverse aspects to present a clear approach for the transition that can fit all the states, particularly given India’s need to ensure energy security.

We aim to do this by creating a framework to not only think about various techno-economic and political aspects of the clean electricity transition but also track and measure the transition sub-nationally. This framework has four dimensions of clean electricity transition, which we identified during consultations with several sectoral experts.

These dimensions are:

- Decarbonisation: To evaluate the states’ preparedness in terms of shifting from fossil-based power to renewable energy sources

- Performance of the Power System: To evaluate states’ ability to create greener market pulls effectively

- Readiness of the Power Ecosystem: To evaluate how ready the states are to transform their power systems while ensuring reliable electricity supply

- Policies and Political Commitments: To evaluate how proactive the states are being in promoting innovative policies to decarbonise their power sectors

These dimensions and their respective parameters (captured in the methodology chapter) form the basis for the States’ Electricity Transition (SET) scores.

The objectives of the SET scores are to:

- Track and measure where different Indian states are relative to each other in terms of clean electricity transition,

- Identify several parameters critical for electricity transition, grouped under the four dimensions mentioned above, and objectively assess Indian states on these dimensions,

- Highlight key barriers holding back the transition in a few states and cross-learning opportunities among states

- Empower states with the knowledge to make more informed decisions.

Saloni Sachdeva Michael Energy Analyst, IEEFA

The transition now requires cooperation and leadership of Indian states to collectively fight the challenges that impede implementation of the ambitious climate action at the national level.

Dimension-1

Decarbonisation

Karnataka, Rajasthan, Punjab, and Haryana performed well across all the parameters.

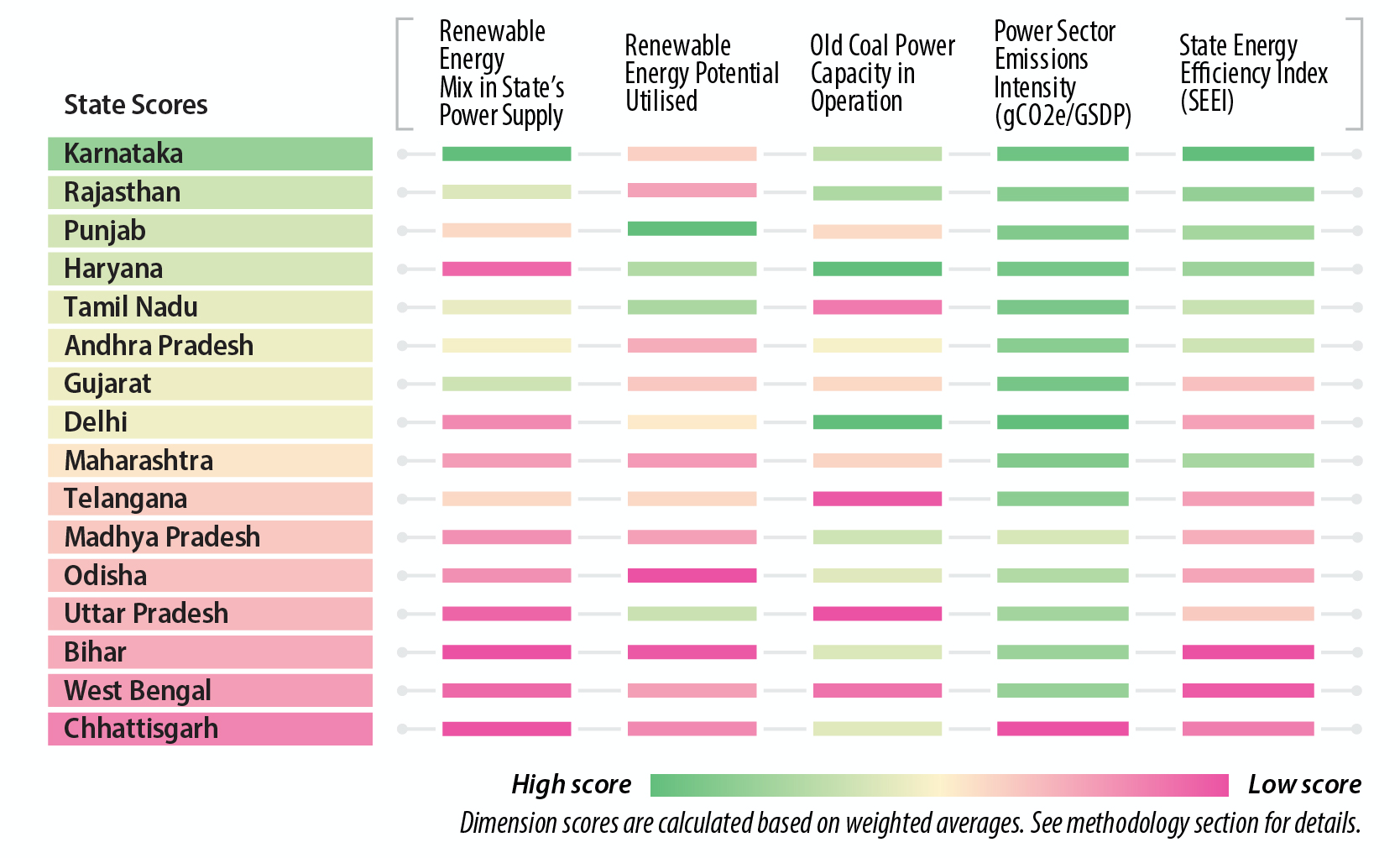

Decarbonising the electricity sector is often considered the lowest-hanging fruit to curb greenhouse gas emissions. We analyse the performance of the 16 states with regard to decarbonisation based on the five parameters stated in Figure 2 in the methodology document.

States like Karnataka, Rajasthan, Punjab, and Haryana performed well across all the parameters. Conversely, Chhattisgarh, West Bengal, Bihar, and Uttar Pradesh scored low on most parameters. We present the overall scores and the scores in each parameter in Figure 4.

Karnataka has been an early adopter of renewable energy through proactive policies around open access, solar park development and public awareness, which led to the state stealing a march on the other states. The state fared the best in decarbonising its power sector and has the highest share of renewables in its power supply mix (48%). Only Delhi’s power sector’s emission intensity of GSDP is lower than that of Karnataka (2.2 kgCO2eq/Rs1,000). Karnataka also has the highest State Energy Efficiency Index (SEEI) score, according to data from the Bureau of Energy Efficiency (BEE) and Alliance for an Energy Efficient Economy (AEEE). All of these factors helped the state achieve a high overall score.

Currently, Karnataka is one of the few states overachieving its Renewable Purchase Obligations (RPO) targets. Interestingly, the state still has a large amount of untapped renewable energy potential, having installed just 11% of its total potential. This highlights the state’s tremendous opportunity to provide power to neighbouring states through green market mechanisms.

Rajasthan is second only to Karnataka, with renewables supplying 29% of the state’s power mix. The state saw a spurt in new renewable energy capacity. In March 2022, Rajasthan became the state with the largest installed capacity of renewable energy. Progressive policies like the Rajasthan Wind Solar Hybrid Policy 2019 and Rajasthan Electric Vehicle Policy 2022 helped accelerate the capacity addition. The state targets installing 3.5 GW of hybrid projects by FY2024-25. Of this, the hybridisation of existing wind or solar projects will account for 200 megawatts (MW), new wind-solar hybrid projects will account for 2 GW, wind-solar hybrid with storage systems will account for 500 MW, and hybridisation of existing conventional projects will account for 800 MW.

To enhance DISCOM viability, Rajasthan’s wind-solar hybrid policy allows DISCOMs to procure power up to 5% of their RPO target from hybrid projects with storage systems at a tariff discovered through competitive bidding. This is in addition to the RPO target. There is still scope for the state’s renewable energy sector to grow even more, as it has utilised just 7% of its renewable energy potential.

Punjab and Haryana were the other front-runners. As of September 2022, Punjab turned about a quarter of its renewable energy potential into installed capacity (1.8 GW). The state targets to install solar PV projects with a total capacity of 300 MW in the state, including 200 MW of canal top solar PV power projects and 100 MW of floating solar PV power projects on reservoirs and lakes. On the other hand, Haryana has the lowest installed capacity of older, more polluting coal power plants. It only had about 210 MW of coal power capacity older than 25 years, which, in absolute terms, is much lower than the numbers in other states. With the retirement of Unit 5 of the Panipat power station in 2020, the state has no coal power plant older than 25 years. Both these states scored relatively high on the emissions intensity of GSDP and SEEI, because of which their overall score was high despite having a very low renewable energy share in the power supply mix.

Chhattisgarh scored low across all the parameters. The state has the highest emissions intensity of GSDP (43 kgCO2eq/ Rs1,000). Its renewable energy share in the power supply mix (1%) is better than only Bihar. It has converted just 6% of its renewable energy potential into installed capacity, better than only two states – Odisha (1.8%) and Bihar (2.4%). Despite being one of the country’s leading coal producers, the state aims to uplift its rural healthcare system by harnessing solar energy. It has set up solar power plants with a combined capacity of 457 MW in 1,432 health centres and hospitals run by the Chhattisgarh government as part of the National Health Mission (NHM). These power plants generate 6,672,200 kilowatt-hours (kWh) of electricity annually. In addition to Chhattisgarh, Bihar, West Bengal, and Odisha also scored low on almost all the parameters.

Uttar Pradesh (UP), one of India’s largest power-consuming states, has a lot of work to do to decarbonise its power sector. While UP’s low renewable energy potential compared to other big Indian states does hold back its clean electricity transition, it was in the lower half of the table on all other parameters. Among all the states, UP had the highest share of coal power capacity older than 25 years (35%). Its renewable energy share in the power supply mix (3%) is better than only two states – Chhattisgarh and Bihar. However, UP is also witnessing positive developments, with Reliance Industries announcing its plans to install 10 GW of new renewable energy capacity in the state.

Surprises

Gujarat, a state widely regarded as a renewable energy success story in India in recent years, was mid-table in decarbonising its power sector. This is mainly because the fraction of renewable energy potential tapped in the state is still relatively much lower than many other states (10%). Moreover, Gujarat still has a considerable proportion of older coal power plants in its coal fleet (19%), with about 2.9 GW of >25 years coal power plants operational. Both these aspects brought down its overall score.

Maharashtra, with the highest electricity demand in India, was mid-table. This was mainly due to slow renewable energy uptake in the state and the inability to shut down older polluting coal power plants. Its renewable energy share (11%) is lower than most other states. Furthermore, it has utilised just 7% of its renewable energy potential, and about 19% of its operational coal fleet (~4.7 GW) is older than 25 years.

Dimension-2

Performance of the Power System

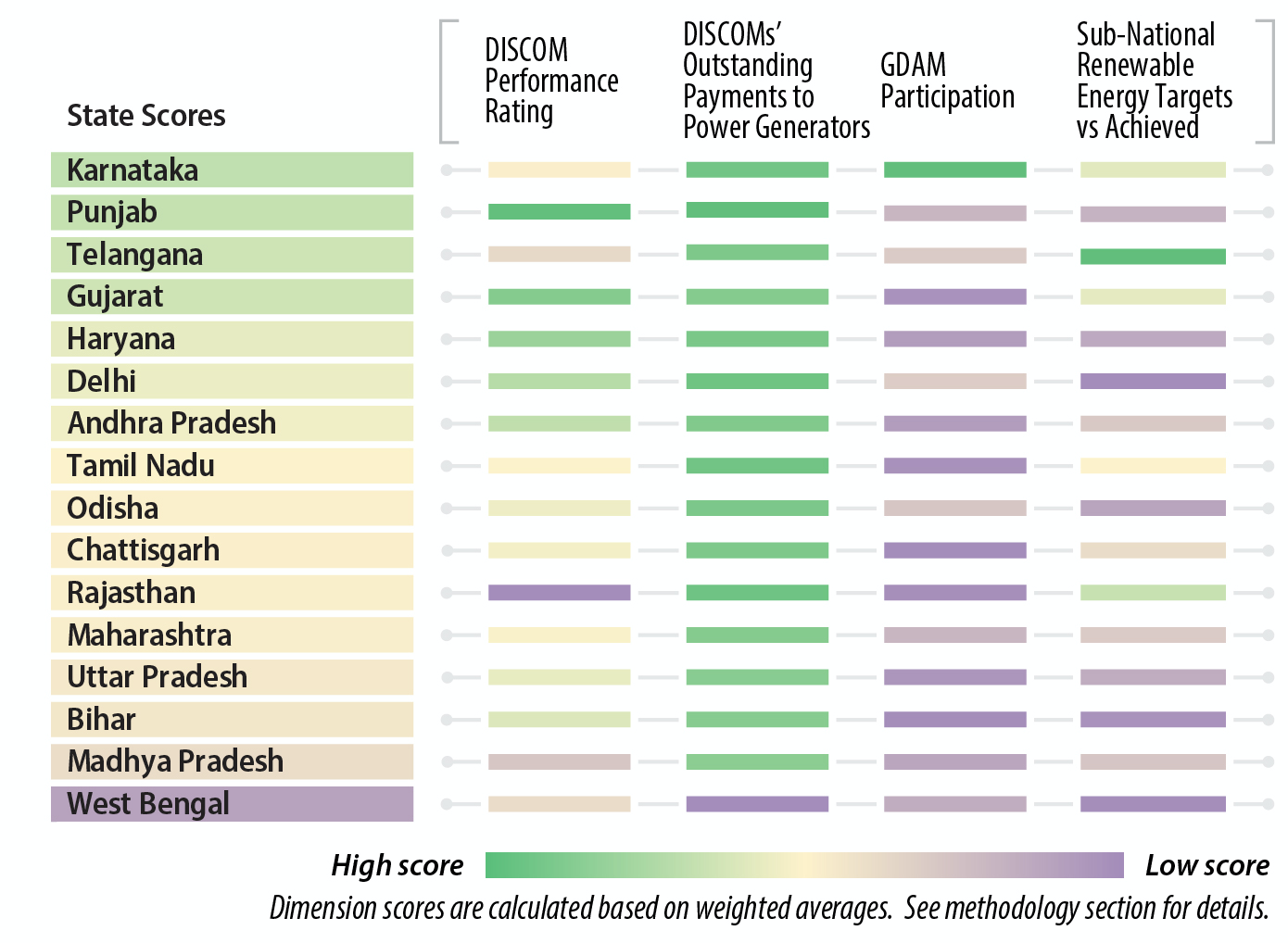

Karnataka tops the list in this dimension as well. Punjab, Telangana, and Gujarat also performed well on most parameters under this dimension.

In addition to generating electricity, it is crucial to strengthen the distribution and transition infrastructure to accelerate the electricity transition. We analyse the performance of the power system of the 16 states based on the four parameters stated in Figure 2 in the methodology document.

Karnataka tops the list in this dimension as well. Punjab, Telangana, and Gujarat also performed well on most parameters under this dimension. West Bengal, Madhya Pradesh, Bihar, and Uttar Pradesh scored low on most parameters in this dimension. We present the overall scores and the scores in each parameter in Figure 5.

Karnataka has the best-performing power system to accelerate electricity transition, followed by Punjab and Telangana. Karnataka purchased and sold the highest volume (~ 614 million units (MUs)) of electricity in the green day ahead market (GDAM) through the power exchange between October 2021 and April 2022. The Union Power Minister, R K Singh, launched GDAM on 24 October 2021 to enable India to achieve its green targets and facilitate the integration and expansion of green energy in an efficient, competitive, sustainable, and transparent manner. Karnataka is also one of the few states which surpassed its renewable energy targets set for the end of 2022 (14.8 GW) with an installed capacity of 16 GW as of September 2022. Karnataka was the first southern state in India to notify a renewable energy policy, the Karnataka Renewable Energy Policy 2009-14, in 2009 to harness green, clean, renewable energy sources for environmental benefits and energy security. Recently, the state released the Karnataka Renewable Energy Policy 2022-2027 to facilitate more renewable energy development with or without storage, decarbonise transportation and create energy markets to integrate more renewable energy into the grid. The intent also aligns with the state’s participation in existing green market mechanisms.

Karnataka did not score well in the DISCOM ratings. NITI Aayog’s State Energy and Climate Index (SECI), which looks at DISCOMs performance parameter consisting of nine indicators, forms the basis for this score. Currently, Karnataka has less than 13% Aggregated Technical and Commercial (AT&C) losses, which is below the fixed target under the Ujwal DISCOM Assurance Yojana (UDAY) scheme. Karnataka also successfully reduced its total overdue amount/owed payment ratio to 64% in March 2022 from 85% in March 2018. This shows that state DISCOMs have taken initiatives to clear backlog payments even though the total overdue amount increased to Rs45.94 billion (US$0.55bn) from Rs14.5 billion (US$0.17bn) during FY2018/19-2021/22. The amount of overdue data focuses on two data points, March 2018 and March 2022, to take into account the efforts undertaken by the state under the UDAY scheme. We also referred to the Annual Integrated Rating & Ranking: Power Distribution Utilities by the Power Finance Corporation Ltd (PFC) for qualitative analysis which shows that Karnataka’s DISCOMs performance may have further deteriorated in FY2021.

Punjab also performed well on this dimension, mainly due to the high scores for DISCOM performance rating and outstanding payments by DISCOMs to generators. However, note that analysis of FY2020 data of SECI ratings forms the basis for the scores. The recent PFC – Annual Integrated Rating & Ranking report indicates that the DISCOM performance in the state has deteriorated by FY2021. We will factor this in the subsequent update of this report. The state also did not meet its sub-national renewable energy targets and had lower-than-expected volumes transacted through GDAM. Punjab saw the purchase or sale of only 86.46 MUs through GDAM out of the total 7635 MUs exchanged in short-term transactions through bilateral, power exchange and demand side management (DSM). The state successfully reduced its total overdue amount/owed payment ratio to 53% in March 2022 from 116% in March 2018. This helped Punjab get comparatively higher scores in indicators such as debt-equity ratio, regulatory assets, open access surcharge and complexity of tariff in the NITI Aayog index.

Telangana and Gujarat were other front-runners. Telangana is the best-performing state in meeting its renewable energy targets set for the end of 2022 (2 GW), with an installed capacity of 5 GW as of

September 2022. On the other hand, Gujarat also installed 18 GW of renewable energy by September 2022 and, in doing so, overachieved its target. Only two states – Karnataka and Delhi – topped Telangana’s electricity purchases and sales volume (~138 MUs) through GDAM. Meanwhile, Gujarat purchased and sold just ~27 MUs through GDAM. On the other hand, Gujarat is one the states with the highest DISCOM rating under the NITI Aayog’s SECI score.

West Bengal scored low across all the parameters. The state’s outstanding payments to generators have increased by 500% from March 2018 to March 2022. Its percentage of sub-national renewable energy targets met (11%) is only better than Delhi, with an installed capacity of just 598 MW in September 2022. However, the state DISCOMs have shown improvement in performance as per the recent PFC – Annual Integrated Rating & Ranking report based on FY2021 data.

Surprisingly, Madhya Pradesh’s (MP) overall score was only better than one state. This was primarily because of the bad performance of its DISCOMs and lower-than-expected renewable energy uptake. As of September 2022, the state has approximately 5.8 GW of installed renewable energy capacity, aiming to achieve 12 GW by December 2022. The state has a renewable energy potential of approximately 79 GW, as estimated by the Ministry of Statistics and Programme Implementation (MOSPI) on 31 March 2021. In addition, the state only met 49% of its renewable energy target to be achieved by Dec 2022. MP has been home to major coal mining projects and several coal-based power plants operating for decades. The state is now focusing on large-scale renewable power projects to fill the deficit and rapidly progress towards its targets.

The Madhya Pradesh Energy Department aims to reach 10 GW of renewable power by 2026. Several projects are likely to start operations before 2026, including the Kusum A and C renewable projects totalling 1.75 GW, the 1.5 GW Agar-Shajapur-Neemuch solar plant, the 1.4 GW Chambal solar plant, the 950 MW hybrid storage Chhatarpur project and the 600 MW Omkar Eshwar floating solar plant. However, potential hurdles, such as land conflict, technology upgrades and lack of transmission infrastructure, could come in the way of achieving the target. While the state is focusing on large-scale renewable power projects, mainly utility-scale solar, it is ignoring other possibly viable options, such as rooftop solar. The state has 120 MW installed rooftop solar capacity as of 31 August 2021.

Bihar, Uttar Pradesh and Maharashtra also scored low on almost all the parameters.

Saloni Sachdeva Michael Energy Analyst, IEEFA

We found limited participation of states in green market mechanisms like the Green Day Ahead Market (GDAM), Green Term Ahead Market (GTAM) and more. Developing a more robust market is an opportunity to support states with low renewable energy potential. To achieve this, states need to take urgent actions like removing banking restrictions and allowing banking of renewable energy not just monthly but also quarterly and yearly, especially for wind generation.

Surprises

Rajasthan and Maharashtra had low scores despite being among the front-runners in initiating various reforms in the power sector. These states have made significant progress over the last decade in increasing generation capacity and strengthening network infrastructure leading to improvements in power supply.

Rajasthan has shown remarkable progress in reducing the AT&C losses of its DISCOMs from a peak of 28% in 2016 to 17.3% by 30 September 2022. Yet, it is still above the target of 15% set under the UDAY scheme. The gap between the average cost of supply (ACS) per unit of power and the average revenue realised (ARR) for Rajasthan DISCOMs has been reducing since FY2013-14. However, they are yet to achieve the target of zero ACS–ARR gap, as stipulated under the UDAY scheme.

Maharashtra, too, fell below its UDAY loss reduction target, with AT&C losses of its DISCOMs at 18.9% as of 30 September 2022. The Maharashtra State Electricity Distribution Company Limited (MSEDCL) also shows a declining trend on most ACS- ARR gap components between FY2019 and FY2021. In addition, the sector’s regulatory assets slightly increased to Rs908.32 billion (US$11 billion) in FY2021, with Rajasthan and Maharashtra contributing 51% and 11%, respectively, of that increase.

Rajasthan and Maharashtra showed low participation in green markets, with just 7 MUs, and 112 MUs, respectively, purchased or sold through GDAM. As seen in Dimension 1, the states have a huge potential to become renewable energy export hubs by utilising their untapped clean energy potential.

Dimension-3

Readiness of the Power Ecosystem

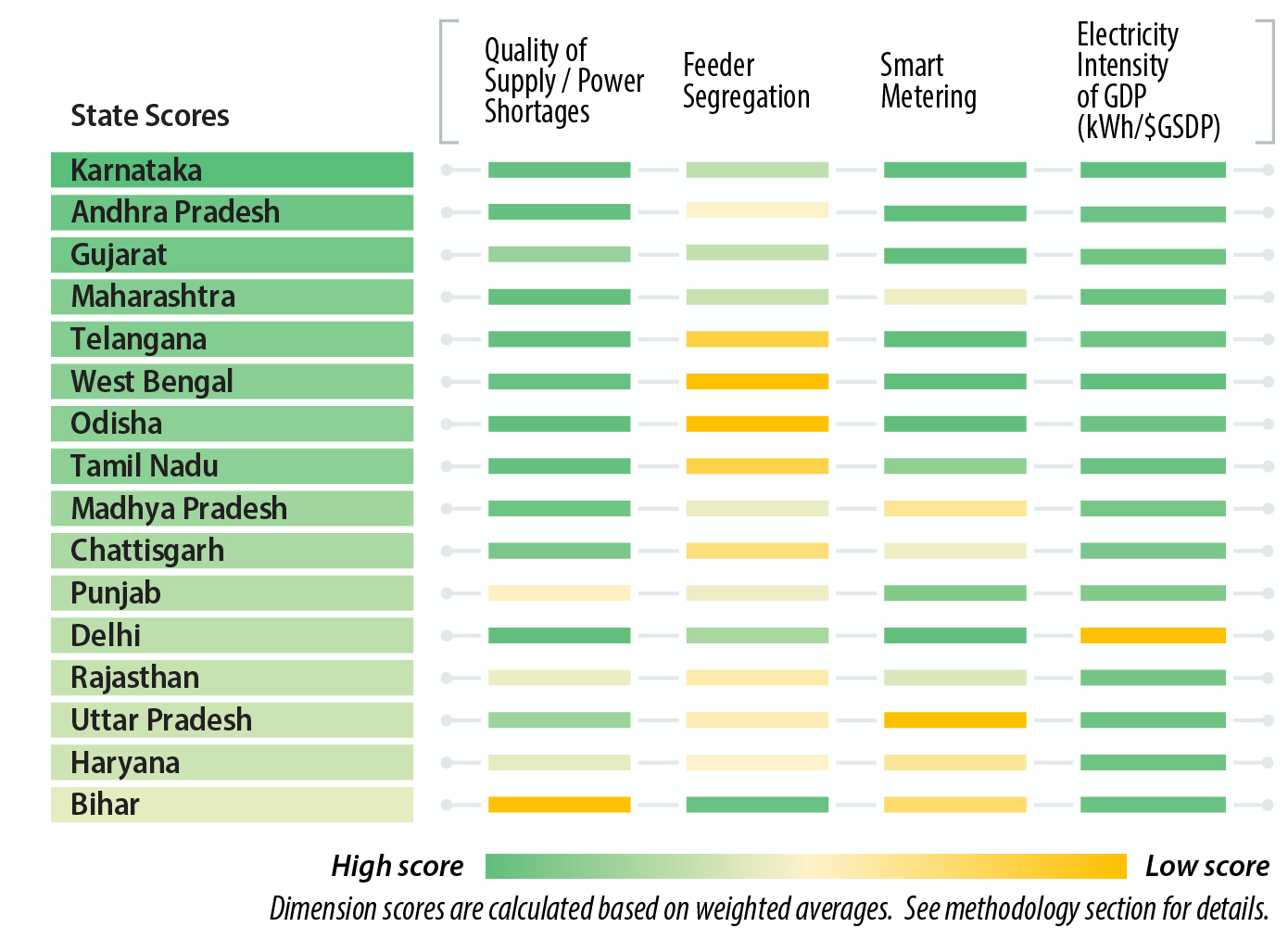

As in the previous two dimensions, Karnataka leads the way here too. Andhra Pradesh and Gujarat were the other two states whose power ecosystems appear ready for the clean energy transition.

Tracking and monitoring the flow of electrons is necessary for the efficient utilisation of electricity. We analyse the readiness of the power ecosystem of the 16 states based on the four parameters stated in Figure 2 in the methodology document.

As in the previous two dimensions, Karnataka leads the way here too. Andhra Pradesh and Gujarat were the other two states whose power ecosystems appear ready for the clean energy transition. Bihar, Haryana, Uttar Pradesh, and Rajasthan have work to do to prepare their power ecosystems adequately. We present the overall scores and the scores in each parameter in Figure 6.

Aditya Lolla Senior Electricity Policy Analyst, Asia, Ember

Even the long-considered front-runners of adding renewable energy capacity, Rajasthan and Tamil Nadu, have to improve the readiness of their power ecosystems for a clean electricity transition. State energy departments also need to strengthen electricity infrastructure for better integration of renewables. In addition to managing the demand and supply of electricity, ensuring effective utilisation, monitoring, and tracking of electrons is also very important.

Karnataka’s power ecosystem appears well-placed for the clean energy transition. The state consistently scored high on all parameters. It was able to supply electricity to meet almost all its power requirements in FY2022, with a shortage of just 9 MUs against the total annual power requirement of 72,692 MUs. This aligns with the findings in Dimensions 1 and 2 regarding the state’s renewable energy share in its power supply mix, overachievement of installed renewable energy capacity targets and volume of electricity purchased and sold through GDAM. Karnataka is also one of the better-performing states when it comes to feeder segregation. The state surpassed its feeder segregation targets under the UDAY scheme, touching 116% of the target as of January 2021. A separate feeder shall help the state in load shedding for the agricultural power demand without compromising other consumers. Karnataka also deployed 20,916 smart meters as of September 2022, achieving 100% of the sanctioned target under the National Smart Mission. The state also had the lowest electricity intensity of GSDP ratio (3.5 kWh/Rs), which indicates effective utilisation and distribution of each unit of electricity to generate a unit of GSDP growth.

Andhra Pradesh is another top performer in this dimension, scoring quite high on most parameters. The state achieved 100% of its sanctioned smart metering target under the UDAY scheme, with 2,000 smart meters installed as of September 2022. Its electricity intensity of GDP (5.7 kWh/Rs) was relatively low compared to most other states. The state also managed to keep the power shortages to 0.02% of the total power requirement in FY2022. While the state also met its feeder segregation targets under the UDAY scheme as early as 2017, it is unclear if the state carried out any more feeder segregation since then, as the last available data from the UDAY portal is from December 2017.

Gujarat also scored well overall on this dimension. The state met both its smart meter and feeder segregation targets, while it placed in the mid-table on electricity intensity of GDP (6.7 kWh/Rs). However, it saw high power shortages (290 MUs) relative to its power requirement (129,672 MUs), bumping its overall score. This was mainly due to the sudden rise in temperature, lack of adequate coal, and increased international coal prices. Gujarat ordered a staggered shutdown of “non-continuous process” industries in key cities to facilitate continuous power supply to farmers.

Bihar’s power system is less prepared for the transition despite performing well in a few parameters. The state achieved almost 218% of its feeder segregation target of 565 feeders under the UDAY scheme and also had one of the lowest electricity intensity of GSDP (5 kWh/Rs). However, Bihar scored poorly in the other two parameters relegating it to the bottom overall. Bihar saw a power shortage of about 410 MUs in FY2022, which is about 1.13% of its total power requirement – the highest among all the Indian states for FY2022. The state also met only 45% of its sanctioned smart meter target under the National Smart Mission scheme despite installing approximately 1.1 million smart meters. This also aligns with Bihar’s low collection efficiency of 79.7% in 2019-20.

Other northern states like Uttar Pradesh and Haryana also scored low on this dimension. Uttar Pradesh made the least progress on the smart meter targets under the National Smart Mission, installing only 29% of the sanctioned smart meters as of September 2022, while Haryana installed only 53% of the sanctioned numbers. Uttar Pradesh’s progress on feeder segregation also appears to be slow, as it achieved 70% of its target under the UDAY scheme as of June 2020 (latest data available on the UDAY portal). The lack of availability of recent data on the UDAY portal also counted against Uttar Pradesh. Haryana achieved 100% of its feeder segregation, but data transparency issues counted against it in the overall score. Both Haryana and Uttar Pradesh also saw considerable power shortages – Haryana couldn’t meet 0.53% of its annual power requirement (shortage of 292 MUs) in FY2022, while Uttar Pradesh saw a shortage of 0.23% (302 MUs).

Surprises

Rajasthan, one of the top states successfully decarbonising its power sector, scored relatively low on most parameters of this dimension. In absolute terms, it had the highest shortage of power supply with 489 MUs in FY2021-22, which is 0.55% of its annual power requirement. Only Bihar and Punjab had more percentage shortage in their power requirement in FY2021-22. The state even had to ration electricity by scheduling one-hour power cuts due to a nationwide coal shortage last year, while industries got only eight hours of electricity daily. This was mainly due to a sudden surge in national coal demand and the power demand spike after the COVID-19 pandemic. In addition, Rajasthan has only met around 39% of its feeder segregation and 70% of its smart metering targets under the UDAY scheme and National Smart Mission, respectively. Despite making good progress, the state is still far from deploying the remaining 300,000 sanctioned smart meters.

Despite scoring well on most parameters, Punjab performed below average in this dimension, even behind Odisha and West Bengal. This was mainly due to the state’s inability to meet its annual power requirement in FY2022. It saw a high-power shortage of about 418 MUs, which is 0.66% of the total power requirement. Like in Gujarat and Rajasthan, the sudden rise in temperature, lack of adequate coal, and increased international coal prices all led to these shortages in Punjab.

Punjab also relies heavily on thermal power plants for electricity. However, units that supplied the state suffered from erratic coal availability. For example, a unit of GVK Power’s 540 MW thermal power plant at Goindwal Sahib in Tarn Taran and another of the 1,260 MW Guru Gobind Singh Super Thermal Power Plant at Ropar had to shut down in April 2022 because of coal shortages. This ultimately led to Punjab getting scored down.

Tamil Nadu, an agriculture-dependent state, was also in the mid-table mainly due to the slow deployment of feeder segregation initiatives. However, the Tamil Nadu Generation and Distribution Corporation (Tangedco) recently decided to segregate 475 feeders for agricultural services from the existing feeders. The utility estimates to reduce the line loss to 11.92% from 13.5% gradually by initiating feeder segregation.

Aditya Lolla Senior Electricity Policy Analyst, Asia, Ember

Introducing private sector participation and competition would bring more capital and management expertise into the electricity sector. This will help enhance operational efficiency and increase accessibility and affordability.

Dimension-4

Policies and Political Commitments

While Haryana, Gujarat and Karnataka showed good intent to accelerate the electricity transition, Odisha, West Bengal, and Andhra Pradesh still have work to do.

Every implementation plan starts with an intent to bring change. Policies and political commitments are the best indicators of a government’s intent. This dimension aims at qualifying the intent to accelerate electricity transition at the state level through the four parameters defined in Figure 2 in the methodology document.

While Haryana, Gujarat and Karnataka showed good intent to accelerate the electricity transition, Odisha, West Bengal, and Andhra Pradesh still have work to do. We present the overall scores and the scores in each parameter in Figure 7.

Haryana scored the highest in this dimension, mainly by making the most efforts to avoid coal power lock-in for the future. It previously announced its plans to cut down its dependency on coal power. The coal power plant data analyses on the GEM tracker validate the intent, as the state has no new coal power projects under construction or in the pre-construction states. Therefore, despite the state importing coal from other states to run existing thermal power plants recently, it is avoiding increasing its dependency on coal for future power requirements. Haryana also led the charts in recognising the need to track, handle and recycle waste streams not just to accelerate but also to sustain the electricity transition. As of April 2022, Haryana has 42 registered e-waste dismantlers, refurbishers, and recyclers with a total capacity of recycling 137,416 metric tonnes per annum (TPA). In addition, the state also has 274,864TPA of battery recycling capacity as of March 2022. As per our data analysis, this totals to an e-waste and battery recycling capacity of 14.27kg per capita in a year.

According to the Central Pollution Control Board (CPCB), the growth rate of e-waste is even higher than plastics in India. This waste was 771,000 tonnes in 2018-19 and 1.014 million tonnes in 2019-20, an increase of about 31%.

Waste from batteries and solar panels has increased at a similar pace. International Renewable Energy Agency (IRENA) estimates India will accumulate 78 million tonnes of solar PV waste by 2050. The report acknowledges that the policy and process to handle e-waste, battery, and solar PV waste will be different and will change rapidly with technology growth. However, due to a lack of data, we have taken the present e-waste and battery recycling capacities as a proxy to understand the intent of states to develop circular systems.

Gujarat and Karnataka are the other two states that performed well in this dimension. Both states have announced that they will not build new coal power plants and do not have any coal power plants currently under construction. Gujarat has about 0.85 GW of new coal power projects in the pre-construction stages, and Karnataka has about 1.6 GW. While much of this pipeline in Gujarat is a state-sector undertaking to expand the Ukai thermal power plant, in Karnataka, it is a private-sector undertaking to develop the Udupi power station. Local activists have strongly opposed the expansion of the Udupi power station. As a result, Karnataka scored slightly higher than Gujarat, while both states had high scores compared to other states.

Both states also have favourable banking provisions leading to high scores on this parameter. Karnataka scored slightly higher by allowing 100% banking for captive and third-party consumers and an annual banking settlement period. Banking allows a generating plant to supply excess power to the grid, with the option of drawing back the same amount of power within a certain time against the banking charges specified by State Electricity Regulatory Commissions (SERCs).

Gujarat stole a march on Karnataka and fared the best in moving early on pilot projects related to battery storage capacity. Gujarat Power Corporation Limited (GPCL) has commissioned 15 megawatt-hours (MWh) of Solar + Battery Energy Storage System (BESS) system, while Gujarat Urja Vikas Nigam Limited (GUVNL) has issued a request for selection (RfS) for two projects adding up to 1,250 MWh. Gujarat State Electricity Corporation Limited (GSECL) has also issued an RfS for a Solar + BESS system of 57 MWh. The state currently has the most battery storage projects in the pipeline with these projects. Overall, Gujarat and Karnataka were pretty much neck-to-neck in the overall dimensional score.

Odisha scored low in almost all the parameters. The GEM data shows it has 60 MW of coal power capacity under construction and 6.2 GW of coal power capacity in the pre-construction stages. The proposed new coal power plants include central, state, and private ventures. As such, this state scored the lowest in avoiding new coal power lock-in. Although it recently cleared a project to build a 600 MW pumped storage plant, Odisha also has no battery storage projects in the pipeline. As a result, it had the lowest score even on this parameter. Odisha has low per capita e-waste and battery recycling capacity (0.12 kg per capita in a year).

West Bengal and Andhra Pradesh are two other states that scored low in this dimension. Both states do not have any grid-scale battery storage plants in the pipeline, and we did not find their banking provisions favourable. West Bengal’s and Andhra Pradesh’s per-capita e-waste and battery recycling capacities at 1.36 and 3 kg per capita in a year, respectively, were among the lowest in the country.

The states also have new coal power capacity under active construction by respective state utilities (1,600 MW in Andhra Pradesh and 660 MW in West Bengal). As a result, they scored on all the parameters of the dimension.

Surprises

Tamil Nadu, one of the Indian states with the most renewable energy capacity, was in the bottom half of the table in this dimension. This is mainly because of a lack of policy intent to move its future power system away from coal and weak banking provisions, which led to the lowest possible scores on these two parameters. According to GEM, as of June 2022, the state has about 5.7 GW of new coal capacity under construction and 4 GW in the pre-construction stages. The state has been reluctant to commit to no new coal announcements despite studies suggesting that this can save billions of rupees.

Rajasthan was mid-table on this dimension, scoring much lower than other renewable energy leaders like Gujarat and Karnataka. This is mainly due to the state’s inability to commit to not building any new coal power plants despite being in a position to do so. Moreover, the state also has about 2.1 GW of new coal power plant proposals in the pre-construction stages, all of which are state-sector undertakings through Rajasthan Rajya Vidyut Utpadan Nigam Limited. This reduced the state’s overall score significantly in this dimension.

Conclusion

Way Forward

Tremendous efforts have been undertaken by some of the states to walk the electricity transition pathway.

In this chapter:

The report acknowledges and accolades the tremendous efforts undertaken by some of the states to walk the electricity transition pathway. Figure 8 below summarises where the states stand regarding their progress across different parameters and dimensions of this transition.

While India’s electricity transition has begun, its complete realisation will require both central and state governments to continue to track the progress and performance of all states on various schemes and policies.

We summarise our findings and provide recommendations on how states can improve their performance for each dimension in the following sub-sections.

Dimension-1: Decarbonisation

Key Takeaway

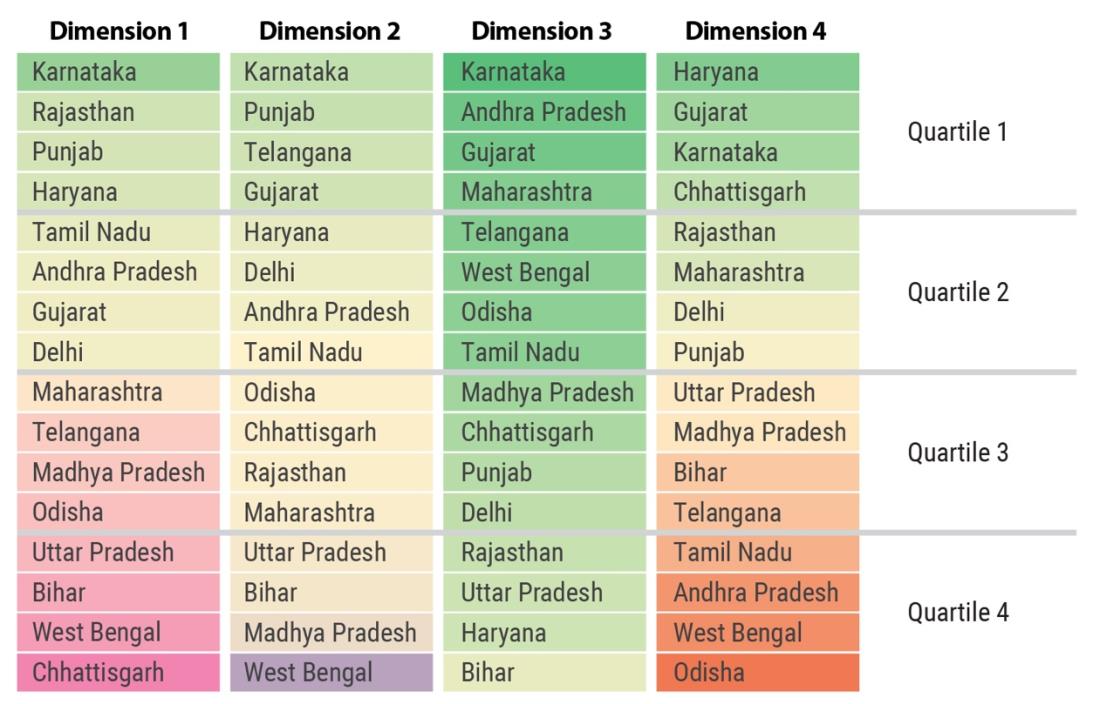

Quartile – 1: Karnataka, Rajasthan, Punjab, and Haryana

- Karnataka and Rajasthan, while topping the charts with maximum renewable energy deployment, still have a massive renewable energy potential which they can utilise.

- These states are making dual efforts to increase renewable energy deployment and reduce dependency on thermal plants.

- Haryana lies in this category as the state has no coal capacity over 25 years of age.

Quartile – 2: Tamil Nadu, Andhra Pradesh, Gujarat, and Delhi

- States like Tamil Nadu and Gujarat can further accelerate decarbonisation by focusing on offshore wind and closely monitoring their retired coal fleet.

- Andhra Pradesh, Tamil Nadu, and Gujarat still have massive untapped renewable energy potential.

Quartile – 3: Maharashtra, Telangana, Madhya Pradesh, and Odisha

- All states under this category had low scores in most parameters.

- Odisha stands out with the lowest renewable energy installed capacity relative to its renewable potential.

Quartile – 4: Uttar Pradesh, Bihar, West Bengal, and Chhattisgarh

- All the states in this quartile had low scores on all the parameters.

- Uttar Pradesh’s coal fleet is relatively aged, with about 31% of its installed coal power capacity (~7.6 GW) now older than 25 years – the highest among all the states.

- Bihar and Odisha are meaningfully utilising their renewable energy potentials.

Actions Needed

- States must take a more structured and holistic approach (considering their renewable energy potential) to set renewable energy targets.

- States should actively participate in green market mechanisms to support those with lower renewable energy potential.

- India has the potential to generate 140 GW of electricity from offshore wind along its 7,600km coastline. However, there is a need to develop local supply chain, logistics and port infrastructure to utilise offshore wind’s full potential.

- State energy departments need to closely monitor their coal plants and retire older plants, unless needed as peaker plants during high-demand months.

- States need to conduct more studies to understand the need and potential of energy efficiency interventions (considering various consumer categories – buildings, commercial, industrial, electric vehicles and more).

Dimension-2: Performance of the Power System

Key Takeaway

Quartile -1: Karnataka, Punjab, Telangana, and Gujarat

- Though states like Karnataka and Telangana did not have good DISCOM ratings, they still topped the charts owing to the best progress on GDAM participation and meeting sub-national renewable energy targets, respectively.

- Gujarat and Punjab had the best DISCOM ratings in this edition of the analysis, but their participation in green markets is negligible. Punjab DISCOM performance may have deteriorated subsequently, as evident from the most recent PFC – Annual Integrated Rating & Ranking report.

Quartile – 2: Haryana, Delhi, Andhra Pradesh, and Tamil Nadu

- All four states under this category have average-performing DISCOMs.

- All these states show a trajectory of reducing their overdue/owed payments from DISCOMs to generators.

Quartile – 3: Odisha, Chhattisgarh, Rajasthan, and Maharashtra

- All states under this category did not perform well in all parameters except outstanding payments of DISCOMs to generators.

- These states have made limited efforts to participate in green market mechanisms like GDAM.

Quartile – 4: Uttar Pradesh, Bihar, Madhya Pradesh, and West Bengal

- These states performed poorly in all the parameters, with the least scores.

Actions Needed

- Qualitative and quantitative analysis should back state-level renewable energy targets set by MNRE.

- States need to focus on increasing participation in green market mechanisms like GDAM, GTAM, open access, corporate PPAs etc. In addition, states also need to focus on innovative bilateral financial markets mechanisms like Virtual Power Purchase Agreements (VPPA) and Contracts for Difference (CfD).

- Data transparency and availability at the state level needs an enhancement for robust analysis.

- Robust transmission infrastructure is necessary to better evacuate renewables at the state level.

- States should ensure honouring all types of contracts along with making timely payments.

Dimension-3: Readiness of the Power Ecosystem

Key Takeaway

Quartile – 1: Karnataka, Andhra Pradesh, Gujarat, and Maharashtra

- All states under this category performed relatively well in all parameters.

- All four states achieved at least 100% of their feeder segregation targets under the UDAY scheme.

- Karnataka, Andhra Pradesh, and Gujarat installed 100% of their sanctioned smart meters as of September 2022 under the National Smart Mission.

Quartile – 2: Telangana, West Bengal, Odisha and Tamil Nadu

- Overall, the performance of all states has been average in all parameters except feeder segregation.

- West Bengal and Odisha scored quite low in this analysis on feeder segregation due lack of data availability and progress, despite having a considerable agricultural load.

- Tamil Nadu and Telangana’s progress on meeting their UDAY feeder segregation target was among the lowest, because of which their overall score fell despite good performance on other parameters.

Quartile – 3: Chhattisgarh, Madhya Pradesh, Punjab, and Delhi

- States under this category did not perform well in at least two of the four parameters. For example, Chhattisgarh and Madhya Pradesh did not meet their feeder segregation and smart metering targets.

- On the other hand, Punjab and Haryana performed lower than average on the quality of supply parameters.

Quartile – 4: Uttar Pradesh, Rajasthan, Haryana, and Bihar

- These states performed poorly in all the parameters, with the least scores.

- Bihar, as an exception, was the only state to have achieved its UDAY’s feeder segregation targets. However, its overall score got marked down by a lack of progress on other parameters. Bihar faced a maximum percentage of power shortage against the total power requirement in FY2022.

Actions Needed

- In addition to managing the demand and supply of electricity, ensuring effective utilisation, monitoring, and tracking electrons is also very important.

- Introduction of private sector participation and competition shall bring more capital and management expertise into the electricity sector. This will help enhance operational efficiency, increase accessibility and affordability.

- Reliable state-level data on feeder segregation needs to be made available for more robust analysis. States with large agriculture loads need to focus more on feeder segregation.

Dimension-4: Policies and Political Commitments

Key Takeaway

Quartile – 1: Haryana, Gujarat, Karnataka, and Chhattisgarh

- All states under this category scored the maximum in at least one of the four parameters under this dimension.

- Haryana has the highest e-waste and battery waste management capacity, and Gujarat has the highest grid-level battery storage projects.

Quartile – 2: Rajasthan, Maharashtra, Delhi, and Punjab

- All states performed average under all dimensions except circular economy.

- Rajasthan, Maharashtra, and Punjab have relatively progressive banking provisions.

Quartile – 3: Uttar Pradesh, Madhya Pradesh, Bihar, and Telangana

- All four states showed no or limited intent to avoid new coal power lock-in.

- Madhya Pradesh, Bihar, and Telangana could undertake more efforts to increase battery storage capacity as they don’t have grid-level battery storage projects in the pipeline.

Quartile – 4: Tamil Nadu, Andhra Pradesh, West Bengal, and Odisha

- These states performed poorly in all the parameters, with the least scores.

Actions Needed

- States must enable deployment of more storage solutions for better renewable energy integration.

- Initiatives like ‘Time of Day tariff’ and ‘Direct Benefit Transfer’ need more focus for state-level implementation in addition to regular tariff revisions by the state regulators.

- States need to develop a holistic and circular approach towards handling solar panel, battery, and electric vehicle waste. This is even more crucial as India sets up new manufacturing units under the Atmanirbhar Bharat scheme.

- States must support power banking to provide renewable energy generators with much-needed comfort.

Recommendations

Based on our analysis, we have the following recommendations to accelerate the sub-national electricity transition:

-

01

Multi-dimensional efforts to ensure effective and sustained electricity transition

A holistic transition requires both supply-side decarbonisation and demand-side revamping through energy-efficient intervention. States need to set more well-researched and well-defined renewable energy targets. We found that most renewable energy-rich states still have massive untapped renewable energy potential as of 31 March 2021. Punjab, the highest scorer in this category, converted 25% of its renewable energy potential to installed capacity.

High renewable energy potential states should aim to become export hubs, and this can be facilitated by strengthening interstate transmission networks. The recently launched Rs2.44 trillion (US$29.6 billion) ‘Transmission System for Integration of over 500 GW renewable energy capacity by 2030 plan aims to build transmission lines to better integrate increasing renewable energy generation. This is a welcoming move, given India has one national grid, as it allows power flow from renewable energy-rich states to high power-demand states.

The recently issued General Network Access (GNA) regulation by the Central Electricity Regulatory Commission (CERC) in June 2022 is also a welcome step to enable supply from any point, as long as the quantum contracted for is met. The regulations aim to provide non-discriminatory open access to the inter-state transmission system (ISTS) to generating companies through general network access (GNA). Unlike the present ISTS open access system, where generators are required to identify a consumer before granting open access.

An increase in storage solutions (battery, pumped hydro, market mechanism and more) would be critical to accelerate this transition. States must deploy more storage solutions for better renewable energy integration.

-

02

States should increase participation in green market mechanisms through more favourable policies like open access and banking of power

We found limited participation of states in green market mechanisms like the Green Day Ahead Market (GDAM), Green Term Ahead Market (GTAM) and more. Karnataka was an exception.

Developing a more robust market is also an opportunity to support states with low renewable energy potential. To achieve this, states need to take urgent actions like removing banking restrictions and allowing banking not just monthly but also quarterly and yearly, especially for wind generation. Such restrictions, along with the levying of additional surcharges on captive and group captive renewable energy projects and limiting net metering regulations to only residential consumers, negatively impacted the growth of the corporate renewable PPA market in India.

Innovative bilateral financial markets mechanisms like Virtual Power Purchase Agreements (VPPA) and Contracts for Difference (CfD) have huge potential to open up the market and give buyers and regulators the required assurance on handling intermittent renewable energy generation.

-

03

Enhancing state-level data transparency and availability for proper tracking of progress

Access to reliable, public state-level data was a challenge throughout the study. We could not consider several parameters, like GTAM, the quantum of electricity exchanged through open access, state-level performance on green energy corridors and more, as part of the analysis due to a lack of state-level data. In addition, data on feeder segregation and smart metering was also missing for a few states.

Even though several national-level data portals exist, regular maintenance and updating need effort. State authorities should be trained to capture, analyse, and transfer the data efficiently and accurately.

-

04

Bridge the gap between intent and implementation

Many states have made progressive announcements like no coal, green manufacturing, and direct benefit transfers, but tracking these intents’ conversion into implementation plans is crucial.

The Ministry of Power has issued the Electricity (Promoting Renewable Energy Through Green Energy Open Access Rules), 2022. Under the new regulations, consumers with a contracted demand or sanctioned load of 100 kW or more will be eligible for green energy open access. This limit has been reduced from 1 MW. This policy initiative can increase the open access market size manifold. However, limited updates and state-level implementation are undertaken.

In addition, state electricity regulatory commissions, in consultation with other industry stakeholders (consumers, DISCOMs and renewable energy generators), should design competitive green tariffs vis-a-vis other alternate routes for end consumers. States also need to develop a more holistic and circular approach towards handling solar panel, battery and electric vehicle waste. This is even more crucial as India sets up new manufacturing units under the Atmanirbhar Bharat scheme.

Annexures

Annexure 1: Scale Used for Scoring

To create a neutral foundation for analysis across parameters with different metrics and units, we normalised the indices to a standard scale of 0 – 10. In other words, we scored the states relative to each other on a scale of 0-10 for each parameter, 10 being the score for the state that performed the best and 0 being the worst. We borrowed the normalisation method from NITI Aayog’s State Energy and Climate Index (SECI). It required us to classify the parameters as progressive or regressive indicators.

For progressive indicators, higher values on the parameter metric imply better performance. In this case, we used the following formula: Index score = [(Actual value – Lowest value)/ (Highest value – Lowest value)] *10

For regressive indicators, lower values imply better performance. We used the following formula:

Index score = [(Highest value – Actual value)/ (Highest value – Lowest value)] *10

For the fourth dimension, we categorise the states into four grades, A to D, based on their normalised index scores (A: 7.5-10, B: 5-7.5, C:2.5-5, D: 0-2.5). We did this as the parameters under this dimension are more qualitative in nature, and relative scoring of the states on a normalised 0-10 scale may not be sufficient to control for the subjective nature of the parameters. The idea is to provide a broadly indicative grade of the state’s current policy and political intent.

Selection of weightages for parameters within a dimension

As stated earlier, we requested experts to provide weightages to the selected parameters to capture the perceived importance to the identified dimensions. We thoroughly discussed the feedback through follow-up consultations and subsequently assigned the final weightages to the parameters.

We also ensured stakeholders gave higher weightage to all the critical parameters for clean electricity transition. Overall, the purpose of this scoring is to be indicative, not prescriptive. Through the expert consultation process, we ensured that the finalised weightages and scoring indicated the current status.

Annexure 2: Data-related Challenges and Assumptions

| Dimensions | Parameters | Challenges | Assumptions |

|---|---|---|---|

| Dimension 1: Decarbonisation | Renewable Energy Mix in State’s Power Supply | - | Direct data collection from source and analysis |

| Renewable Energy Potential Utilised by the States | The 2022 estimates of renewable energy potential for different states were not publicly available. The latest available data on the renewable energy potential of states is from MoSPI’s Energy Statistic 2022 report pertaining to potentials as of April 2021. We used this data as a proxy for potential estimates in 2022. | Direct data collection from source and analysis. | |

| Old Coal Power Capacity in Operation | The coal power capacity data from CEA’s installed capacity reports differed from the data from the NPP monthly generation reports. To consider the current coal capacity and assess the coal power plant age, we used data from the GEM coal power plant tracker. The GEM data seemed close to monitored capacity data from NPP reports. | Since coal power is the dirtiest form of electricity, Discoms should consider retiring coal power plants older than 25 years (also recommended in NEP 13). Hence, tracking the % of old coal power capacity in different states is crucial to decarbonise the electricity sector. | |

| Power Sector Emissions Intensity (gCO2e/GSDP) | While calculating the emissions intensity of Gross State Domestic Product (GSDP), FY 2022 GSDP data was not available for Maharashtra, Gujarat, Chhattisgarh and West Bengal in the RBI database. Therefore, they have been estimated for FY2022 based on FY2021 GSDP data and assuming an 8.7% real GDP growth rate (national average) for FY2022. | Emission intensity factors have been assumed per Ember's Global Electricity Review 2022, based on IPCC 5th Assessment Report Annex-3. | |

| State Energy Efficiency Index (SEEI) | - | The SEEI is the best proxy source to capture energy efficiency progress at the state level | |

| Dimensions | Parameters | Challenges | Assumptions |

| Dimension 2: Performance of the Power System | DISCOM Performance Rating | Due to the lack of credible and consistent data for all the states, we used the NITI Aayog SECI rating for DISCOMs performance as a proxy. We also referred to the Power Finance Corporation Ltd. (PFC) Annual Integrated ratings for qualitative inputs, as the report only provided grades at the DISCOM level. For this report, we needed cumulative data at the state level. | Due to the lack of credible and consistent data from different states, we used the NITI Aayog rating for DISCOM performance as a proxy. |

| Percentage of Outstanding Payments of DISCOMs to Power Generators | - | Overdue amount/ owed amount by the DISCOM is a good measurement to understand DISCOM’s financial health. Also, DISCOMs, which have reduced their % of (overdue amount/ owed amount) from March 2018 till March 2022, are better equipped to focus on electricity transition. | |

| GDAM Participation | Tracking states' performance in Green Term Ahead Market (GTAM) is also crucial along with Green Day Ahead Market (GDAM). Due to a lack of data availability on state-level GTAM performance, this report could not capture it. | Total volumes (quantum inclusive of buy and sell) through GDAM shall give a good understanding of states' participation in green markets. | |

| Sub-National Renewable Energy Targets vs Achieved (Till the end of 2022) | - | Direct data collection from source and analysis | |

| Dimensions | Parameters | Challenges | Assumptions |

| Dimension 3: Readiness of the Power Ecosystem | Quality of Supply / Power Shortages | - | Direct data collection from source and analysis |

| Feeder Segregation | Non-availability of feeder segregation data for the states not part of the UDAY scheme was a big issue. To control for it, a rubric was created giving a weightage of 25% for data availability and frequency of updates. The actual progress on feeder segregation targets under the UDAY scheme constituted 75% of the score. Further, since Delhi doesn’t have an agricultural load, it was assumed to have achieved 100% progress to keep the analysis simple. | States showing better progress and meeting their UDAY targets have more chances of accelerating the electricity transition. Assuming UDAY portal data is sufficient for such analysis. | |

| Smart Metering | The sanctioned smart meter target and installed data on the NSM portal have been used as a proxy representation of states' smart metering targets. There are possibilities that states with a lower quantum of sanctioned targets over-perform and vice versa. | The sanctioned data on the National Smart Mission portal has been used as a proxy representation of states’ smart metering targets. | |

| Electricity Intensity of GDP (kWh/$GSDP) | - | The sectoral split in terms of electricity consumption is same for all the states. Latest data on state-wise sectoral power consumption couldn't be sourced from publicly available databases | |

| Dimensions | Parameters | Challenges | Assumptions |

| Dimension 4: Policies and Political Commitments | Avoiding Coal Power Lock-In | - | - |

| Flexibility - Battery Policy | - | - | |

| Circular Economy | - | States with better policies and provisions for handling e-waste might be better prepared to handle solar PV and battery waste. | |

| Banking Restrictions | - | Better banking provisions at the state level helps DISCOMs with peak load shifting, and imposing restrictions will result in more unstable grid management. |

State-level progress on parameters like open access, green energy corridors, and transmission infrastructure could not be included as part of this study due to a lack of data availability.

Supporting Material

Methodology

The backbone of the SET scores

The backbone of the SET scores is the data dimensions selected, along with the sub-parameters. As stated above, there are four broad dimensions. These dimensions have seventeen parameters in total. A rationale for selection and a mode of measurement backs each of these parameters.

Download the full methodology here.

Acknowledgements

- Saloni Sachdeva Michael, IEEFA

- Aditya Lolla, Ember

- Vibhuti Garg, IEEFA

The authors would like to acknowledge and thank Mr. Abhishek Ranjan (ReNew Power), Ms. Aarti Khosla (Climate Trends), Mr. SC Saxena (personal capacity), Mr. Tim Buckley (Climate Energy Finance), for the constructive feedback provided during the peer-review process.

We are immensely grateful to Mr. Abhishek Ranjan and Mr. SC Saxena for their detailed comments on the data analysis undertaken as part of this study, although any errors are our own and should not tarnish the reputations of these esteemed persons.

We would also like to thank Mr. Akhilesh Magal (Climate Dot), Ms. Disha Agarwal (CEEW), Mr. Neeraj Kuldeep (CEEW), Mr. Ashish Fernandes (Climate Risk Horizons), Dr. Praveer Sinha (Tata Power), Mr. Kashish Shah (Wood Mackenzie), and Mr. Raghav Pachouri (Vasudha Foundation), for their contributions in finalising the report methodology and data analysis process.

Header imageSolar panel trees at the National Salt Satyagraha Memorial, Gujarat, India.

Credit: Indigo Photos / Alamy Stock Photo